Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

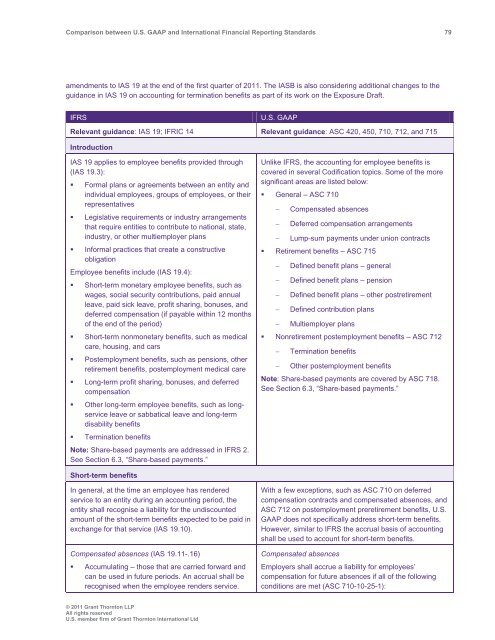

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 79<br />

amendments to IAS 19 at the end of the first quarter of 2011. The IASB is also considering additional changes to the<br />

guidance in IAS 19 on accounting for termination benefits as part of its work on the Exposure Draft.<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 19; IFRIC 14 Relevant guidance: ASC 420, 450, 710, 712, <strong>and</strong> 715<br />

Introduction<br />

IAS 19 applies to employee benefits provided through<br />

(IAS 19.3):<br />

• Formal plans or agreements <strong>between</strong> an entity <strong>and</strong><br />

individual employees, groups of employees, or their<br />

representatives<br />

• Legislative requirements or industry arrangements<br />

that require entities to contribute to national, state,<br />

industry, or other multiemployer plans<br />

• Informal practices that create a constructive<br />

obligation<br />

Employee benefits include (IAS 19.4):<br />

• Short-term monetary employee benefits, such as<br />

wages, social security contributions, paid annual<br />

leave, paid sick leave, profit sharing, bonuses, <strong>and</strong><br />

deferred compensation (if payable within 12 months<br />

of the end of the period)<br />

• Short-term nonmonetary benefits, such as medical<br />

care, housing, <strong>and</strong> cars<br />

• Postemployment benefits, such as pensions, other<br />

retirement benefits, postemployment medical care<br />

• Long-term profit sharing, bonuses, <strong>and</strong> deferred<br />

compensation<br />

• Other long-term employee benefits, such as longservice<br />

leave or sabbatical leave <strong>and</strong> long-term<br />

disability benefits<br />

• Termination benefits<br />

Note: Share-based payments are addressed in IFRS 2.<br />

See Section 6.3, “Share-based payments.”<br />

Unlike IFRS, the accounting for employee benefits is<br />

covered in several Codification topics. Some of the more<br />

significant areas are listed below:<br />

• General – ASC 710<br />

<br />

<br />

Compensated absences<br />

Deferred compensation arrangements<br />

Lump-sum payments under union contracts<br />

• Retirement benefits – ASC 715<br />

<br />

<br />

<br />

<br />

Defined benefit plans – general<br />

Defined benefit plans – pension<br />

Defined benefit plans – other postretirement<br />

Defined contribution plans<br />

Multiemployer plans<br />

• Nonretirement postemployment benefits – ASC 712<br />

<br />

Termination benefits<br />

Other postemployment benefits<br />

Note: Share-based payments are covered by ASC 718.<br />

See Section 6.3, “Share-based payments.”<br />

Short-term benefits<br />

In general, at the time an employee has rendered<br />

service to an entity during an accounting period, the<br />

entity shall recognise a liability for the undiscounted<br />

amount of the short-term benefits expected to be paid in<br />

exchange for that service (IAS 19.10).<br />

Compensated absences (IAS 19.11-.16)<br />

• Accumulating – those that are carried forward <strong>and</strong><br />

can be used in future periods. An accrual shall be<br />

recognised when the employee renders service.<br />

With a few exceptions, such as ASC 710 on deferred<br />

compensation contracts <strong>and</strong> compensated absences, <strong>and</strong><br />

ASC 712 on postemployment preretirement benefits, U.S.<br />

<strong>GAAP</strong> does not specifically address short-term benefits.<br />

However, similar to IFRS the accrual basis of accounting<br />

shall be used to account for short-term benefits.<br />

Compensated absences<br />

Employers shall accrue a liability for employees’<br />

compensation for future absences if all of the following<br />

conditions are met (ASC 710-10-25-1):<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd