Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

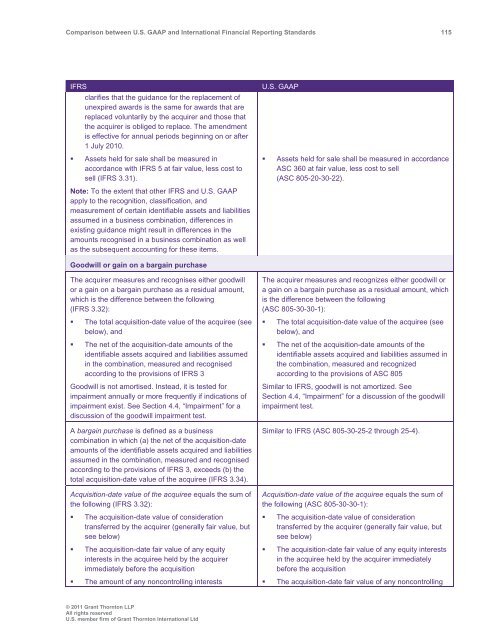

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 115<br />

IFRS<br />

clarifies that the guidance for the replacement of<br />

unexpired awards is the same for awards that are<br />

replaced voluntarily by the acquirer <strong>and</strong> those that<br />

the acquirer is obliged to replace. The amendment<br />

is effective for annual periods beginning on or after<br />

1 July 2010.<br />

• Assets held for sale shall be measured in<br />

accordance with IFRS 5 at fair value, less cost to<br />

sell (IFRS 3.31).<br />

Note: To the extent that other IFRS <strong>and</strong> U.S. <strong>GAAP</strong><br />

apply to the recognition, classification, <strong>and</strong><br />

measurement of certain identifiable assets <strong>and</strong> liabilities<br />

assumed in a business combination, differences in<br />

existing guidance might result in differences in the<br />

amounts recognised in a business combination as well<br />

as the subsequent accounting for these items.<br />

U.S. <strong>GAAP</strong><br />

• Assets held for sale shall be measured in accordance<br />

ASC 360 at fair value, less cost to sell<br />

(ASC 805-20-30-22).<br />

Goodwill or gain on a bargain purchase<br />

The acquirer measures <strong>and</strong> recognises either goodwill<br />

or a gain on a bargain purchase as a residual amount,<br />

which is the difference <strong>between</strong> the following<br />

(IFRS 3.32):<br />

• The total acquisition-date value of the acquiree (see<br />

below), <strong>and</strong><br />

• The net of the acquisition-date amounts of the<br />

identifiable assets acquired <strong>and</strong> liabilities assumed<br />

in the combination, measured <strong>and</strong> recognised<br />

according to the provisions of IFRS 3<br />

Goodwill is not amortised. Instead, it is tested for<br />

impairment annually or more frequently if indications of<br />

impairment exist. See Section 4.4, “Impairment” for a<br />

discussion of the goodwill impairment test.<br />

A bargain purchase is defined as a business<br />

combination in which (a) the net of the acquisition-date<br />

amounts of the identifiable assets acquired <strong>and</strong> liabilities<br />

assumed in the combination, measured <strong>and</strong> recognised<br />

according to the provisions of IFRS 3, exceeds (b) the<br />

total acquisition-date value of the acquiree (IFRS 3.34).<br />

Acquisition-date value of the acquiree equals the sum of<br />

the following (IFRS 3.32):<br />

• The acquisition-date value of consideration<br />

transferred by the acquirer (generally fair value, but<br />

see below)<br />

• The acquisition-date fair value of any equity<br />

interests in the acquiree held by the acquirer<br />

immediately before the acquisition<br />

• The amount of any noncontrolling interests<br />

The acquirer measures <strong>and</strong> recognizes either goodwill or<br />

a gain on a bargain purchase as a residual amount, which<br />

is the difference <strong>between</strong> the following<br />

(ASC 805-30-30-1):<br />

• The total acquisition-date value of the acquiree (see<br />

below), <strong>and</strong><br />

• The net of the acquisition-date amounts of the<br />

identifiable assets acquired <strong>and</strong> liabilities assumed in<br />

the combination, measured <strong>and</strong> recognized<br />

according to the provisions of ASC 805<br />

Similar to IFRS, goodwill is not amortized. See<br />

Section 4.4, “Impairment” for a discussion of the goodwill<br />

impairment test.<br />

Similar to IFRS (ASC 805-30-25-2 through 25-4).<br />

Acquisition-date value of the acquiree equals the sum of<br />

the following (ASC 805-30-30-1):<br />

• The acquisition-date value of consideration<br />

transferred by the acquirer (generally fair value, but<br />

see below)<br />

• The acquisition-date fair value of any equity interests<br />

in the acquiree held by the acquirer immediately<br />

before the acquisition<br />

• The acquisition-date fair value of any noncontrolling<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd