Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

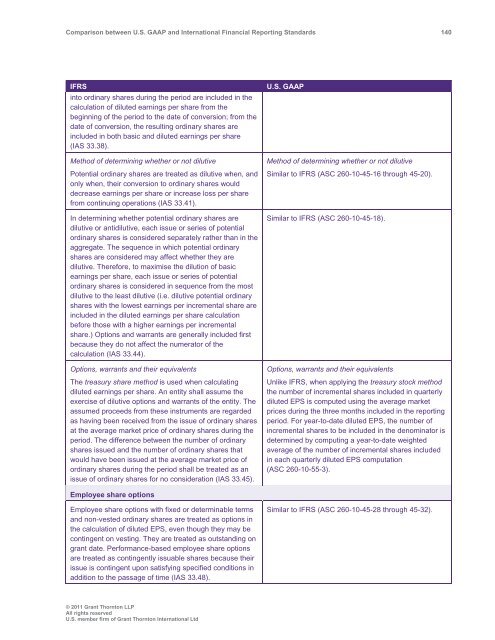

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 140<br />

IFRS<br />

into ordinary shares during the period are included in the<br />

calculation of diluted earnings per share from the<br />

beginning of the period to the date of conversion; from the<br />

date of conversion, the resulting ordinary shares are<br />

included in both basic <strong>and</strong> diluted earnings per share<br />

(IAS 33.38).<br />

Method of determining whether or not dilutive<br />

Potential ordinary shares are treated as dilutive when, <strong>and</strong><br />

only when, their conversion to ordinary shares would<br />

decrease earnings per share or increase loss per share<br />

from continuing operations (IAS 33.41).<br />

In determining whether potential ordinary shares are<br />

dilutive or antidilutive, each issue or series of potential<br />

ordinary shares is considered separately rather than in the<br />

aggregate. The sequence in which potential ordinary<br />

shares are considered may affect whether they are<br />

dilutive. Therefore, to maximise the dilution of basic<br />

earnings per share, each issue or series of potential<br />

ordinary shares is considered in sequence from the most<br />

dilutive to the least dilutive (i.e. dilutive potential ordinary<br />

shares with the lowest earnings per incremental share are<br />

included in the diluted earnings per share calculation<br />

before those with a higher earnings per incremental<br />

share.) Options <strong>and</strong> warrants are generally included first<br />

because they do not affect the numerator of the<br />

calculation (IAS 33.44).<br />

Options, warrants <strong>and</strong> their equivalents<br />

The treasury share method is used when calculating<br />

diluted earnings per share. An entity shall assume the<br />

exercise of dilutive options <strong>and</strong> warrants of the entity. The<br />

assumed proceeds from these instruments are regarded<br />

as having been received from the issue of ordinary shares<br />

at the average market price of ordinary shares during the<br />

period. The difference <strong>between</strong> the number of ordinary<br />

shares issued <strong>and</strong> the number of ordinary shares that<br />

would have been issued at the average market price of<br />

ordinary shares during the period shall be treated as an<br />

issue of ordinary shares for no consideration (IAS 33.45).<br />

U.S. <strong>GAAP</strong><br />

Method of determining whether or not dilutive<br />

Similar to IFRS (ASC 260-10-45-16 through 45-20).<br />

Similar to IFRS (ASC 260-10-45-18).<br />

Options, warrants <strong>and</strong> their equivalents<br />

Unlike IFRS, when applying the treasury stock method<br />

the number of incremental shares included in quarterly<br />

diluted EPS is computed using the average market<br />

prices during the three months included in the reporting<br />

period. For year-to-date diluted EPS, the number of<br />

incremental shares to be included in the denominator is<br />

determined by computing a year-to-date weighted<br />

average of the number of incremental shares included<br />

in each quarterly diluted EPS computation<br />

(ASC 260-10-55-3).<br />

Employee share options<br />

Employee share options with fixed or determinable terms<br />

<strong>and</strong> non-vested ordinary shares are treated as options in<br />

the calculation of diluted EPS, even though they may be<br />

contingent on vesting. They are treated as outst<strong>and</strong>ing on<br />

grant date. Performance-based employee share options<br />

are treated as contingently issuable shares because their<br />

issue is contingent upon satisfying specified conditions in<br />

addition to the passage of time (IAS 33.48).<br />

Similar to IFRS (ASC 260-10-45-28 through 45-32).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd