Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

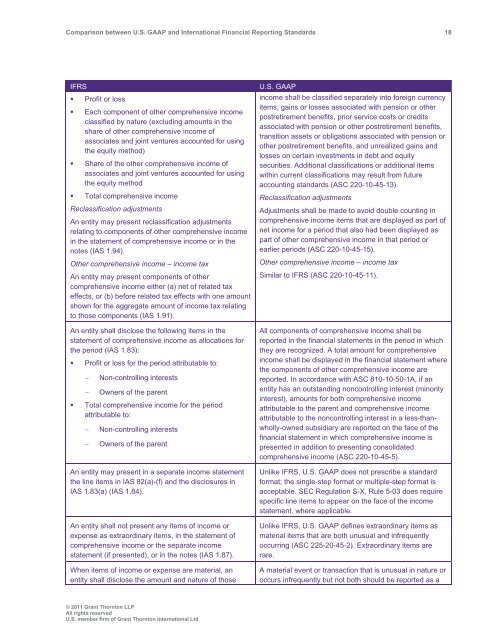

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 18<br />

IFRS<br />

• Profit or loss<br />

• Each component of other comprehensive income<br />

classified by nature (excluding amounts in the<br />

share of other comprehensive income of<br />

associates <strong>and</strong> joint ventures accounted for using<br />

the equity method)<br />

• Share of the other comprehensive income of<br />

associates <strong>and</strong> joint ventures accounted for using<br />

the equity method<br />

• Total comprehensive income<br />

Reclassification adjustments<br />

An entity may present reclassification adjustments<br />

relating to components of other comprehensive income<br />

in the statement of comprehensive income or in the<br />

notes (IAS 1.94).<br />

Other comprehensive income – income tax<br />

An entity may present components of other<br />

comprehensive income either (a) net of related tax<br />

effects, or (b) before related tax effects with one amount<br />

shown for the aggregate amount of income tax relating<br />

to those components (IAS 1.91).<br />

An entity shall disclose the following items in the<br />

statement of comprehensive income as allocations for<br />

the period (IAS 1.83):<br />

• Profit or loss for the period attributable to:<br />

<br />

Non-controlling interests<br />

Owners of the parent<br />

• Total comprehensive income for the period<br />

attributable to:<br />

<br />

<br />

Non-controlling interests<br />

Owners of the parent<br />

An entity may present in a separate income statement<br />

the line items in IAS 82(a)-(f) <strong>and</strong> the disclosures in<br />

IAS 1.83(a) (IAS 1.84).<br />

An entity shall not present any items of income or<br />

expense as extraordinary items, in the statement of<br />

comprehensive income or the separate income<br />

statement (if presented), or in the notes (IAS 1.87).<br />

When items of income or expense are material, an<br />

entity shall disclose the amount <strong>and</strong> nature of those<br />

U.S. <strong>GAAP</strong><br />

income shall be classified separately into foreign currency<br />

items, gains or losses associated with pension or other<br />

postretirement benefits, prior service costs or credits<br />

associated with pension or other postretirement benefits,<br />

transition assets or obligations associated with pension or<br />

other postretirement benefits, <strong>and</strong> unrealized gains <strong>and</strong><br />

losses on certain investments in debt <strong>and</strong> equity<br />

securities. Additional classifications or additional items<br />

within current classifications may result from future<br />

accounting st<strong>and</strong>ards (ASC 220-10-45-13).<br />

Reclassification adjustments<br />

Adjustments shall be made to avoid double counting in<br />

comprehensive income items that are displayed as part of<br />

net income for a period that also had been displayed as<br />

part of other comprehensive income in that period or<br />

earlier periods (ASC 220-10-45-15).<br />

Other comprehensive income – income tax<br />

Similar to IFRS (ASC 220-10-45-11).<br />

All components of comprehensive income shall be<br />

reported in the financial statements in the period in which<br />

they are recognized. A total amount for comprehensive<br />

income shall be displayed in the financial statement where<br />

the components of other comprehensive income are<br />

reported. In accordance with ASC 810-10-50-1A, if an<br />

entity has an outst<strong>and</strong>ing noncontrolling interest (minority<br />

interest), amounts for both comprehensive income<br />

attributable to the parent <strong>and</strong> comprehensive income<br />

attributable to the noncontrolling interest in a less-thanwholly-owned<br />

subsidiary are reported on the face of the<br />

financial statement in which comprehensive income is<br />

presented in addition to presenting consolidated<br />

comprehensive income (ASC 220-10-45-5).<br />

Unlike IFRS, U.S. <strong>GAAP</strong> does not prescribe a st<strong>and</strong>ard<br />

format; the single-step format or multiple-step format is<br />

acceptable. SEC Regulation S-X, Rule 5-03 does require<br />

specific line items to appear on the face of the income<br />

statement, where applicable.<br />

Unlike IFRS, U.S. <strong>GAAP</strong> defines extraordinary items as<br />

material items that are both unusual <strong>and</strong> infrequently<br />

occurring (ASC 225-20-45-2). Extraordinary items are<br />

rare.<br />

A material event or transaction that is unusual in nature or<br />

occurs infrequently but not both should be reported as a<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd