Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

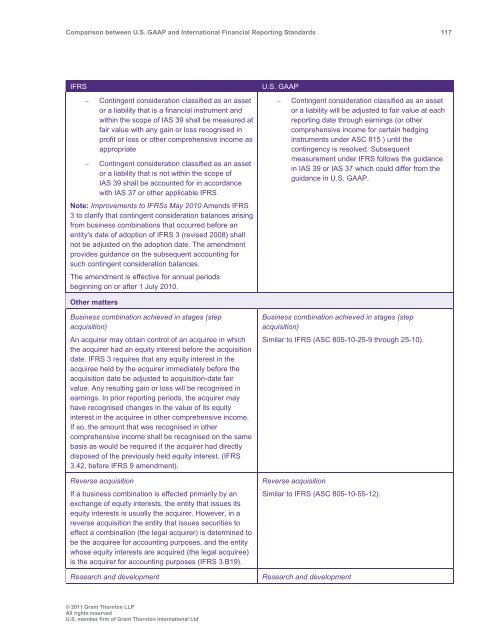

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 117<br />

IFRS<br />

<br />

Contingent consideration classified as an asset<br />

or a liability that is a financial instrument <strong>and</strong><br />

within the scope of IAS 39 shall be measured at<br />

fair value with any gain or loss recognised in<br />

profit or loss or other comprehensive income as<br />

appropriate<br />

Contingent consideration classified as an asset<br />

or a liability that is not within the scope of<br />

IAS 39 shall be accounted for in accordance<br />

with IAS 37 or other applicable IFRS<br />

Note: Improvements to IFRSs May 2010 Amends IFRS<br />

3 to clarify that contingent consideration balances arising<br />

from business combinations that occurred before an<br />

entity's date of adoption of IFRS 3 (revised 2008) shall<br />

not be adjusted on the adoption date. The amendment<br />

provides guidance on the subsequent accounting for<br />

such contingent consideration balances.<br />

The amendment is effective for annual periods<br />

beginning on or after 1 July 2010.<br />

U.S. <strong>GAAP</strong><br />

<br />

Contingent consideration classified as an asset<br />

or a liability will be adjusted to fair value at each<br />

reporting date through earnings (or other<br />

comprehensive income for certain hedging<br />

instruments under ASC 815 ) until the<br />

contingency is resolved. Subsequent<br />

measurement under IFRS follows the guidance<br />

in IAS 39 or IAS 37 which could differ from the<br />

guidance in U.S. <strong>GAAP</strong>.<br />

Other matters<br />

Business combination achieved in stages (step<br />

acquisition)<br />

An acquirer may obtain control of an acquiree in which<br />

the acquirer had an equity interest before the acquisition<br />

date. IFRS 3 requires that any equity interest in the<br />

acquiree held by the acquirer immediately before the<br />

acquisition date be adjusted to acquisition-date fair<br />

value. Any resulting gain or loss will be recognised in<br />

earnings. In prior reporting periods, the acquirer may<br />

have recognised changes in the value of its equity<br />

interest in the acquiree in other comprehensive income.<br />

If so, the amount that was recognised in other<br />

comprehensive income shall be recognised on the same<br />

basis as would be required if the acquirer had directly<br />

disposed of the previously held equity interest. (IFRS<br />

3.42, before IFRS 9 amendment).<br />

Reverse acquisition<br />

If a business combination is effected primarily by an<br />

exchange of equity interests, the entity that issues its<br />

equity interests is usually the acquirer. However, in a<br />

reverse acquisition the entity that issues securities to<br />

effect a combination (the legal acquirer) is determined to<br />

be the acquiree for accounting purposes, <strong>and</strong> the entity<br />

whose equity interests are acquired (the legal acquiree)<br />

is the acquirer for accounting purposes (IFRS 3.B19).<br />

Research <strong>and</strong> development<br />

Business combination achieved in stages (step<br />

acquisition)<br />

Similar to IFRS (ASC 805-10-25-9 through 25-10).<br />

Reverse acquisition<br />

Similar to IFRS (ASC 805-10-55-12).<br />

Research <strong>and</strong> development<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd