Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

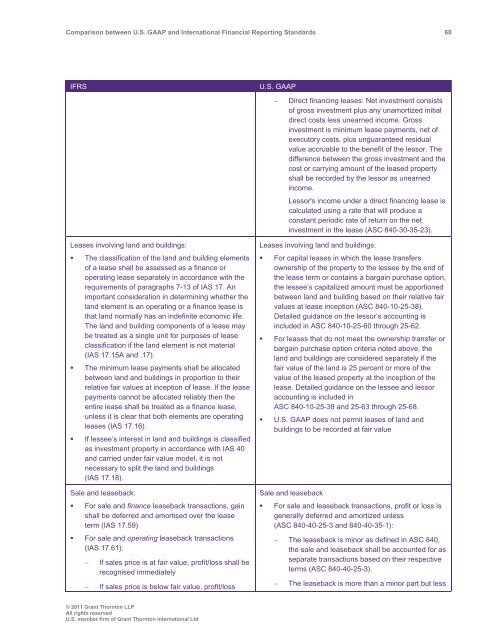

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 60<br />

IFRS<br />

Leases involving l<strong>and</strong> <strong>and</strong> buildings:<br />

• The classification of the l<strong>and</strong> <strong>and</strong> building elements<br />

of a lease shall be assessed as a finance or<br />

operating lease separately in accordance with the<br />

requirements of paragraphs 7-13 of IAS 17. An<br />

important consideration in determining whether the<br />

l<strong>and</strong> element is an operating or a finance lease is<br />

that l<strong>and</strong> normally has an indefinite economic life.<br />

The l<strong>and</strong> <strong>and</strong> building components of a lease may<br />

be treated as a single unit for purposes of lease<br />

classification if the l<strong>and</strong> element is not material<br />

(IAS 17.15A <strong>and</strong> .17).<br />

• The minimum lease payments shall be allocated<br />

<strong>between</strong> l<strong>and</strong> <strong>and</strong> buildings in proportion to their<br />

relative fair values at inception of lease. If the lease<br />

payments cannot be allocated reliably then the<br />

entire lease shall be treated as a finance lease,<br />

unless it is clear that both elements are operating<br />

leases (IAS 17.16).<br />

• If lessee’s interest in l<strong>and</strong> <strong>and</strong> buildings is classified<br />

as investment property in accordance with IAS 40<br />

<strong>and</strong> carried under fair value model, it is not<br />

necessary to split the l<strong>and</strong> <strong>and</strong> buildings<br />

(IAS 17.18).<br />

Sale <strong>and</strong> leaseback:<br />

• For sale <strong>and</strong> finance leaseback transactions, gain<br />

shall be deferred <strong>and</strong> amortised over the lease<br />

term (IAS 17.59)<br />

• For sale <strong>and</strong> operating leaseback transactions<br />

(IAS 17.61):<br />

<br />

<br />

If sales price is at fair value, profit/loss shall be<br />

recognised immediately<br />

If sales price is below fair value, profit/loss<br />

U.S. <strong>GAAP</strong><br />

<br />

Direct financing leases: Net investment consists<br />

of gross investment plus any unamortized initial<br />

direct costs less unearned income. Gross<br />

investment is minimum lease payments, net of<br />

executory costs, plus unguaranteed residual<br />

value accruable to the benefit of the lessor. The<br />

difference <strong>between</strong> the gross investment <strong>and</strong> the<br />

cost or carrying amount of the leased property<br />

shall be recorded by the lessor as unearned<br />

income.<br />

Lessor's income under a direct financing lease is<br />

calculated using a rate that will produce a<br />

constant periodic rate of return on the net<br />

investment in the lease (ASC 840-30-35-23).<br />

Leases involving l<strong>and</strong> <strong>and</strong> buildings:<br />

• For capital leases in which the lease transfers<br />

ownership of the property to the lessee by the end of<br />

the lease term or contains a bargain purchase option,<br />

the lessee’s capitalized amount must be apportioned<br />

<strong>between</strong> l<strong>and</strong> <strong>and</strong> building based on their relative fair<br />

values at lease inception (ASC 840-10-25-38).<br />

Detailed guidance on the lessor’s accounting is<br />

included in ASC 840-10-25-60 through 25-62.<br />

• For leases that do not meet the ownership transfer or<br />

bargain purchase option criteria noted above, the<br />

l<strong>and</strong> <strong>and</strong> buildings are considered separately if the<br />

fair value of the l<strong>and</strong> is 25 percent or more of the<br />

value of the leased property at the inception of the<br />

lease. Detailed guidance on the lessee <strong>and</strong> lessor<br />

accounting is included in<br />

ASC 840-10-25-38 <strong>and</strong> 25-63 through 25-68.<br />

• U.S. <strong>GAAP</strong> does not permit leases of l<strong>and</strong> <strong>and</strong><br />

buildings to be recorded at fair value<br />

Sale <strong>and</strong> leaseback<br />

• For sale <strong>and</strong> leaseback transactions, profit or loss is<br />

generally deferred <strong>and</strong> amortized unless<br />

(ASC 840-40-25-3 <strong>and</strong> 840-40-35-1):<br />

The leaseback is minor as defined in ASC 840,<br />

the sale <strong>and</strong> leaseback shall be accounted for as<br />

separate transactions based on their respective<br />

terms (ASC 840-40-25-3).<br />

<br />

The leaseback is more than a minor part but less<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd