Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 2<br />

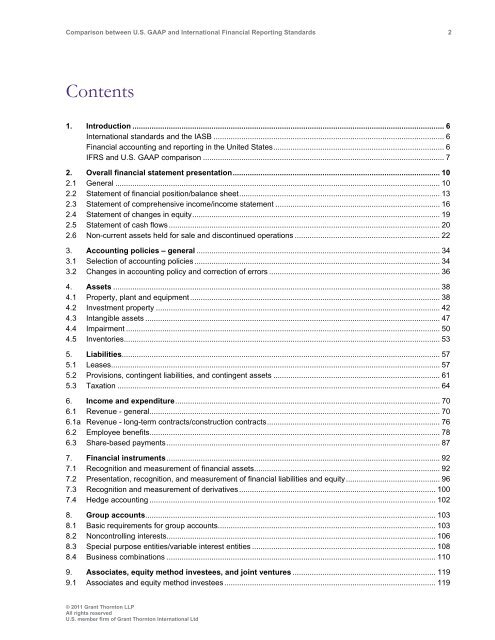

Contents<br />

1. Introduction .................................................................................................................................................. 6<br />

<strong>International</strong> st<strong>and</strong>ards <strong>and</strong> the IASB ............................................................................................................ 6<br />

Financial accounting <strong>and</strong> reporting in the United States................................................................................ 6<br />

IFRS <strong>and</strong> U.S. <strong>GAAP</strong> comparison ................................................................................................................. 7<br />

2. Overall financial statement presentation................................................................................................. 10<br />

2.1 General ........................................................................................................................................................ 10<br />

2.2 Statement of financial position/balance sheet.............................................................................................. 13<br />

2.3 Statement of comprehensive income/income statement ............................................................................. 16<br />

2.4 Statement of changes in equity.................................................................................................................... 19<br />

2.5 Statement of cash flows ............................................................................................................................... 20<br />

2.6 Non-current assets held for sale <strong>and</strong> discontinued operations ....................................................................22<br />

3. Accounting policies – general .................................................................................................................. 34<br />

3.1 Selection of accounting policies ................................................................................................................... 34<br />

3.2 Changes in accounting policy <strong>and</strong> correction of errors ................................................................................ 36<br />

4. Assets ......................................................................................................................................................... 38<br />

4.1 Property, plant <strong>and</strong> equipment..................................................................................................................... 38<br />

4.2 Investment property ..................................................................................................................................... 42<br />

4.3 Intangible assets .......................................................................................................................................... 47<br />

4.4 Impairment ................................................................................................................................................... 50<br />

4.5 Inventories.................................................................................................................................................... 53<br />

5. Liabilities..................................................................................................................................................... 57<br />

5.1 Leases.......................................................................................................................................................... 57<br />

5.2 Provisions, contingent liabilities, <strong>and</strong> contingent assets .............................................................................. 61<br />

5.3 Taxation ....................................................................................................................................................... 64<br />

6. Income <strong>and</strong> expenditure............................................................................................................................ 70<br />

6.1 Revenue - general........................................................................................................................................ 70<br />

6.1a Revenue - long-term contracts/construction contracts................................................................................. 76<br />

6.2 Employee benefits........................................................................................................................................ 78<br />

6.3 Share-based payments................................................................................................................................ 87<br />

7. Financial instruments ................................................................................................................................92<br />

7.1 Recognition <strong>and</strong> measurement of financial assets....................................................................................... 92<br />

7.2 Presentation, recognition, <strong>and</strong> measurement of financial liabilities <strong>and</strong> equity............................................ 96<br />

7.3 Recognition <strong>and</strong> measurement of derivatives............................................................................................ 100<br />

7.4 Hedge accounting ...................................................................................................................................... 102<br />

8. Group accounts........................................................................................................................................ 103<br />

8.1 Basic requirements for group accounts...................................................................................................... 103<br />

8.2 Noncontrolling interests.............................................................................................................................. 106<br />

8.3 Special purpose entities/variable interest entities ...................................................................................... 108<br />

8.4 Business combinations .............................................................................................................................. 110<br />

9. Associates, equity method investees, <strong>and</strong> joint ventures ................................................................... 119<br />

9.1 Associates <strong>and</strong> equity method investees................................................................................................... 119<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd