Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

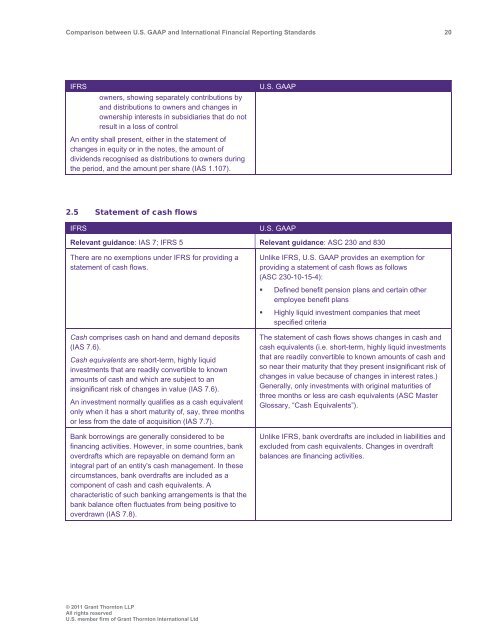

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 20<br />

IFRS<br />

owners, showing separately contributions by<br />

<strong>and</strong> distributions to owners <strong>and</strong> changes in<br />

ownership interests in subsidiaries that do not<br />

result in a loss of control<br />

An entity shall present, either in the statement of<br />

changes in equity or in the notes, the amount of<br />

dividends recognised as distributions to owners during<br />

the period, <strong>and</strong> the amount per share (IAS 1.107).<br />

U.S. <strong>GAAP</strong><br />

2.5 Statement of cash flows<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 7; IFRS 5 Relevant guidance: ASC 230 <strong>and</strong> 830<br />

There are no exemptions under IFRS for providing a<br />

statement of cash flows.<br />

Cash comprises cash on h<strong>and</strong> <strong>and</strong> dem<strong>and</strong> deposits<br />

(IAS 7.6).<br />

Cash equivalents are short-term, highly liquid<br />

investments that are readily convertible to known<br />

amounts of cash <strong>and</strong> which are subject to an<br />

insignificant risk of changes in value (IAS 7.6).<br />

An investment normally qualifies as a cash equivalent<br />

only when it has a short maturity of, say, three months<br />

or less from the date of acquisition (IAS 7.7).<br />

Bank borrowings are generally considered to be<br />

financing activities. However, in some countries, bank<br />

overdrafts which are repayable on dem<strong>and</strong> form an<br />

integral part of an entity's cash management. In these<br />

circumstances, bank overdrafts are included as a<br />

component of cash <strong>and</strong> cash equivalents. A<br />

characteristic of such banking arrangements is that the<br />

bank balance often fluctuates from being positive to<br />

overdrawn (IAS 7.8).<br />

Unlike IFRS, U.S. <strong>GAAP</strong> provides an exemption for<br />

providing a statement of cash flows as follows<br />

(ASC 230-10-15-4):<br />

• Defined benefit pension plans <strong>and</strong> certain other<br />

employee benefit plans<br />

• Highly liquid investment companies that meet<br />

specified criteria<br />

The statement of cash flows shows changes in cash <strong>and</strong><br />

cash equivalents (i.e. short-term, highly liquid investments<br />

that are readily convertible to known amounts of cash <strong>and</strong><br />

so near their maturity that they present insignificant risk of<br />

changes in value because of changes in interest rates.)<br />

Generally, only investments with original maturities of<br />

three months or less are cash equivalents (ASC Master<br />

Glossary, “Cash Equivalents”).<br />

Unlike IFRS, bank overdrafts are included in liabilities <strong>and</strong><br />

excluded from cash equivalents. Changes in overdraft<br />

balances are financing activities.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd