Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

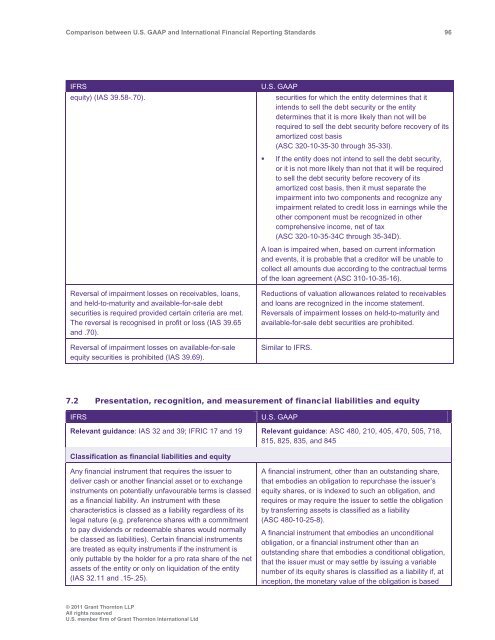

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 96<br />

IFRS<br />

equity) (IAS 39.58-.70).<br />

Reversal of impairment losses on receivables, loans,<br />

<strong>and</strong> held-to-maturity <strong>and</strong> available-for-sale debt<br />

securities is required provided certain criteria are met.<br />

The reversal is recognised in profit or loss (IAS 39.65<br />

<strong>and</strong> .70).<br />

Reversal of impairment losses on available-for-sale<br />

equity securities is prohibited (IAS 39.69).<br />

U.S. <strong>GAAP</strong><br />

securities for which the entity determines that it<br />

intends to sell the debt security or the entity<br />

determines that it is more likely than not will be<br />

required to sell the debt security before recovery of its<br />

amortized cost basis<br />

(ASC 320-10-35-30 through 35-33I).<br />

• If the entity does not intend to sell the debt security,<br />

or it is not more likely than not that it will be required<br />

to sell the debt security before recovery of its<br />

amortized cost basis, then it must separate the<br />

impairment into two components <strong>and</strong> recognize any<br />

impairment related to credit loss in earnings while the<br />

other component must be recognized in other<br />

comprehensive income, net of tax<br />

(ASC 320-10-35-34C through 35-34D).<br />

A loan is impaired when, based on current information<br />

<strong>and</strong> events, it is probable that a creditor will be unable to<br />

collect all amounts due according to the contractual terms<br />

of the loan agreement (ASC 310-10-35-16).<br />

Reductions of valuation allowances related to receivables<br />

<strong>and</strong> loans are recognized in the income statement.<br />

Reversals of impairment losses on held-to-maturity <strong>and</strong><br />

available-for-sale debt securities are prohibited.<br />

Similar to IFRS.<br />

7.2 Presentation, recognition, <strong>and</strong> measurement of financial liabilities <strong>and</strong> equity<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 32 <strong>and</strong> 39; IFRIC 17 <strong>and</strong> 19 Relevant guidance: ASC 480, 210, 405, 470, 505, 718,<br />

815, 825, 835, <strong>and</strong> 845<br />

Classification as financial liabilities <strong>and</strong> equity<br />

Any financial instrument that requires the issuer to<br />

deliver cash or another financial asset or to exchange<br />

instruments on potentially unfavourable terms is classed<br />

as a financial liability. An instrument with these<br />

characteristics is classed as a liability regardless of its<br />

legal nature (e.g. preference shares with a commitment<br />

to pay dividends or redeemable shares would normally<br />

be classed as liabilities). Certain financial instruments<br />

are treated as equity instruments if the instrument is<br />

only puttable by the holder for a pro rata share of the net<br />

assets of the entity or only on liquidation of the entity<br />

(IAS 32.11 <strong>and</strong> .15-.25).<br />

A financial instrument, other than an outst<strong>and</strong>ing share,<br />

that embodies an obligation to repurchase the issuer’s<br />

equity shares, or is indexed to such an obligation, <strong>and</strong><br />

requires or may require the issuer to settle the obligation<br />

by transferring assets is classified as a liability<br />

(ASC 480-10-25-8).<br />

A financial instrument that embodies an unconditional<br />

obligation, or a financial instrument other than an<br />

outst<strong>and</strong>ing share that embodies a conditional obligation,<br />

that the issuer must or may settle by issuing a variable<br />

number of its equity shares is classified as a liability if, at<br />

inception, the monetary value of the obligation is based<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd