Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

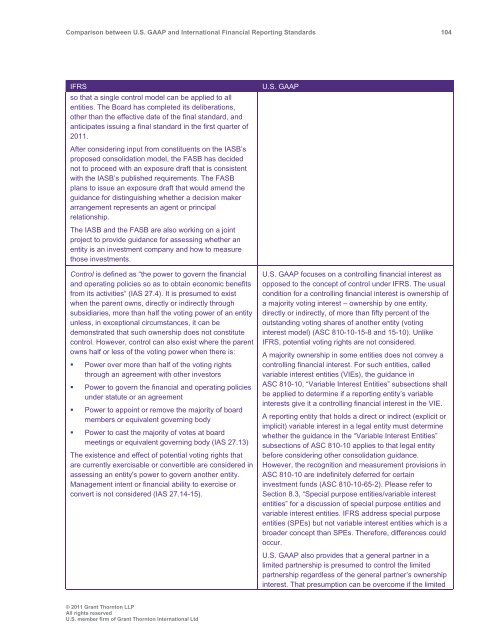

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 104<br />

IFRS<br />

so that a single control model can be applied to all<br />

entities. The Board has completed its deliberations,<br />

other than the effective date of the final st<strong>and</strong>ard, <strong>and</strong><br />

anticipates issuing a final st<strong>and</strong>ard in the first quarter of<br />

2011.<br />

After considering input from constituents on the IASB’s<br />

proposed consolidation model, the FASB has decided<br />

not to proceed with an exposure draft that is consistent<br />

with the IASB’s published requirements. The FASB<br />

plans to issue an exposure draft that would amend the<br />

guidance for distinguishing whether a decision maker<br />

arrangement represents an agent or principal<br />

relationship.<br />

The IASB <strong>and</strong> the FASB are also working on a joint<br />

project to provide guidance for assessing whether an<br />

entity is an investment company <strong>and</strong> how to measure<br />

those investments.<br />

Control is defined as “the power to govern the financial<br />

<strong>and</strong> operating policies so as to obtain economic benefits<br />

from its activities” (IAS 27.4). It is presumed to exist<br />

when the parent owns, directly or indirectly through<br />

subsidiaries, more than half the voting power of an entity<br />

unless, in exceptional circumstances, it can be<br />

demonstrated that such ownership does not constitute<br />

control. However, control can also exist where the parent<br />

owns half or less of the voting power when there is:<br />

• Power over more than half of the voting rights<br />

through an agreement with other investors<br />

• Power to govern the financial <strong>and</strong> operating policies<br />

under statute or an agreement<br />

• Power to appoint or remove the majority of board<br />

members or equivalent governing body<br />

• Power to cast the majority of votes at board<br />

meetings or equivalent governing body (IAS 27.13)<br />

The existence <strong>and</strong> effect of potential voting rights that<br />

are currently exercisable or convertible are considered in<br />

assessing an entity's power to govern another entity.<br />

Management intent or financial ability to exercise or<br />

convert is not considered (IAS 27.14-15).<br />

U.S. <strong>GAAP</strong><br />

U.S. <strong>GAAP</strong> focuses on a controlling financial interest as<br />

opposed to the concept of control under IFRS. The usual<br />

condition for a controlling financial interest is ownership of<br />

a majority voting interest – ownership by one entity,<br />

directly or indirectly, of more than fifty percent of the<br />

outst<strong>and</strong>ing voting shares of another entity (voting<br />

interest model) (ASC 810-10-15-8 <strong>and</strong> 15-10). Unlike<br />

IFRS, potential voting rights are not considered.<br />

A majority ownership in some entities does not convey a<br />

controlling financial interest. For such entities, called<br />

variable interest entities (VIEs), the guidance in<br />

ASC 810-10, “Variable Interest Entities” subsections shall<br />

be applied to determine if a reporting entity’s variable<br />

interests give it a controlling financial interest in the VIE.<br />

A reporting entity that holds a direct or indirect (explicit or<br />

implicit) variable interest in a legal entity must determine<br />

whether the guidance in the “Variable Interest Entities”<br />

subsections of ASC 810-10 applies to that legal entity<br />

before considering other consolidation guidance.<br />

However, the recognition <strong>and</strong> measurement provisions in<br />

ASC 810-10 are indefinitely deferred for certain<br />

investment funds (ASC 810-10-65-2). Please refer to<br />

Section 8.3, “Special purpose entities/variable interest<br />

entities” for a discussion of special purpose entities <strong>and</strong><br />

variable interest entities. IFRS address special purpose<br />

entities (SPEs) but not variable interest entities which is a<br />

broader concept than SPEs. Therefore, differences could<br />

occur.<br />

U.S. <strong>GAAP</strong> also provides that a general partner in a<br />

limited partnership is presumed to control the limited<br />

partnership regardless of the general partner’s ownership<br />

interest. That presumption can be overcome if the limited<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd