Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

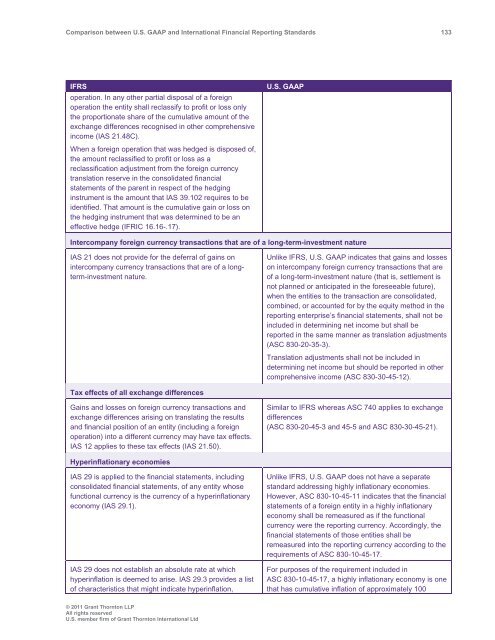

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 133<br />

IFRS<br />

operation. In any other partial disposal of a foreign<br />

operation the entity shall reclassify to profit or loss only<br />

the proportionate share of the cumulative amount of the<br />

exchange differences recognised in other comprehensive<br />

income (IAS 21.48C).<br />

When a foreign operation that was hedged is disposed of,<br />

the amount reclassified to profit or loss as a<br />

reclassification adjustment from the foreign currency<br />

translation reserve in the consolidated financial<br />

statements of the parent in respect of the hedging<br />

instrument is the amount that IAS 39.102 requires to be<br />

identified. That amount is the cumulative gain or loss on<br />

the hedging instrument that was determined to be an<br />

effective hedge (IFRIC 16.16-.17).<br />

U.S. <strong>GAAP</strong><br />

Intercompany foreign currency transactions that are of a long-term-investment nature<br />

IAS 21 does not provide for the deferral of gains on<br />

intercompany currency transactions that are of a longterm-investment<br />

nature.<br />

Unlike IFRS, U.S. <strong>GAAP</strong> indicates that gains <strong>and</strong> losses<br />

on intercompany foreign currency transactions that are<br />

of a long-term-investment nature (that is, settlement is<br />

not planned or anticipated in the foreseeable future),<br />

when the entities to the transaction are consolidated,<br />

combined, or accounted for by the equity method in the<br />

reporting enterprise’s financial statements, shall not be<br />

included in determining net income but shall be<br />

reported in the same manner as translation adjustments<br />

(ASC 830-20-35-3).<br />

Translation adjustments shall not be included in<br />

determining net income but should be reported in other<br />

comprehensive income (ASC 830-30-45-12).<br />

Tax effects of all exchange differences<br />

Gains <strong>and</strong> losses on foreign currency transactions <strong>and</strong><br />

exchange differences arising on translating the results<br />

<strong>and</strong> financial position of an entity (including a foreign<br />

operation) into a different currency may have tax effects.<br />

IAS 12 applies to these tax effects (IAS 21.50).<br />

Similar to IFRS whereas ASC 740 applies to exchange<br />

differences<br />

(ASC 830-20-45-3 <strong>and</strong> 45-5 <strong>and</strong> ASC 830-30-45-21).<br />

Hyperinflationary economies<br />

IAS 29 is applied to the financial statements, including<br />

consolidated financial statements, of any entity whose<br />

functional currency is the currency of a hyperinflationary<br />

economy (IAS 29.1).<br />

IAS 29 does not establish an absolute rate at which<br />

hyperinflation is deemed to arise. IAS 29.3 provides a list<br />

of characteristics that might indicate hyperinflation,<br />

Unlike IFRS, U.S. <strong>GAAP</strong> does not have a separate<br />

st<strong>and</strong>ard addressing highly inflationary economies.<br />

However, ASC 830-10-45-11 indicates that the financial<br />

statements of a foreign entity in a highly inflationary<br />

economy shall be remeasured as if the functional<br />

currency were the reporting currency. Accordingly, the<br />

financial statements of those entities shall be<br />

remeasured into the reporting currency according to the<br />

requirements of ASC 830-10-45-17.<br />

For purposes of the requirement included in<br />

ASC 830-10-45-17, a highly inflationary economy is one<br />

that has cumulative inflation of approximately 100<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd