Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

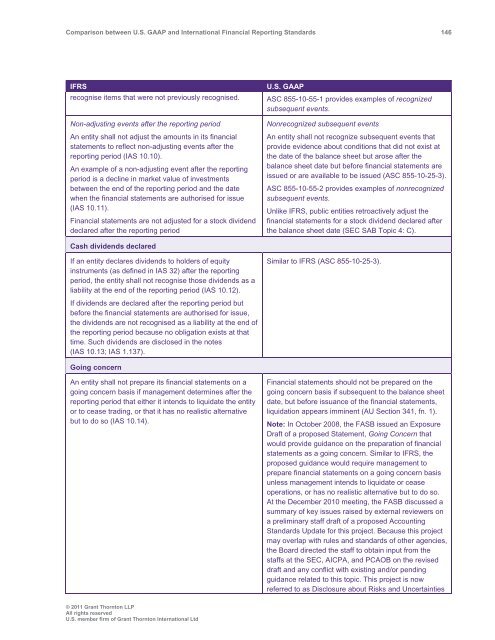

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 146<br />

IFRS<br />

recognise items that were not previously recognised.<br />

Non-adjusting events after the reporting period<br />

An entity shall not adjust the amounts in its financial<br />

statements to reflect non-adjusting events after the<br />

reporting period (IAS 10.10).<br />

An example of a non-adjusting event after the reporting<br />

period is a decline in market value of investments<br />

<strong>between</strong> the end of the reporting period <strong>and</strong> the date<br />

when the financial statements are authorised for issue<br />

(IAS 10.11).<br />

Financial statements are not adjusted for a stock dividend<br />

declared after the reporting period<br />

U.S. <strong>GAAP</strong><br />

ASC 855-10-55-1 provides examples of recognized<br />

subsequent events.<br />

Nonrecognized subsequent events<br />

An entity shall not recognize subsequent events that<br />

provide evidence about conditions that did not exist at<br />

the date of the balance sheet but arose after the<br />

balance sheet date but before financial statements are<br />

issued or are available to be issued (ASC 855-10-25-3).<br />

ASC 855-10-55-2 provides examples of nonrecognized<br />

subsequent events.<br />

Unlike IFRS, public entities retroactively adjust the<br />

financial statements for a stock dividend declared after<br />

the balance sheet date (SEC SAB Topic 4: C).<br />

Cash dividends declared<br />

If an entity declares dividends to holders of equity<br />

instruments (as defined in IAS 32) after the reporting<br />

period, the entity shall not recognise those dividends as a<br />

liability at the end of the reporting period (IAS 10.12).<br />

Similar to IFRS (ASC 855-10-25-3).<br />

If dividends are declared after the reporting period but<br />

before the financial statements are authorised for issue,<br />

the dividends are not recognised as a liability at the end of<br />

the reporting period because no obligation exists at that<br />

time. Such dividends are disclosed in the notes<br />

(IAS 10.13; IAS 1.137).<br />

Going concern<br />

An entity shall not prepare its financial statements on a<br />

going concern basis if management determines after the<br />

reporting period that either it intends to liquidate the entity<br />

or to cease trading, or that it has no realistic alternative<br />

but to do so (IAS 10.14).<br />

Financial statements should not be prepared on the<br />

going concern basis if subsequent to the balance sheet<br />

date, but before issuance of the financial statements,<br />

liquidation appears imminent (AU Section 341, fn. 1).<br />

Note: In October 2008, the FASB issued an Exposure<br />

Draft of a proposed Statement, Going Concern that<br />

would provide guidance on the preparation of financial<br />

statements as a going concern. Similar to IFRS, the<br />

proposed guidance would require management to<br />

prepare financial statements on a going concern basis<br />

unless management intends to liquidate or cease<br />

operations, or has no realistic alternative but to do so.<br />

At the December 2010 meeting, the FASB discussed a<br />

summary of key issues raised by external reviewers on<br />

a preliminary staff draft of a proposed Accounting<br />

St<strong>and</strong>ards Update for this project. Because this project<br />

may overlap with rules <strong>and</strong> st<strong>and</strong>ards of other agencies,<br />

the Board directed the staff to obtain input from the<br />

staffs at the SEC, AICPA, <strong>and</strong> PCAOB on the revised<br />

draft <strong>and</strong> any conflict with existing <strong>and</strong>/or pending<br />

guidance related to this topic. This project is now<br />

referred to as Disclosure about Risks <strong>and</strong> Uncertainties<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd