Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

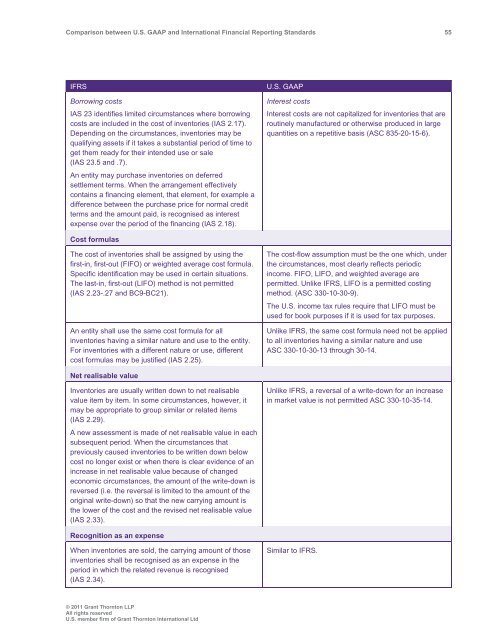

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 55<br />

IFRS<br />

Borrowing costs<br />

IAS 23 identifies limited circumstances where borrowing<br />

costs are included in the cost of inventories (IAS 2.17).<br />

Depending on the circumstances, inventories may be<br />

qualifying assets if it takes a substantial period of time to<br />

get them ready for their intended use or sale<br />

(IAS 23.5 <strong>and</strong> .7).<br />

An entity may purchase inventories on deferred<br />

settlement terms. When the arrangement effectively<br />

contains a financing element, that element, for example a<br />

difference <strong>between</strong> the purchase price for normal credit<br />

terms <strong>and</strong> the amount paid, is recognised as interest<br />

expense over the period of the financing (IAS 2.18).<br />

U.S. <strong>GAAP</strong><br />

Interest costs<br />

Interest costs are not capitalized for inventories that are<br />

routinely manufactured or otherwise produced in large<br />

quantities on a repetitive basis (ASC 835-20-15-6).<br />

Cost formulas<br />

The cost of inventories shall be assigned by using the<br />

first-in, first-out (FIFO) or weighted average cost formula.<br />

Specific identification may be used in certain situations.<br />

The last-in, first-out (LIFO) method is not permitted<br />

(IAS 2.23-.27 <strong>and</strong> BC9-BC21).<br />

An entity shall use the same cost formula for all<br />

inventories having a similar nature <strong>and</strong> use to the entity.<br />

For inventories with a different nature or use, different<br />

cost formulas may be justified (IAS 2.25).<br />

The cost-flow assumption must be the one which, under<br />

the circumstances, most clearly reflects periodic<br />

income. FIFO, LIFO, <strong>and</strong> weighted average are<br />

permitted. Unlike IFRS, LIFO is a permitted costing<br />

method. (ASC 330-10-30-9).<br />

The U.S. income tax rules require that LIFO must be<br />

used for book purposes if it is used for tax purposes.<br />

Unlike IFRS, the same cost formula need not be applied<br />

to all inventories having a similar nature <strong>and</strong> use<br />

ASC 330-10-30-13 through 30-14.<br />

Net realisable value<br />

Inventories are usually written down to net realisable<br />

value item by item. In some circumstances, however, it<br />

may be appropriate to group similar or related items<br />

(IAS 2.29).<br />

A new assessment is made of net realisable value in each<br />

subsequent period. When the circumstances that<br />

previously caused inventories to be written down below<br />

cost no longer exist or when there is clear evidence of an<br />

increase in net realisable value because of changed<br />

economic circumstances, the amount of the write-down is<br />

reversed (i.e. the reversal is limited to the amount of the<br />

original write-down) so that the new carrying amount is<br />

the lower of the cost <strong>and</strong> the revised net realisable value<br />

(IAS 2.33).<br />

Unlike IFRS, a reversal of a write-down for an increase<br />

in market value is not permitted ASC 330-10-35-14.<br />

Recognition as an expense<br />

When inventories are sold, the carrying amount of those<br />

inventories shall be recognised as an expense in the<br />

period in which the related revenue is recognised<br />

(IAS 2.34).<br />

Similar to IFRS.<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd