Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

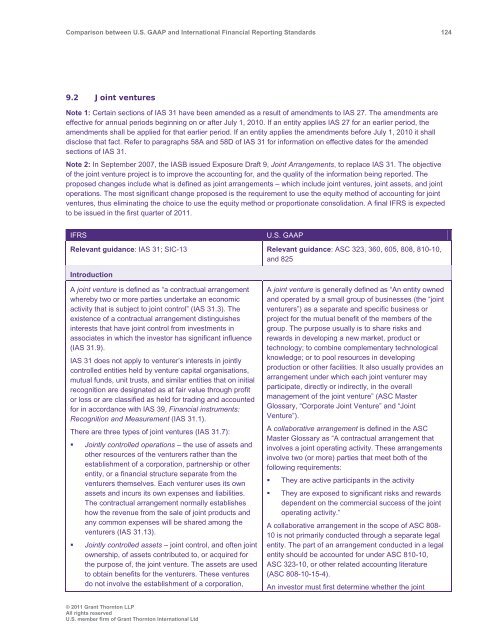

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 124<br />

9.2 Joint ventures<br />

Note 1: Certain sections of IAS 31 have been amended as a result of amendments to IAS 27. The amendments are<br />

effective for annual periods beginning on or after July 1, 2010. If an entity applies IAS 27 for an earlier period, the<br />

amendments shall be applied for that earlier period. If an entity applies the amendments before July 1, 2010 it shall<br />

disclose that fact. Refer to paragraphs 58A <strong>and</strong> 58D of IAS 31 for information on effective dates for the amended<br />

sections of IAS 31.<br />

Note 2: In September 2007, the IASB issued Exposure Draft 9, Joint Arrangements, to replace IAS 31. The objective<br />

of the joint venture project is to improve the accounting for, <strong>and</strong> the quality of the information being reported. The<br />

proposed changes include what is defined as joint arrangements – which include joint ventures, joint assets, <strong>and</strong> joint<br />

operations. The most significant change proposed is the requirement to use the equity method of accounting for joint<br />

ventures, thus eliminating the choice to use the equity method or proportionate consolidation. A final IFRS is expected<br />

to be issued in the first quarter of 2011.<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 31; SIC-13 Relevant guidance: ASC 323, 360, 605, 808, 810-10,<br />

<strong>and</strong> 825<br />

Introduction<br />

A joint venture is defined as “a contractual arrangement<br />

whereby two or more parties undertake an economic<br />

activity that is subject to joint control” (IAS 31.3). The<br />

existence of a contractual arrangement distinguishes<br />

interests that have joint control from investments in<br />

associates in which the investor has significant influence<br />

(IAS 31.9).<br />

IAS 31 does not apply to venturer’s interests in jointly<br />

controlled entities held by venture capital organisations,<br />

mutual funds, unit trusts, <strong>and</strong> similar entities that on initial<br />

recognition are designated as at fair value through profit<br />

or loss or are classified as held for trading <strong>and</strong> accounted<br />

for in accordance with IAS 39, Financial instruments:<br />

Recognition <strong>and</strong> Measurement (IAS 31.1).<br />

There are three types of joint ventures (IAS 31.7):<br />

• Jointly controlled operations – the use of assets <strong>and</strong><br />

other resources of the venturers rather than the<br />

establishment of a corporation, partnership or other<br />

entity, or a financial structure separate from the<br />

venturers themselves. Each venturer uses its own<br />

assets <strong>and</strong> incurs its own expenses <strong>and</strong> liabilities.<br />

The contractual arrangement normally establishes<br />

how the revenue from the sale of joint products <strong>and</strong><br />

any common expenses will be shared among the<br />

venturers (IAS 31.13).<br />

• Jointly controlled assets – joint control, <strong>and</strong> often joint<br />

ownership, of assets contributed to, or acquired for<br />

the purpose of, the joint venture. The assets are used<br />

to obtain benefits for the venturers. These ventures<br />

do not involve the establishment of a corporation,<br />

A joint venture is generally defined as “An entity owned<br />

<strong>and</strong> operated by a small group of businesses (the “joint<br />

venturers”) as a separate <strong>and</strong> specific business or<br />

project for the mutual benefit of the members of the<br />

group. The purpose usually is to share risks <strong>and</strong><br />

rewards in developing a new market, product or<br />

technology; to combine complementary technological<br />

knowledge; or to pool resources in developing<br />

production or other facilities. It also usually provides an<br />

arrangement under which each joint venturer may<br />

participate, directly or indirectly, in the overall<br />

management of the joint venture” (ASC Master<br />

Glossary, “Corporate Joint Venture” <strong>and</strong> “Joint<br />

Venture”).<br />

A collaborative arrangement is defined in the ASC<br />

Master Glossary as “A contractual arrangement that<br />

involves a joint operating activity. These arrangements<br />

involve two (or more) parties that meet both of the<br />

following requirements:<br />

• They are active participants in the activity<br />

• They are exposed to significant risks <strong>and</strong> rewards<br />

dependent on the commercial success of the joint<br />

operating activity.”<br />

A collaborative arrangement in the scope of ASC 808-<br />

10 is not primarily conducted through a separate legal<br />

entity. The part of an arrangement conducted in a legal<br />

entity should be accounted for under ASC 810-10,<br />

ASC 323-10, or other related accounting literature<br />

(ASC 808-10-15-4).<br />

An investor must first determine whether the joint<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd