Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

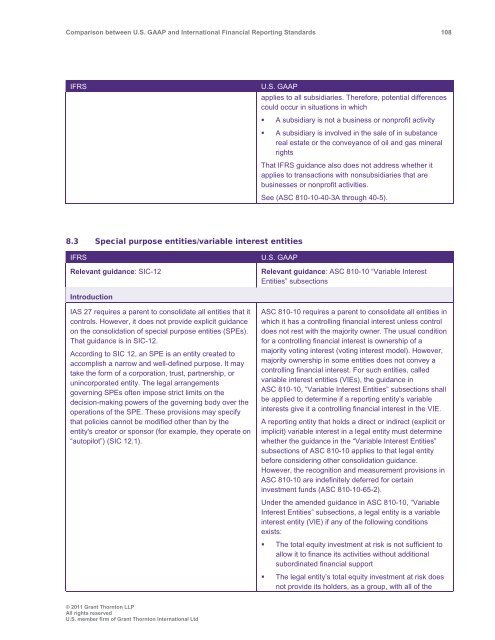

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 108<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

applies to all subsidiaries. Therefore, potential differences<br />

could occur in situations in which<br />

• A subsidiary is not a business or nonprofit activity<br />

• A subsidiary is involved in the sale of in substance<br />

real estate or the conveyance of oil <strong>and</strong> gas mineral<br />

rights<br />

That IFRS guidance also does not address whether it<br />

applies to transactions with nonsubsidiaries that are<br />

businesses or nonprofit activities.<br />

See (ASC 810-10-40-3A through 40-5).<br />

8.3 Special purpose entities/variable interest entities<br />

IFRS<br />

Relevant guidance: SIC-12<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: ASC 810-10 “Variable Interest<br />

Entities” subsections<br />

Introduction<br />

IAS 27 requires a parent to consolidate all entities that it<br />

controls. However, it does not provide explicit guidance<br />

on the consolidation of special purpose entities (SPEs).<br />

That guidance is in SIC-12.<br />

According to SIC 12, an SPE is an entity created to<br />

accomplish a narrow <strong>and</strong> well-defined purpose. It may<br />

take the form of a corporation, trust, partnership, or<br />

unincorporated entity. The legal arrangements<br />

governing SPEs often impose strict limits on the<br />

decision-making powers of the governing body over the<br />

operations of the SPE. These provisions may specify<br />

that policies cannot be modified other than by the<br />

entity's creator or sponsor (for example, they operate on<br />

“autopilot”) (SIC 12.1).<br />

ASC 810-10 requires a parent to consolidate all entities in<br />

which it has a controlling financial interest unless control<br />

does not rest with the majority owner. The usual condition<br />

for a controlling financial interest is ownership of a<br />

majority voting interest (voting interest model). However,<br />

majority ownership in some entities does not convey a<br />

controlling financial interest. For such entities, called<br />

variable interest entities (VIEs), the guidance in<br />

ASC 810-10, “Variable Interest Entities” subsections shall<br />

be applied to determine if a reporting entity’s variable<br />

interests give it a controlling financial interest in the VIE.<br />

A reporting entity that holds a direct or indirect (explicit or<br />

implicit) variable interest in a legal entity must determine<br />

whether the guidance in the “Variable Interest Entities”<br />

subsections of ASC 810-10 applies to that legal entity<br />

before considering other consolidation guidance.<br />

However, the recognition <strong>and</strong> measurement provisions in<br />

ASC 810-10 are indefinitely deferred for certain<br />

investment funds (ASC 810-10-65-2).<br />

Under the amended guidance in ASC 810-10, “Variable<br />

Interest Entities” subsections, a legal entity is a variable<br />

interest entity (VIE) if any of the following conditions<br />

exists:<br />

• The total equity investment at risk is not sufficient to<br />

allow it to finance its activities without additional<br />

subordinated financial support<br />

• The legal entity’s total equity investment at risk does<br />

not provide its holders, as a group, with all of the<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd