Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

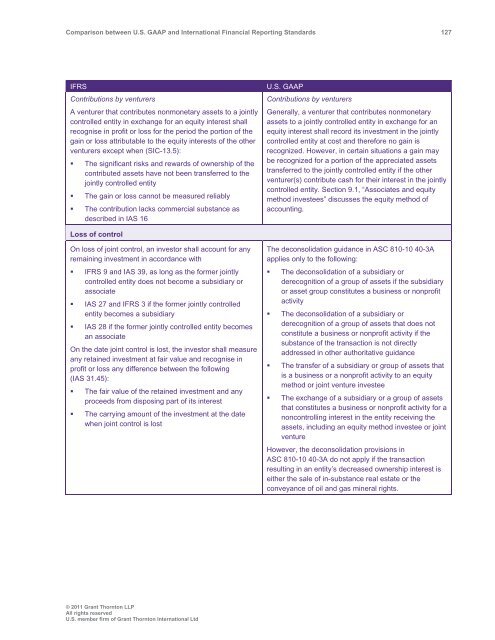

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 127<br />

IFRS<br />

Contributions by venturers<br />

A venturer that contributes nonmonetary assets to a jointly<br />

controlled entity in exchange for an equity interest shall<br />

recognise in profit or loss for the period the portion of the<br />

gain or loss attributable to the equity interests of the other<br />

venturers except when (SIC-13.5):<br />

• The significant risks <strong>and</strong> rewards of ownership of the<br />

contributed assets have not been transferred to the<br />

jointly controlled entity<br />

• The gain or loss cannot be measured reliably<br />

• The contribution lacks commercial substance as<br />

described in IAS 16<br />

U.S. <strong>GAAP</strong><br />

Contributions by venturers<br />

Generally, a venturer that contributes nonmonetary<br />

assets to a jointly controlled entity in exchange for an<br />

equity interest shall record its investment in the jointly<br />

controlled entity at cost <strong>and</strong> therefore no gain is<br />

recognized. However, in certain situations a gain may<br />

be recognized for a portion of the appreciated assets<br />

transferred to the jointly controlled entity if the other<br />

venturer(s) contribute cash for their interest in the jointly<br />

controlled entity. Section 9.1, “Associates <strong>and</strong> equity<br />

method investees” discusses the equity method of<br />

accounting.<br />

Loss of control<br />

On loss of joint control, an investor shall account for any<br />

remaining investment in accordance with<br />

• IFRS 9 <strong>and</strong> IAS 39, as long as the former jointly<br />

controlled entity does not become a subsidiary or<br />

associate<br />

• IAS 27 <strong>and</strong> IFRS 3 if the former jointly controlled<br />

entity becomes a subsidiary<br />

• IAS 28 if the former jointly controlled entity becomes<br />

an associate<br />

On the date joint control is lost, the investor shall measure<br />

any retained investment at fair value <strong>and</strong> recognise in<br />

profit or loss any difference <strong>between</strong> the following<br />

(IAS 31.45):<br />

• The fair value of the retained investment <strong>and</strong> any<br />

proceeds from disposing part of its interest<br />

• The carrying amount of the investment at the date<br />

when joint control is lost<br />

The deconsolidation guidance in ASC 810-10 40-3A<br />

applies only to the following:<br />

• The deconsolidation of a subsidiary or<br />

derecognition of a group of assets if the subsidiary<br />

or asset group constitutes a business or nonprofit<br />

activity<br />

• The deconsolidation of a subsidiary or<br />

derecognition of a group of assets that does not<br />

constitute a business or nonprofit activity if the<br />

substance of the transaction is not directly<br />

addressed in other authoritative guidance<br />

• The transfer of a subsidiary or group of assets that<br />

is a business or a nonprofit activity to an equity<br />

method or joint venture investee<br />

• The exchange of a subsidiary or a group of assets<br />

that constitutes a business or nonprofit activity for a<br />

noncontrolling interest in the entity receiving the<br />

assets, including an equity method investee or joint<br />

venture<br />

However, the deconsolidation provisions in<br />

ASC 810-10 40-3A do not apply if the transaction<br />

resulting in an entity’s decreased ownership interest is<br />

either the sale of in-substance real estate or the<br />

conveyance of oil <strong>and</strong> gas mineral rights.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd