Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

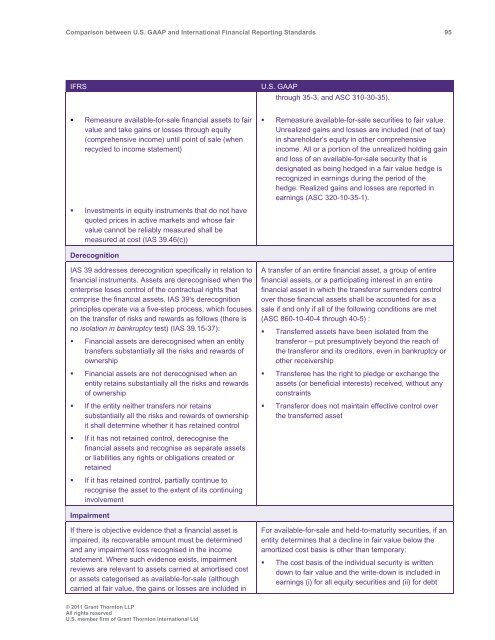

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 95<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

through 35-3, <strong>and</strong> ASC 310-30-35).<br />

• Remeasure available-for-sale financial assets to fair<br />

value <strong>and</strong> take gains or losses through equity<br />

(comprehensive income) until point of sale (when<br />

recycled to income statement)<br />

• Investments in equity instruments that do not have<br />

quoted prices in active markets <strong>and</strong> whose fair<br />

value cannot be reliably measured shall be<br />

measured at cost (IAS 39.46(c))<br />

• Remeasure available-for-sale securities to fair value.<br />

Unrealized gains <strong>and</strong> losses are included (net of tax)<br />

in shareholder’s equity in other comprehensive<br />

income. All or a portion of the unrealized holding gain<br />

<strong>and</strong> loss of an available-for-sale security that is<br />

designated as being hedged in a fair value hedge is<br />

recognized in earnings during the period of the<br />

hedge. Realized gains <strong>and</strong> losses are reported in<br />

earnings (ASC 320-10-35-1).<br />

Derecognition<br />

IAS 39 addresses derecognition specifically in relation to<br />

financial instruments. Assets are derecognised when the<br />

enterprise loses control of the contractual rights that<br />

comprise the financial assets. IAS 39's derecognition<br />

principles operate via a five-step process, which focuses<br />

on the transfer of risks <strong>and</strong> rewards as follows (there is<br />

no isolation in bankruptcy test) (IAS 39.15-37):<br />

• Financial assets are derecognised when an entity<br />

transfers substantially all the risks <strong>and</strong> rewards of<br />

ownership<br />

• Financial assets are not derecognised when an<br />

entity retains substantially all the risks <strong>and</strong> rewards<br />

of ownership<br />

• If the entity neither transfers nor retains<br />

substantially all the risks <strong>and</strong> rewards of ownership<br />

it shall determine whether it has retained control<br />

• If it has not retained control, derecognise the<br />

financial assets <strong>and</strong> recognise as separate assets<br />

or liabilities any rights or obligations created or<br />

retained<br />

• If it has retained control, partially continue to<br />

recognise the asset to the extent of its continuing<br />

involvement<br />

A transfer of an entire financial asset, a group of entire<br />

financial assets, or a participating interest in an entire<br />

financial asset in which the transferor surrenders control<br />

over those financial assets shall be accounted for as a<br />

sale if <strong>and</strong> only if all of the following conditions are met<br />

(ASC 860-10-40-4 through 40-5) :<br />

• Transferred assets have been isolated from the<br />

transferor – put presumptively beyond the reach of<br />

the transferor <strong>and</strong> its creditors, even in bankruptcy or<br />

other receivership<br />

• Transferee has the right to pledge or exchange the<br />

assets (or beneficial interests) received, without any<br />

constraints<br />

• Transferor does not maintain effective control over<br />

the transferred asset<br />

Impairment<br />

If there is objective evidence that a financial asset is<br />

impaired, its recoverable amount must be determined<br />

<strong>and</strong> any impairment loss recognised in the income<br />

statement. Where such evidence exists, impairment<br />

reviews are relevant to assets carried at amortised cost<br />

or assets categorised as available-for-sale (although<br />

carried at fair value, the gains or losses are included in<br />

For available-for-sale <strong>and</strong> held-to-maturity securities, if an<br />

entity determines that a decline in fair value below the<br />

amortized cost basis is other than temporary:<br />

• The cost basis of the individual security is written<br />

down to fair value <strong>and</strong> the write-down is included in<br />

earnings (i) for all equity securities <strong>and</strong> (ii) for debt<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd