Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

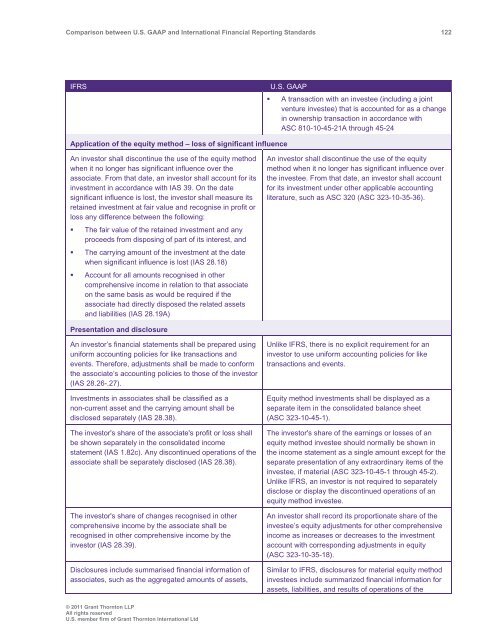

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 122<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

• A transaction with an investee (including a joint<br />

venture investee) that is accounted for as a change<br />

in ownership transaction in accordance with<br />

ASC 810-10-45-21A through 45-24<br />

Application of the equity method – loss of significant influence<br />

An investor shall discontinue the use of the equity method<br />

when it no longer has significant influence over the<br />

associate. From that date, an investor shall account for its<br />

investment in accordance with IAS 39. On the date<br />

significant influence is lost, the investor shall measure its<br />

retained investment at fair value <strong>and</strong> recognise in profit or<br />

loss any difference <strong>between</strong> the following:<br />

• The fair value of the retained investment <strong>and</strong> any<br />

proceeds from disposing of part of its interest, <strong>and</strong><br />

• The carrying amount of the investment at the date<br />

when significant influence is lost (IAS 28.18)<br />

• Account for all amounts recognised in other<br />

comprehensive income in relation to that associate<br />

on the same basis as would be required if the<br />

associate had directly disposed the related assets<br />

<strong>and</strong> liabilities (IAS 28.19A)<br />

An investor shall discontinue the use of the equity<br />

method when it no longer has significant influence over<br />

the investee. From that date, an investor shall account<br />

for its investment under other applicable accounting<br />

literature, such as ASC 320 (ASC 323-10-35-36).<br />

Presentation <strong>and</strong> disclosure<br />

An investor’s financial statements shall be prepared using<br />

uniform accounting policies for like transactions <strong>and</strong><br />

events. Therefore, adjustments shall be made to conform<br />

the associate’s accounting policies to those of the investor<br />

(IAS 28.26-.27).<br />

Investments in associates shall be classified as a<br />

non-current asset <strong>and</strong> the carrying amount shall be<br />

disclosed separately (IAS 28.38).<br />

The investor's share of the associate's profit or loss shall<br />

be shown separately in the consolidated income<br />

statement (IAS 1.82c). Any discontinued operations of the<br />

associate shall be separately disclosed (IAS 28.38).<br />

The investor's share of changes recognised in other<br />

comprehensive income by the associate shall be<br />

recognised in other comprehensive income by the<br />

investor (IAS 28.39).<br />

Disclosures include summarised financial information of<br />

associates, such as the aggregated amounts of assets,<br />

Unlike IFRS, there is no explicit requirement for an<br />

investor to use uniform accounting policies for like<br />

transactions <strong>and</strong> events.<br />

Equity method investments shall be displayed as a<br />

separate item in the consolidated balance sheet<br />

(ASC 323-10-45-1).<br />

The investor's share of the earnings or losses of an<br />

equity method investee should normally be shown in<br />

the income statement as a single amount except for the<br />

separate presentation of any extraordinary items of the<br />

investee, if material (ASC 323-10-45-1 through 45-2).<br />

Unlike IFRS, an investor is not required to separately<br />

disclose or display the discontinued operations of an<br />

equity method investee.<br />

An investor shall record its proportionate share of the<br />

investee’s equity adjustments for other comprehensive<br />

income as increases or decreases to the investment<br />

account with corresponding adjustments in equity<br />

(ASC 323-10-35-18).<br />

Similar to IFRS, disclosures for material equity method<br />

investees include summarized financial information for<br />

assets, liabilities, <strong>and</strong> results of operations of the<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd