Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

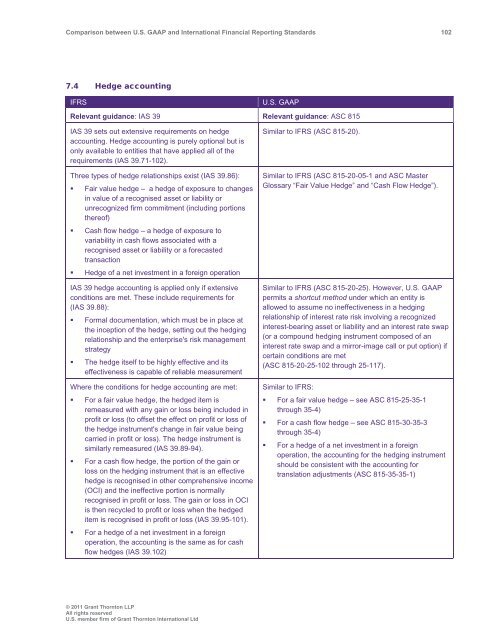

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 102<br />

7.4 Hedge accounting<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 39 Relevant guidance: ASC 815<br />

IAS 39 sets out extensive requirements on hedge<br />

accounting. Hedge accounting is purely optional but is<br />

only available to entities that have applied all of the<br />

requirements (IAS 39.71-102).<br />

Three types of hedge relationships exist (IAS 39.86):<br />

• Fair value hedge – a hedge of exposure to changes<br />

in value of a recognised asset or liability or<br />

unrecognized firm commitment (including portions<br />

thereof)<br />

• Cash flow hedge – a hedge of exposure to<br />

variability in cash flows associated with a<br />

recognised asset or liability or a forecasted<br />

transaction<br />

• Hedge of a net investment in a foreign operation<br />

IAS 39 hedge accounting is applied only if extensive<br />

conditions are met. These include requirements for<br />

(IAS 39.88):<br />

• Formal documentation, which must be in place at<br />

the inception of the hedge, setting out the hedging<br />

relationship <strong>and</strong> the enterprise's risk management<br />

strategy<br />

• The hedge itself to be highly effective <strong>and</strong> its<br />

effectiveness is capable of reliable measurement<br />

Where the conditions for hedge accounting are met:<br />

• For a fair value hedge, the hedged item is<br />

remeasured with any gain or loss being included in<br />

profit or loss (to offset the effect on profit or loss of<br />

the hedge instrument's change in fair value being<br />

carried in profit or loss). The hedge instrument is<br />

similarly remeasured (IAS 39.89-94).<br />

• For a cash flow hedge, the portion of the gain or<br />

loss on the hedging instrument that is an effective<br />

hedge is recognised in other comprehensive income<br />

(OCI) <strong>and</strong> the ineffective portion is normally<br />

recognised in profit or loss. The gain or loss in OCI<br />

is then recycled to profit or loss when the hedged<br />

item is recognised in profit or loss (IAS 39.95-101).<br />

• For a hedge of a net investment in a foreign<br />

operation, the accounting is the same as for cash<br />

flow hedges (IAS 39.102)<br />

Similar to IFRS (ASC 815-20).<br />

Similar to IFRS (ASC 815-20-05-1 <strong>and</strong> ASC Master<br />

Glossary “Fair Value Hedge” <strong>and</strong> “Cash Flow Hedge”).<br />

Similar to IFRS (ASC 815-20-25). However, U.S. <strong>GAAP</strong><br />

permits a shortcut method under which an entity is<br />

allowed to assume no ineffectiveness in a hedging<br />

relationship of interest rate risk involving a recognized<br />

interest-bearing asset or liability <strong>and</strong> an interest rate swap<br />

(or a compound hedging instrument composed of an<br />

interest rate swap <strong>and</strong> a mirror-image call or put option) if<br />

certain conditions are met<br />

(ASC 815-20-25-102 through 25-117).<br />

Similar to IFRS:<br />

• For a fair value hedge – see ASC 815-25-35-1<br />

through 35-4)<br />

• For a cash flow hedge – see ASC 815-30-35-3<br />

through 35-4)<br />

• For a hedge of a net investment in a foreign<br />

operation, the accounting for the hedging instrument<br />

should be consistent with the accounting for<br />

translation adjustments (ASC 815-35-35-1)<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd