Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 16<br />

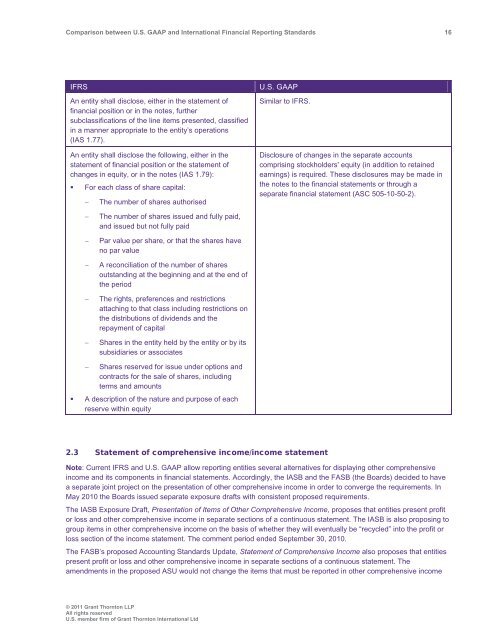

IFRS<br />

An entity shall disclose, either in the statement of<br />

financial position or in the notes, further<br />

subclassifications of the line items presented, classified<br />

in a manner appropriate to the entity’s operations<br />

(IAS 1.77).<br />

An entity shall disclose the following, either in the<br />

statement of financial position or the statement of<br />

changes in equity, or in the notes (IAS 1.79):<br />

• For each class of share capital:<br />

<br />

The number of shares authorised<br />

U.S. <strong>GAAP</strong><br />

Similar to IFRS.<br />

Disclosure of changes in the separate accounts<br />

comprising stockholders' equity (in addition to retained<br />

earnings) is required. These disclosures may be made in<br />

the notes to the financial statements or through a<br />

separate financial statement (ASC 505-10-50-2).<br />

<br />

<br />

<br />

<br />

<br />

The number of shares issued <strong>and</strong> fully paid,<br />

<strong>and</strong> issued but not fully paid<br />

Par value per share, or that the shares have<br />

no par value<br />

A reconciliation of the number of shares<br />

outst<strong>and</strong>ing at the beginning <strong>and</strong> at the end of<br />

the period<br />

The rights, preferences <strong>and</strong> restrictions<br />

attaching to that class including restrictions on<br />

the distributions of dividends <strong>and</strong> the<br />

repayment of capital<br />

Shares in the entity held by the entity or by its<br />

subsidiaries or associates<br />

Shares reserved for issue under options <strong>and</strong><br />

contracts for the sale of shares, including<br />

terms <strong>and</strong> amounts<br />

• A description of the nature <strong>and</strong> purpose of each<br />

reserve within equity<br />

2.3 Statement of comprehensive income/income statement<br />

Note: Current IFRS <strong>and</strong> U.S. <strong>GAAP</strong> allow reporting entities several alternatives for displaying other comprehensive<br />

income <strong>and</strong> its components in financial statements. Accordingly, the IASB <strong>and</strong> the FASB (the Boards) decided to have<br />

a separate joint project on the presentation of other comprehensive income in order to converge the requirements. In<br />

May 2010 the Boards issued separate exposure drafts with consistent proposed requirements.<br />

The IASB Exposure Draft, Presentation of Items of Other Comprehensive Income, proposes that entities present profit<br />

or loss <strong>and</strong> other comprehensive income in separate sections of a continuous statement. The IASB is also proposing to<br />

group items in other comprehensive income on the basis of whether they will eventually be “recycled” into the profit or<br />

loss section of the income statement. The comment period ended September 30, 2010.<br />

The FASB’s proposed Accounting St<strong>and</strong>ards Update, Statement of Comprehensive Income also proposes that entities<br />

present profit or loss <strong>and</strong> other comprehensive income in separate sections of a continuous statement. The<br />

amendments in the proposed ASU would not change the items that must be reported in other comprehensive income<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd