Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

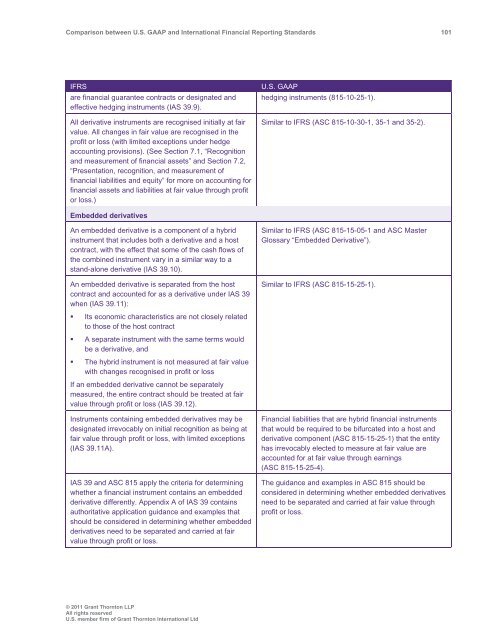

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 101<br />

IFRS<br />

are financial guarantee contracts or designated <strong>and</strong><br />

effective hedging instruments (IAS 39.9).<br />

All derivative instruments are recognised initially at fair<br />

value. All changes in fair value are recognised in the<br />

profit or loss (with limited exceptions under hedge<br />

accounting provisions). (See Section 7.1, “Recognition<br />

<strong>and</strong> measurement of financial assets” <strong>and</strong> Section 7.2,<br />

“Presentation, recognition, <strong>and</strong> measurement of<br />

financial liabilities <strong>and</strong> equity” for more on accounting for<br />

financial assets <strong>and</strong> liabilities at fair value through profit<br />

or loss.)<br />

U.S. <strong>GAAP</strong><br />

hedging instruments (815-10-25-1).<br />

Similar to IFRS (ASC 815-10-30-1, 35-1 <strong>and</strong> 35-2).<br />

Embedded derivatives<br />

An embedded derivative is a component of a hybrid<br />

instrument that includes both a derivative <strong>and</strong> a host<br />

contract, with the effect that some of the cash flows of<br />

the combined instrument vary in a similar way to a<br />

st<strong>and</strong>-alone derivative (IAS 39.10).<br />

An embedded derivative is separated from the host<br />

contract <strong>and</strong> accounted for as a derivative under IAS 39<br />

when (IAS 39.11):<br />

Similar to IFRS (ASC 815-15-05-1 <strong>and</strong> ASC Master<br />

Glossary “Embedded Derivative”).<br />

Similar to IFRS (ASC 815-15-25-1).<br />

• Its economic characteristics are not closely related<br />

to those of the host contract<br />

• A separate instrument with the same terms would<br />

be a derivative, <strong>and</strong><br />

• The hybrid instrument is not measured at fair value<br />

with changes recognised in profit or loss<br />

If an embedded derivative cannot be separately<br />

measured, the entire contract should be treated at fair<br />

value through profit or loss (IAS 39.12).<br />

Instruments containing embedded derivatives may be<br />

designated irrevocably on initial recognition as being at<br />

fair value through profit or loss, with limited exceptions<br />

(IAS 39.11A).<br />

IAS 39 <strong>and</strong> ASC 815 apply the criteria for determining<br />

whether a financial instrument contains an embedded<br />

derivative differently. Appendix A of IAS 39 contains<br />

authoritative application guidance <strong>and</strong> examples that<br />

should be considered in determining whether embedded<br />

derivatives need to be separated <strong>and</strong> carried at fair<br />

value through profit or loss.<br />

Financial liabilities that are hybrid financial instruments<br />

that would be required to be bifurcated into a host <strong>and</strong><br />

derivative component (ASC 815-15-25-1) that the entity<br />

has irrevocably elected to measure at fair value are<br />

accounted for at fair value through earnings<br />

(ASC 815-15-25-4).<br />

The guidance <strong>and</strong> examples in ASC 815 should be<br />

considered in determining whether embedded derivatives<br />

need to be separated <strong>and</strong> carried at fair value through<br />

profit or loss.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd