Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

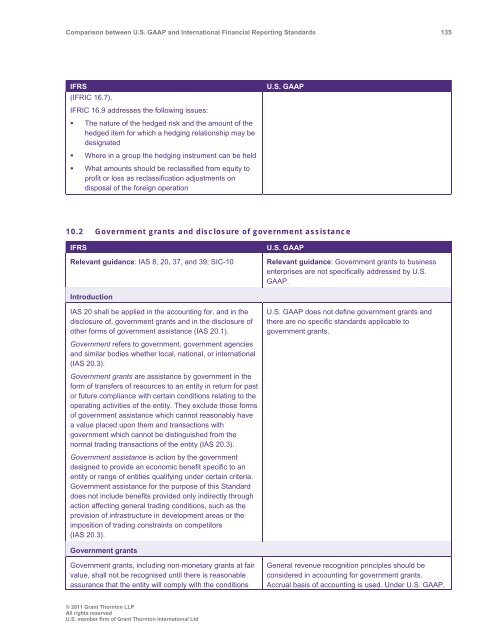

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 135<br />

IFRS<br />

(IFRIC 16.7).<br />

IFRIC 16.9 addresses the following issues:<br />

• The nature of the hedged risk <strong>and</strong> the amount of the<br />

hedged item for which a hedging relationship may be<br />

designated<br />

• Where in a group the hedging instrument can be held<br />

• What amounts should be reclassified from equity to<br />

profit or loss as reclassification adjustments on<br />

disposal of the foreign operation<br />

U.S. <strong>GAAP</strong><br />

10.2 Government grants <strong>and</strong> disclosure of government assistance<br />

IFRS<br />

Relevant guidance: IAS 8, 20, 37, <strong>and</strong> 39; SIC-10<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: Government grants to business<br />

enterprises are not specifically addressed by U.S.<br />

<strong>GAAP</strong>.<br />

Introduction<br />

IAS 20 shall be applied in the accounting for, <strong>and</strong> in the<br />

disclosure of, government grants <strong>and</strong> in the disclosure of<br />

other forms of government assistance (IAS 20.1).<br />

Government refers to government, government agencies<br />

<strong>and</strong> similar bodies whether local, national, or international<br />

(IAS 20.3).<br />

Government grants are assistance by government in the<br />

form of transfers of resources to an entity in return for past<br />

or future compliance with certain conditions relating to the<br />

operating activities of the entity. They exclude those forms<br />

of government assistance which cannot reasonably have<br />

a value placed upon them <strong>and</strong> transactions with<br />

government which cannot be distinguished from the<br />

normal trading transactions of the entity (IAS 20.3).<br />

Government assistance is action by the government<br />

designed to provide an economic benefit specific to an<br />

entity or range of entities qualifying under certain criteria.<br />

Government assistance for the purpose of this St<strong>and</strong>ard<br />

does not include benefits provided only indirectly through<br />

action affecting general trading conditions, such as the<br />

provision of infrastructure in development areas or the<br />

imposition of trading constraints on competitors<br />

(IAS 20.3).<br />

U.S. <strong>GAAP</strong> does not define government grants <strong>and</strong><br />

there are no specific st<strong>and</strong>ards applicable to<br />

government grants.<br />

Government grants<br />

Government grants, including non-monetary grants at fair<br />

value, shall not be recognised until there is reasonable<br />

assurance that the entity will comply with the conditions<br />

General revenue recognition principles should be<br />

considered in accounting for government grants.<br />

Accrual basis of accounting is used. Under U.S. <strong>GAAP</strong>,<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd