Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

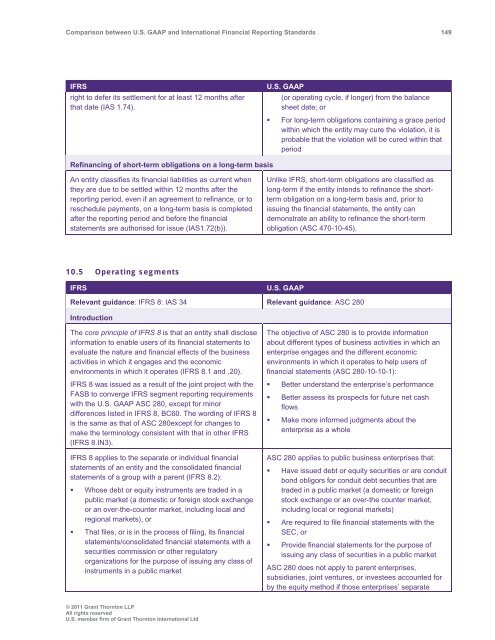

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 149<br />

IFRS<br />

right to defer its settlement for at least 12 months after<br />

that date (IAS 1.74).<br />

U.S. <strong>GAAP</strong><br />

(or operating cycle, if longer) from the balance<br />

sheet date; or<br />

• For long-term obligations containing a grace period<br />

within which the entity may cure the violation, it is<br />

probable that the violation will be cured within that<br />

period<br />

Refinancing of short-term obligations on a long-term basis<br />

An entity classifies its financial liabilities as current when<br />

they are due to be settled within 12 months after the<br />

reporting period, even if an agreement to refinance, or to<br />

reschedule payments, on a long-term basis is completed<br />

after the reporting period <strong>and</strong> before the financial<br />

statements are authorised for issue (IAS1.72(b)).<br />

Unlike IFRS, short-term obligations are classified as<br />

long-term if the entity intends to refinance the shortterm<br />

obligation on a long-term basis <strong>and</strong>, prior to<br />

issuing the financial statements, the entity can<br />

demonstrate an ability to refinance the short-term<br />

obligation (ASC 470-10-45).<br />

10.5 Operating segments<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IFRS 8: IAS 34 Relevant guidance: ASC 280<br />

Introduction<br />

The core principle of IFRS 8 is that an entity shall disclose<br />

information to enable users of its financial statements to<br />

evaluate the nature <strong>and</strong> financial effects of the business<br />

activities in which it engages <strong>and</strong> the economic<br />

environments in which it operates (IFRS 8.1 <strong>and</strong> .20).<br />

IFRS 8 was issued as a result of the joint project with the<br />

FASB to converge IFRS segment reporting requirements<br />

with the U.S. <strong>GAAP</strong> ASC 280, except for minor<br />

differences listed in IFRS 8, BC60. The wording of IFRS 8<br />

is the same as that of ASC 280except for changes to<br />

make the terminology consistent with that in other IFRS<br />

(IFRS 8.IN3).<br />

IFRS 8 applies to the separate or individual financial<br />

statements of an entity <strong>and</strong> the consolidated financial<br />

statements of a group with a parent (IFRS 8.2):<br />

• Whose debt or equity instruments are traded in a<br />

public market (a domestic or foreign stock exchange<br />

or an over-the-counter market, including local <strong>and</strong><br />

regional markets), or<br />

• That files, or is in the process of filing, its financial<br />

statements/consolidated financial statements with a<br />

securities commission or other regulatory<br />

organizations for the purpose of issuing any class of<br />

instruments in a public market<br />

The objective of ASC 280 is to provide information<br />

about different types of business activities in which an<br />

enterprise engages <strong>and</strong> the different economic<br />

environments in which it operates to help users of<br />

financial statements (ASC 280-10-10-1):<br />

• Better underst<strong>and</strong> the enterprise’s performance<br />

• Better assess its prospects for future net cash<br />

flows<br />

• Make more informed judgments about the<br />

enterprise as a whole<br />

ASC 280 applies to public business enterprises that:<br />

• Have issued debt or equity securities or are conduit<br />

bond obligors for conduit debt securities that are<br />

traded in a public market (a domestic or foreign<br />

stock exchange or an over-the counter market,<br />

including local or regional markets)<br />

• Are required to file financial statements with the<br />

SEC, or<br />

• Provide financial statements for the purpose of<br />

issuing any class of securities in a public market<br />

ASC 280 does not apply to parent enterprises,<br />

subsidiaries, joint ventures, or investees accounted for<br />

by the equity method if those enterprises’ separate<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd