Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

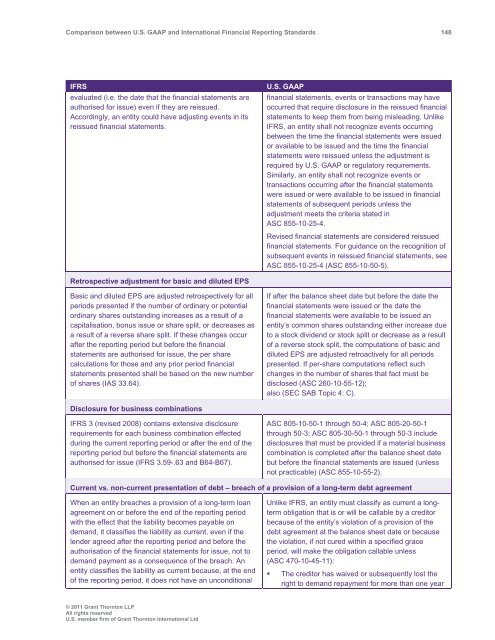

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 148<br />

IFRS<br />

evaluated (i.e. the date that the financial statements are<br />

authorised for issue) even if they are reissued.<br />

Accordingly, an entity could have adjusting events in its<br />

reissued financial statements.<br />

U.S. <strong>GAAP</strong><br />

financial statements, events or transactions may have<br />

occurred that require disclosure in the reissued financial<br />

statements to keep them from being misleading. Unlike<br />

IFRS, an entity shall not recognize events occurring<br />

<strong>between</strong> the time the financial statements were issued<br />

or available to be issued <strong>and</strong> the time the financial<br />

statements were reissued unless the adjustment is<br />

required by U.S. <strong>GAAP</strong> or regulatory requirements.<br />

Similarly, an entity shall not recognize events or<br />

transactions occurring after the financial statements<br />

were issued or were available to be issued in financial<br />

statements of subsequent periods unless the<br />

adjustment meets the criteria stated in<br />

ASC 855-10-25-4.<br />

Revised financial statements are considered reissued<br />

financial statements. For guidance on the recognition of<br />

subsequent events in reissued financial statements, see<br />

ASC 855-10-25-4 (ASC 855-10-50-5).<br />

Retrospective adjustment for basic <strong>and</strong> diluted EPS<br />

Basic <strong>and</strong> diluted EPS are adjusted retrospectively for all<br />

periods presented if the number of ordinary or potential<br />

ordinary shares outst<strong>and</strong>ing increases as a result of a<br />

capitalisation, bonus issue or share split, or decreases as<br />

a result of a reverse share split. If these changes occur<br />

after the reporting period but before the financial<br />

statements are authorised for issue, the per share<br />

calculations for those <strong>and</strong> any prior period financial<br />

statements presented shall be based on the new number<br />

of shares (IAS 33.64).<br />

If after the balance sheet date but before the date the<br />

financial statements were issued or the date the<br />

financial statements were available to be issued an<br />

entity’s common shares outst<strong>and</strong>ing either increase due<br />

to a stock dividend or stock split or decrease as a result<br />

of a reverse stock split, the computations of basic <strong>and</strong><br />

diluted EPS are adjusted retroactively for all periods<br />

presented. If per-share computations reflect such<br />

changes in the number of shares that fact must be<br />

disclosed (ASC 260-10-55-12);<br />

also (SEC SAB Topic 4: C).<br />

Disclosure for business combinations<br />

IFRS 3 (revised 2008) contains extensive disclosure<br />

requirements for each business combination effected<br />

during the current reporting period or after the end of the<br />

reporting period but before the financial statements are<br />

authorised for issue (IFRS 3.59-.63 <strong>and</strong> B64-B67).<br />

ASC 805-10-50-1 through 50-4; ASC 805-20-50-1<br />

through 50-3; ASC 805-30-50-1 through 50-3 include<br />

disclosures that must be provided if a material business<br />

combination is completed after the balance sheet date<br />

but before the financial statements are issued (unless<br />

not practicable) (ASC 855-10-55-2).<br />

Current vs. non-current presentation of debt – breach of a provision of a long-term debt agreement<br />

When an entity breaches a provision of a long-term loan<br />

agreement on or before the end of the reporting period<br />

with the effect that the liability becomes payable on<br />

dem<strong>and</strong>, it classifies the liability as current, even if the<br />

lender agreed after the reporting period <strong>and</strong> before the<br />

authorisation of the financial statements for issue, not to<br />

dem<strong>and</strong> payment as a consequence of the breach. An<br />

entity classifies the liability as current because, at the end<br />

of the reporting period, it does not have an unconditional<br />

Unlike IFRS, an entity must classify as current a longterm<br />

obligation that is or will be callable by a creditor<br />

because of the entity’s violation of a provision of the<br />

debt agreement at the balance sheet date or because<br />

the violation, if not cured within a specified grace<br />

period, will make the obligation callable unless<br />

(ASC 470-10-45-11):<br />

• The creditor has waived or subsequently lost the<br />

right to dem<strong>and</strong> repayment for more than one year<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd