Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

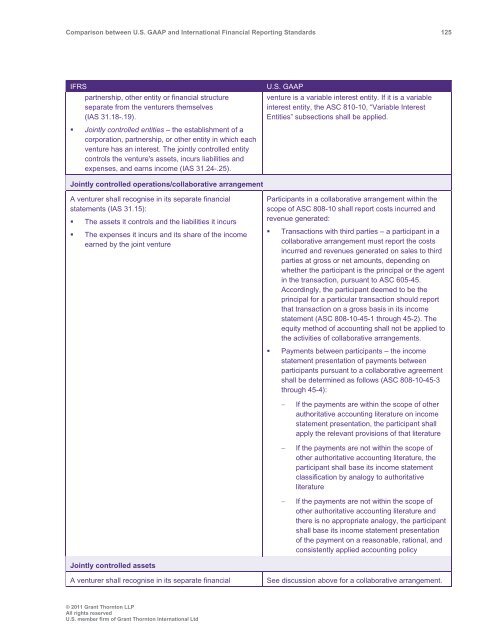

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 125<br />

IFRS<br />

partnership, other entity or financial structure<br />

separate from the venturers themselves<br />

(IAS 31.18-.19).<br />

• Jointly controlled entities – the establishment of a<br />

corporation, partnership, or other entity in which each<br />

venture has an interest. The jointly controlled entity<br />

controls the venture's assets, incurs liabilities <strong>and</strong><br />

expenses, <strong>and</strong> earns income (IAS 31.24-.25).<br />

U.S. <strong>GAAP</strong><br />

venture is a variable interest entity. If it is a variable<br />

interest entity, the ASC 810-10, “Variable Interest<br />

Entities” subsections shall be applied.<br />

Jointly controlled operations/collaborative arrangement<br />

A venturer shall recognise in its separate financial<br />

statements (IAS 31.15):<br />

• The assets it controls <strong>and</strong> the liabilities it incurs<br />

• The expenses it incurs <strong>and</strong> its share of the income<br />

earned by the joint venture<br />

Participants in a collaborative arrangement within the<br />

scope of ASC 808-10 shall report costs incurred <strong>and</strong><br />

revenue generated:<br />

• Transactions with third parties – a participant in a<br />

collaborative arrangement must report the costs<br />

incurred <strong>and</strong> revenues generated on sales to third<br />

parties at gross or net amounts, depending on<br />

whether the participant is the principal or the agent<br />

in the transaction, pursuant to ASC 605-45.<br />

Accordingly, the participant deemed to be the<br />

principal for a particular transaction should report<br />

that transaction on a gross basis in its income<br />

statement (ASC 808-10-45-1 through 45-2). The<br />

equity method of accounting shall not be applied to<br />

the activities of collaborative arrangements.<br />

• Payments <strong>between</strong> participants – the income<br />

statement presentation of payments <strong>between</strong><br />

participants pursuant to a collaborative agreement<br />

shall be determined as follows (ASC 808-10-45-3<br />

through 45-4):<br />

<br />

<br />

<br />

If the payments are within the scope of other<br />

authoritative accounting literature on income<br />

statement presentation, the participant shall<br />

apply the relevant provisions of that literature<br />

If the payments are not within the scope of<br />

other authoritative accounting literature, the<br />

participant shall base its income statement<br />

classification by analogy to authoritative<br />

literature<br />

If the payments are not within the scope of<br />

other authoritative accounting literature <strong>and</strong><br />

there is no appropriate analogy, the participant<br />

shall base its income statement presentation<br />

of the payment on a reasonable, rational, <strong>and</strong><br />

consistently applied accounting policy<br />

Jointly controlled assets<br />

A venturer shall recognise in its separate financial<br />

See discussion above for a collaborative arrangement.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd