Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

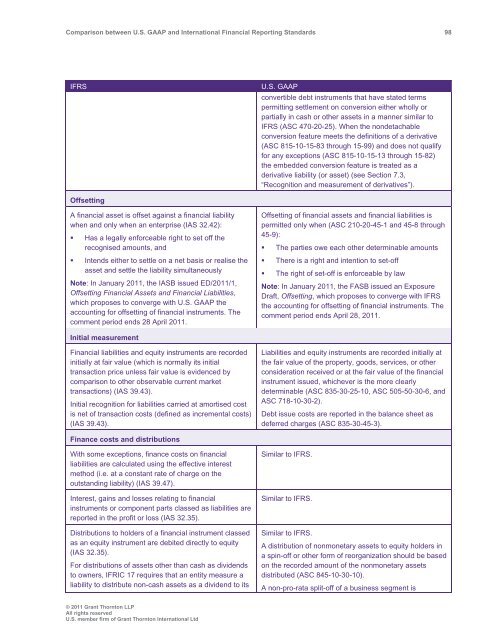

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 98<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

convertible debt instruments that have stated terms<br />

permitting settlement on conversion either wholly or<br />

partially in cash or other assets in a manner similar to<br />

IFRS (ASC 470-20-25). When the nondetachable<br />

conversion feature meets the definitions of a derivative<br />

(ASC 815-10-15-83 through 15-99) <strong>and</strong> does not qualify<br />

for any exceptions (ASC 815-10-15-13 through 15-82)<br />

the embedded conversion feature is treated as a<br />

derivative liability (or asset) (see Section 7.3,<br />

“Recognition <strong>and</strong> measurement of derivatives”).<br />

Offsetting<br />

A financial asset is offset against a financial liability<br />

when <strong>and</strong> only when an enterprise (IAS 32.42):<br />

• Has a legally enforceable right to set off the<br />

recognised amounts, <strong>and</strong><br />

• Intends either to settle on a net basis or realise the<br />

asset <strong>and</strong> settle the liability simultaneously<br />

Note: In January 2011, the IASB issued ED/2011/1,<br />

Offsetting Financial Assets <strong>and</strong> Financial Liabilities,<br />

which proposes to converge with U.S. <strong>GAAP</strong> the<br />

accounting for offsetting of financial instruments. The<br />

comment period ends 28 April 2011.<br />

Offsetting of financial assets <strong>and</strong> financial liabilities is<br />

permitted only when (ASC 210-20-45-1 <strong>and</strong> 45-8 through<br />

45-9):<br />

• The parties owe each other determinable amounts<br />

• There is a right <strong>and</strong> intention to set-off<br />

• The right of set-off is enforceable by law<br />

Note: In January 2011, the FASB issued an Exposure<br />

Draft, Offsetting, which proposes to converge with IFRS<br />

the accounting for offsetting of financial instruments. The<br />

comment period ends April 28, 2011.<br />

Initial measurement<br />

Financial liabilities <strong>and</strong> equity instruments are recorded<br />

initially at fair value (which is normally its initial<br />

transaction price unless fair value is evidenced by<br />

comparison to other observable current market<br />

transactions) (IAS 39.43).<br />

Initial recognition for liabilities carried at amortised cost<br />

is net of transaction costs (defined as incremental costs)<br />

(IAS 39.43).<br />

Liabilities <strong>and</strong> equity instruments are recorded initially at<br />

the fair value of the property, goods, services, or other<br />

consideration received or at the fair value of the financial<br />

instrument issued, whichever is the more clearly<br />

determinable (ASC 835-30-25-10, ASC 505-50-30-6, <strong>and</strong><br />

ASC 718-10-30-2).<br />

Debt issue costs are reported in the balance sheet as<br />

deferred charges (ASC 835-30-45-3).<br />

Finance costs <strong>and</strong> distributions<br />

With some exceptions, finance costs on financial<br />

liabilities are calculated using the effective interest<br />

method (i.e. at a constant rate of charge on the<br />

outst<strong>and</strong>ing liability) (IAS 39.47).<br />

Interest, gains <strong>and</strong> losses relating to financial<br />

instruments or component parts classed as liabilities are<br />

reported in the profit or loss (IAS 32.35).<br />

Distributions to holders of a financial instrument classed<br />

as an equity instrument are debited directly to equity<br />

(IAS 32.35).<br />

For distributions of assets other than cash as dividends<br />

to owners, IFRIC 17 requires that an entity measure a<br />

liability to distribute non-cash assets as a dividend to its<br />

Similar to IFRS.<br />

Similar to IFRS.<br />

Similar to IFRS.<br />

A distribution of nonmonetary assets to equity holders in<br />

a spin-off or other form of reorganization should be based<br />

on the recorded amount of the nonmonetary assets<br />

distributed (ASC 845-10-30-10).<br />

A non-pro-rata split-off of a business segment is<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd