Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

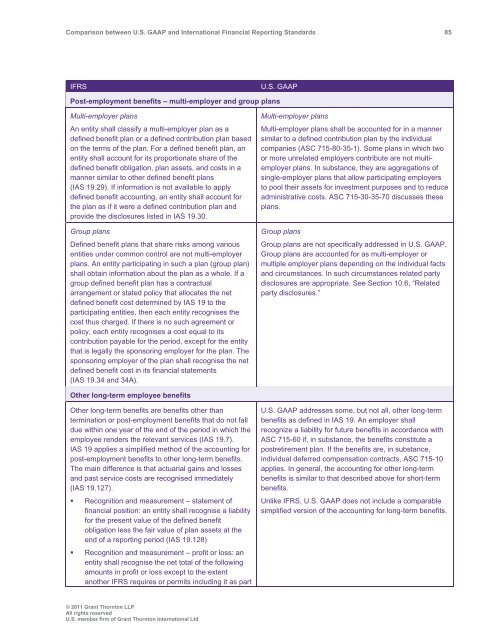

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 85<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Post-employment benefits – multi-employer <strong>and</strong> group plans<br />

Multi-employer plans<br />

An entity shall classify a multi-employer plan as a<br />

defined benefit plan or a defined contribution plan based<br />

on the terms of the plan. For a defined benefit plan, an<br />

entity shall account for its proportionate share of the<br />

defined benefit obligation, plan assets, <strong>and</strong> costs in a<br />

manner similar to other defined benefit plans<br />

(IAS 19.29). If information is not available to apply<br />

defined benefit accounting, an entity shall account for<br />

the plan as if it were a defined contribution plan <strong>and</strong><br />

provide the disclosures listed in IAS 19.30.<br />

Group plans<br />

Defined benefit plans that share risks among various<br />

entities under common control are not multi-employer<br />

plans. An entity participating in such a plan (group plan)<br />

shall obtain information about the plan as a whole. If a<br />

group defined benefit plan has a contractual<br />

arrangement or stated policy that allocates the net<br />

defined benefit cost determined by IAS 19 to the<br />

participating entities, then each entity recognises the<br />

cost thus charged. If there is no such agreement or<br />

policy, each entity recognises a cost equal to its<br />

contribution payable for the period, except for the entity<br />

that is legally the sponsoring employer for the plan. The<br />

sponsoring employer of the plan shall recognise the net<br />

defined benefit cost in its financial statements<br />

(IAS 19.34 <strong>and</strong> 34A).<br />

Multi-employer plans<br />

Multi-employer plans shall be accounted for in a manner<br />

similar to a defined contribution plan by the individual<br />

companies (ASC 715-80-35-1). Some plans in which two<br />

or more unrelated employers contribute are not multiemployer<br />

plans. In substance, they are aggregations of<br />

single-employer plans that allow participating employers<br />

to pool their assets for investment purposes <strong>and</strong> to reduce<br />

administrative costs. ASC 715-30-35-70 discusses these<br />

plans.<br />

Group plans<br />

Group plans are not specifically addressed in U.S. <strong>GAAP</strong>.<br />

Group plans are accounted for as multi-employer or<br />

multiple employer plans depending on the individual facts<br />

<strong>and</strong> circumstances. In such circumstances related party<br />

disclosures are appropriate. See Section 10.6, “Related<br />

party disclosures.”<br />

Other long-term employee benefits<br />

Other long-term benefits are benefits other than<br />

termination or post-employment benefits that do not fall<br />

due within one year of the end of the period in which the<br />

employee renders the relevant services (IAS 19.7).<br />

IAS 19 applies a simplified method of the accounting for<br />

post-employment benefits to other long-term benefits.<br />

The main difference is that actuarial gains <strong>and</strong> losses<br />

<strong>and</strong> past service costs are recognised immediately<br />

(IAS 19.127).<br />

• Recognition <strong>and</strong> measurement – statement of<br />

financial position: an entity shall recognise a liability<br />

for the present value of the defined benefit<br />

obligation less the fair value of plan assets at the<br />

end of a reporting period (IAS 19.128)<br />

• Recognition <strong>and</strong> measurement – profit or loss: an<br />

entity shall recognise the net total of the following<br />

amounts in profit or loss except to the extent<br />

another IFRS requires or permits including it as part<br />

U.S. <strong>GAAP</strong> addresses some, but not all, other long-term<br />

benefits as defined in IAS 19. An employer shall<br />

recognize a liability for future benefits in accordance with<br />

ASC 715-60 if, in substance, the benefits constitute a<br />

postretirement plan. If the benefits are, in substance,<br />

individual deferred compensation contracts, ASC 715-10<br />

applies. In general, the accounting for other long-term<br />

benefits is similar to that described above for short-term<br />

benefits.<br />

Unlike IFRS, U.S. <strong>GAAP</strong> does not include a comparable<br />

simplified version of the accounting for long-term benefits.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd