Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

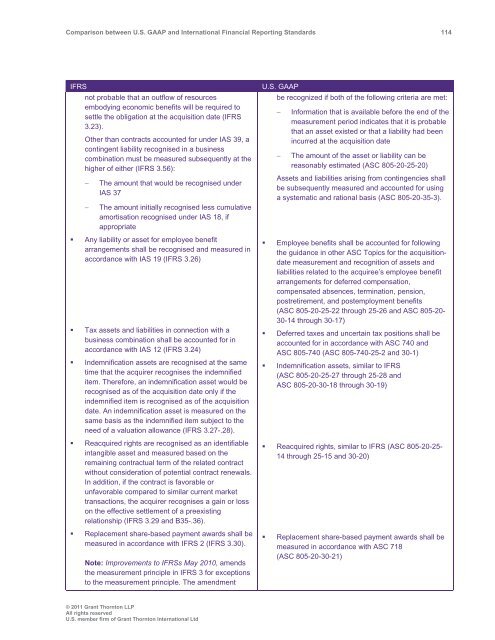

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 114<br />

IFRS<br />

not probable that an outflow of resources<br />

embodying economic benefits will be required to<br />

settle the obligation at the acquisition date (IFRS<br />

3.23).<br />

Other than contracts accounted for under IAS 39, a<br />

contingent liability recognised in a business<br />

combination must be measured subsequently at the<br />

higher of either (IFRS 3.56):<br />

<br />

The amount that would be recognised under<br />

IAS 37<br />

The amount initially recognised less cumulative<br />

amortisation recognised under IAS 18, if<br />

appropriate<br />

• Any liability or asset for employee benefit<br />

arrangements shall be recognised <strong>and</strong> measured in<br />

accordance with IAS 19 (IFRS 3.26)<br />

• Tax assets <strong>and</strong> liabilities in connection with a<br />

business combination shall be accounted for in<br />

accordance with IAS 12 (IFRS 3.24)<br />

• Indemnification assets are recognised at the same<br />

time that the acquirer recognises the indemnified<br />

item. Therefore, an indemnification asset would be<br />

recognised as of the acquisition date only if the<br />

indemnified item is recognised as of the acquisition<br />

date. An indemnification asset is measured on the<br />

same basis as the indemnified item subject to the<br />

need of a valuation allowance (IFRS 3.27-.28).<br />

• Reacquired rights are recognised as an identifiable<br />

intangible asset <strong>and</strong> measured based on the<br />

remaining contractual term of the related contract<br />

without consideration of potential contract renewals.<br />

In addition, if the contract is favorable or<br />

unfavorable compared to similar current market<br />

transactions, the acquirer recognises a gain or loss<br />

on the effective settlement of a preexisting<br />

relationship (IFRS 3.29 <strong>and</strong> B35-.36).<br />

• Replacement share-based payment awards shall be<br />

measured in accordance with IFRS 2 (IFRS 3.30).<br />

Note: Improvements to IFRSs May 2010, amends<br />

the measurement principle in IFRS 3 for exceptions<br />

to the measurement principle. The amendment<br />

U.S. <strong>GAAP</strong><br />

be recognized if both of the following criteria are met:<br />

<br />

Information that is available before the end of the<br />

measurement period indicates that it is probable<br />

that an asset existed or that a liability had been<br />

incurred at the acquisition date<br />

The amount of the asset or liability can be<br />

reasonably estimated (ASC 805-20-25-20)<br />

Assets <strong>and</strong> liabilities arising from contingencies shall<br />

be subsequently measured <strong>and</strong> accounted for using<br />

a systematic <strong>and</strong> rational basis (ASC 805-20-35-3).<br />

• Employee benefits shall be accounted for following<br />

the guidance in other ASC Topics for the acquisitiondate<br />

measurement <strong>and</strong> recognition of assets <strong>and</strong><br />

liabilities related to the acquiree’s employee benefit<br />

arrangements for deferred compensation,<br />

compensated absences, termination, pension,<br />

postretirement, <strong>and</strong> postemployment benefits<br />

(ASC 805-20-25-22 through 25-26 <strong>and</strong> ASC 805-20-<br />

30-14 through 30-17)<br />

• Deferred taxes <strong>and</strong> uncertain tax positions shall be<br />

accounted for in accordance with ASC 740 <strong>and</strong><br />

ASC 805-740 (ASC 805-740-25-2 <strong>and</strong> 30-1)<br />

• Indemnification assets, similar to IFRS<br />

(ASC 805-20-25-27 through 25-28 <strong>and</strong><br />

ASC 805-20-30-18 through 30-19)<br />

• Reacquired rights, similar to IFRS (ASC 805-20-25-<br />

14 through 25-15 <strong>and</strong> 30-20)<br />

• Replacement share-based payment awards shall be<br />

measured in accordance with ASC 718<br />

(ASC 805-20-30-21)<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd