Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

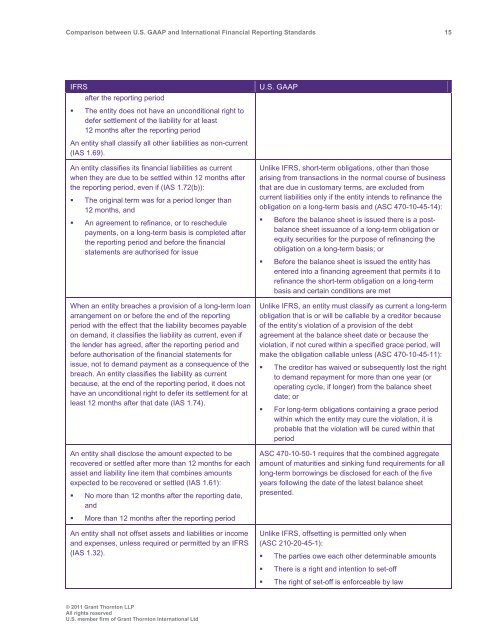

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 15<br />

IFRS<br />

after the reporting period<br />

• The entity does not have an unconditional right to<br />

defer settlement of the liability for at least<br />

12 months after the reporting period<br />

An entity shall classify all other liabilities as non-current<br />

(IAS 1.69).<br />

An entity classifies its financial liabilities as current<br />

when they are due to be settled within 12 months after<br />

the reporting period, even if (IAS 1.72(b)):<br />

• The original term was for a period longer than<br />

12 months, <strong>and</strong><br />

• An agreement to refinance, or to reschedule<br />

payments, on a long-term basis is completed after<br />

the reporting period <strong>and</strong> before the financial<br />

statements are authorised for issue<br />

When an entity breaches a provision of a long-term loan<br />

arrangement on or before the end of the reporting<br />

period with the effect that the liability becomes payable<br />

on dem<strong>and</strong>, it classifies the liability as current, even if<br />

the lender has agreed, after the reporting period <strong>and</strong><br />

before authorisation of the financial statements for<br />

issue, not to dem<strong>and</strong> payment as a consequence of the<br />

breach. An entity classifies the liability as current<br />

because, at the end of the reporting period, it does not<br />

have an unconditional right to defer its settlement for at<br />

least 12 months after that date (IAS 1.74).<br />

An entity shall disclose the amount expected to be<br />

recovered or settled after more than 12 months for each<br />

asset <strong>and</strong> liability line item that combines amounts<br />

expected to be recovered or settled (IAS 1.61):<br />

• No more than 12 months after the reporting date,<br />

<strong>and</strong><br />

• More than 12 months after the reporting period<br />

An entity shall not offset assets <strong>and</strong> liabilities or income<br />

<strong>and</strong> expenses, unless required or permitted by an IFRS<br />

(IAS 1.32).<br />

U.S. <strong>GAAP</strong><br />

Unlike IFRS, short-term obligations, other than those<br />

arising from transactions in the normal course of business<br />

that are due in customary terms, are excluded from<br />

current liabilities only if the entity intends to refinance the<br />

obligation on a long-term basis <strong>and</strong> (ASC 470-10-45-14):<br />

• Before the balance sheet is issued there is a postbalance<br />

sheet issuance of a long-term obligation or<br />

equity securities for the purpose of refinancing the<br />

obligation on a long-term basis; or<br />

• Before the balance sheet is issued the entity has<br />

entered into a financing agreement that permits it to<br />

refinance the short-term obligation on a long-term<br />

basis <strong>and</strong> certain conditions are met<br />

Unlike IFRS, an entity must classify as current a long-term<br />

obligation that is or will be callable by a creditor because<br />

of the entity’s violation of a provision of the debt<br />

agreement at the balance sheet date or because the<br />

violation, if not cured within a specified grace period, will<br />

make the obligation callable unless (ASC 470-10-45-11):<br />

• The creditor has waived or subsequently lost the right<br />

to dem<strong>and</strong> repayment for more than one year (or<br />

operating cycle, if longer) from the balance sheet<br />

date; or<br />

• For long-term obligations containing a grace period<br />

within which the entity may cure the violation, it is<br />

probable that the violation will be cured within that<br />

period<br />

ASC 470-10-50-1 requires that the combined aggregate<br />

amount of maturities <strong>and</strong> sinking fund requirements for all<br />

long-term borrowings be disclosed for each of the five<br />

years following the date of the latest balance sheet<br />

presented.<br />

Unlike IFRS, offsetting is permitted only when<br />

(ASC 210-20-45-1):<br />

• The parties owe each other determinable amounts<br />

• There is a right <strong>and</strong> intention to set-off<br />

• The right of set-off is enforceable by law<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd