Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

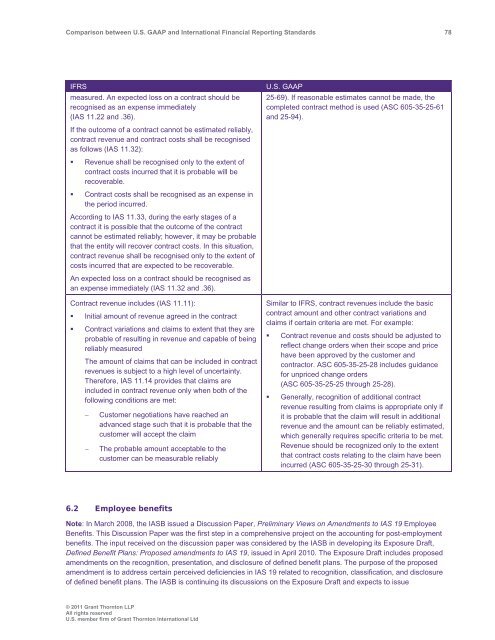

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 78<br />

IFRS<br />

measured. An expected loss on a contract should be<br />

recognised as an expense immediately<br />

(IAS 11.22 <strong>and</strong> .36).<br />

If the outcome of a contract cannot be estimated reliably,<br />

contract revenue <strong>and</strong> contract costs shall be recognised<br />

as follows (IAS 11.32):<br />

• Revenue shall be recognised only to the extent of<br />

contract costs incurred that it is probable will be<br />

recoverable.<br />

• Contract costs shall be recognised as an expense in<br />

the period incurred.<br />

According to IAS 11.33, during the early stages of a<br />

contract it is possible that the outcome of the contract<br />

cannot be estimated reliably; however, it may be probable<br />

that the entity will recover contract costs. In this situation,<br />

contract revenue shall be recognised only to the extent of<br />

costs incurred that are expected to be recoverable.<br />

An expected loss on a contract should be recognised as<br />

an expense immediately (IAS 11.32 <strong>and</strong> .36).<br />

Contract revenue includes (IAS 11.11):<br />

• Initial amount of revenue agreed in the contract<br />

• Contract variations <strong>and</strong> claims to extent that they are<br />

probable of resulting in revenue <strong>and</strong> capable of being<br />

reliably measured<br />

The amount of claims that can be included in contract<br />

revenues is subject to a high level of uncertainty.<br />

Therefore, IAS 11.14 provides that claims are<br />

included in contract revenue only when both of the<br />

following conditions are met:<br />

<br />

<br />

Customer negotiations have reached an<br />

advanced stage such that it is probable that the<br />

customer will accept the claim<br />

The probable amount acceptable to the<br />

customer can be measurable reliably<br />

U.S. <strong>GAAP</strong><br />

25-69). If reasonable estimates cannot be made, the<br />

completed contract method is used (ASC 605-35-25-61<br />

<strong>and</strong> 25-94).<br />

Similar to IFRS, contract revenues include the basic<br />

contract amount <strong>and</strong> other contract variations <strong>and</strong><br />

claims if certain criteria are met. For example:<br />

• Contract revenue <strong>and</strong> costs should be adjusted to<br />

reflect change orders when their scope <strong>and</strong> price<br />

have been approved by the customer <strong>and</strong><br />

contractor. ASC 605-35-25-28 includes guidance<br />

for unpriced change orders<br />

(ASC 605-35-25-25 through 25-28).<br />

• Generally, recognition of additional contract<br />

revenue resulting from claims is appropriate only if<br />

it is probable that the claim will result in additional<br />

revenue <strong>and</strong> the amount can be reliably estimated,<br />

which generally requires specific criteria to be met.<br />

Revenue should be recognized only to the extent<br />

that contract costs relating to the claim have been<br />

incurred (ASC 605-35-25-30 through 25-31).<br />

6.2 Employee benefits<br />

Note: In March 2008, the IASB issued a Discussion Paper, Preliminary Views on Amendments to IAS 19 Employee<br />

Benefits. This Discussion Paper was the first step in a comprehensive project on the accounting for post-employment<br />

benefits. The input received on the discussion paper was considered by the IASB in developing its Exposure Draft,<br />

Defined Benefit Plans: Proposed amendments to IAS 19, issued in April 2010. The Exposure Draft includes proposed<br />

amendments on the recognition, presentation, <strong>and</strong> disclosure of defined benefit plans. The purpose of the proposed<br />

amendment is to address certain perceived deficiencies in IAS 19 related to recognition, classification, <strong>and</strong> disclosure<br />

of defined benefit plans. The IASB is continuing its discussions on the Exposure Draft <strong>and</strong> expects to issue<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd