Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

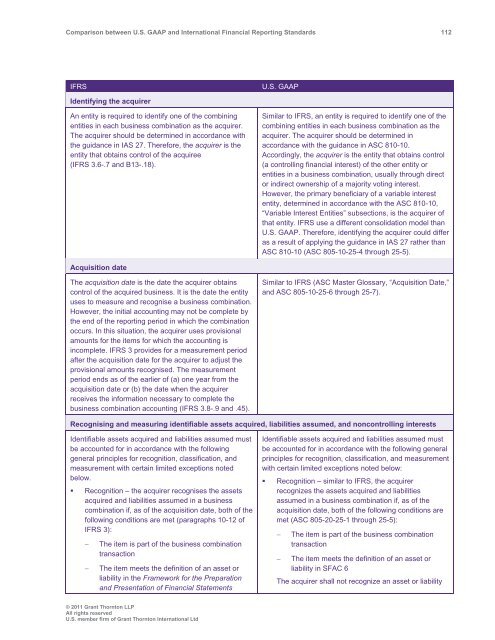

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 112<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Identifying the acquirer<br />

An entity is required to identify one of the combining<br />

entities in each business combination as the acquirer.<br />

The acquirer should be determined in accordance with<br />

the guidance in IAS 27. Therefore, the acquirer is the<br />

entity that obtains control of the acquiree<br />

(IFRS 3.6-.7 <strong>and</strong> B13-.18).<br />

Similar to IFRS, an entity is required to identify one of the<br />

combining entities in each business combination as the<br />

acquirer. The acquirer should be determined in<br />

accordance with the guidance in ASC 810-10.<br />

Accordingly, the acquirer is the entity that obtains control<br />

(a controlling financial interest) of the other entity or<br />

entities in a business combination, usually through direct<br />

or indirect ownership of a majority voting interest.<br />

However, the primary beneficiary of a variable interest<br />

entity, determined in accordance with the ASC 810-10,<br />

“Variable Interest Entities” subsections, is the acquirer of<br />

that entity. IFRS use a different consolidation model than<br />

U.S. <strong>GAAP</strong>. Therefore, identifying the acquirer could differ<br />

as a result of applying the guidance in IAS 27 rather than<br />

ASC 810-10 (ASC 805-10-25-4 through 25-5).<br />

Acquisition date<br />

The acquisition date is the date the acquirer obtains<br />

control of the acquired business. It is the date the entity<br />

uses to measure <strong>and</strong> recognise a business combination.<br />

However, the initial accounting may not be complete by<br />

the end of the reporting period in which the combination<br />

occurs. In this situation, the acquirer uses provisional<br />

amounts for the items for which the accounting is<br />

incomplete. IFRS 3 provides for a measurement period<br />

after the acquisition date for the acquirer to adjust the<br />

provisional amounts recognised. The measurement<br />

period ends as of the earlier of (a) one year from the<br />

acquisition date or (b) the date when the acquirer<br />

receives the information necessary to complete the<br />

business combination accounting (IFRS 3.8-.9 <strong>and</strong> .45).<br />

Similar to IFRS (ASC Master Glossary, “Acquisition Date,”<br />

<strong>and</strong> ASC 805-10-25-6 through 25-7).<br />

Recognising <strong>and</strong> measuring identifiable assets acquired, liabilities assumed, <strong>and</strong> noncontrolling interests<br />

Identifiable assets acquired <strong>and</strong> liabilities assumed must<br />

be accounted for in accordance with the following<br />

general principles for recognition, classification, <strong>and</strong><br />

measurement with certain limited exceptions noted<br />

below.<br />

• Recognition – the acquirer recognises the assets<br />

acquired <strong>and</strong> liabilities assumed in a business<br />

combination if, as of the acquisition date, both of the<br />

following conditions are met (paragraphs 10-12 of<br />

IFRS 3):<br />

<br />

<br />

The item is part of the business combination<br />

transaction<br />

The item meets the definition of an asset or<br />

liability in the Framework for the Preparation<br />

<strong>and</strong> Presentation of Financial Statements<br />

Identifiable assets acquired <strong>and</strong> liabilities assumed must<br />

be accounted for in accordance with the following general<br />

principles for recognition, classification, <strong>and</strong> measurement<br />

with certain limited exceptions noted below:<br />

• Recognition – similar to IFRS, the acquirer<br />

recognizes the assets acquired <strong>and</strong> liabilities<br />

assumed in a business combination if, as of the<br />

acquisition date, both of the following conditions are<br />

met (ASC 805-20-25-1 through 25-5):<br />

<br />

The item is part of the business combination<br />

transaction<br />

The item meets the definition of an asset or<br />

liability in SFAC 6<br />

The acquirer shall not recognize an asset or liability<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd