Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

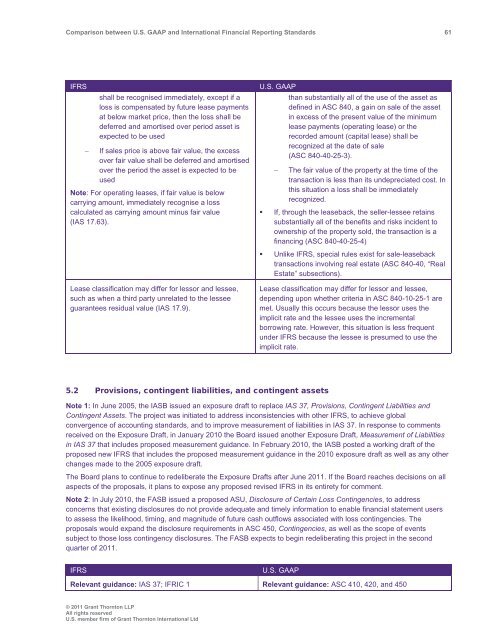

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 61<br />

IFRS<br />

shall be recognised immediately, except if a<br />

loss is compensated by future lease payments<br />

at below market price, then the loss shall be<br />

deferred <strong>and</strong> amortised over period asset is<br />

expected to be used<br />

If sales price is above fair value, the excess<br />

over fair value shall be deferred <strong>and</strong> amortised<br />

over the period the asset is expected to be<br />

used<br />

Note: For operating leases, if fair value is below<br />

carrying amount, immediately recognise a loss<br />

calculated as carrying amount minus fair value<br />

(IAS 17.63).<br />

Lease classification may differ for lessor <strong>and</strong> lessee,<br />

such as when a third party unrelated to the lessee<br />

guarantees residual value (IAS 17.9).<br />

U.S. <strong>GAAP</strong><br />

than substantially all of the use of the asset as<br />

defined in ASC 840, a gain on sale of the asset<br />

in excess of the present value of the minimum<br />

lease payments (operating lease) or the<br />

recorded amount (capital lease) shall be<br />

recognized at the date of sale<br />

(ASC 840-40-25-3).<br />

The fair value of the property at the time of the<br />

transaction is less than its undepreciated cost. In<br />

this situation a loss shall be immediately<br />

recognized.<br />

• If, through the leaseback, the seller-lessee retains<br />

substantially all of the benefits <strong>and</strong> risks incident to<br />

ownership of the property sold, the transaction is a<br />

financing (ASC 840-40-25-4)<br />

• Unlike IFRS, special rules exist for sale-leaseback<br />

transactions involving real estate (ASC 840-40, “Real<br />

Estate” subsections).<br />

Lease classification may differ for lessor <strong>and</strong> lessee,<br />

depending upon whether criteria in ASC 840-10-25-1 are<br />

met. Usually this occurs because the lessor uses the<br />

implicit rate <strong>and</strong> the lessee uses the incremental<br />

borrowing rate. However, this situation is less frequent<br />

under IFRS because the lessee is presumed to use the<br />

implicit rate.<br />

5.2 Provisions, contingent liabilities, <strong>and</strong> contingent assets<br />

Note 1: In June 2005, the IASB issued an exposure draft to replace IAS 37, Provisions, Contingent Liabilities <strong>and</strong><br />

Contingent Assets. The project was initiated to address inconsistencies with other IFRS, to achieve global<br />

convergence of accounting st<strong>and</strong>ards, <strong>and</strong> to improve measurement of liabilities in IAS 37. In response to comments<br />

received on the Exposure Draft, in January 2010 the Board issued another Exposure Draft, Measurement of Liabilities<br />

in IAS 37 that includes proposed measurement guidance. In February 2010, the IASB posted a working draft of the<br />

proposed new IFRS that includes the proposed measurement guidance in the 2010 exposure draft as well as any other<br />

changes made to the 2005 exposure draft.<br />

The Board plans to continue to redeliberate the Exposure Drafts after June 2011. If the Board reaches decisions on all<br />

aspects of the proposals, it plans to expose any proposed revised IFRS in its entirety for comment.<br />

Note 2: In July 2010, the FASB issued a proposed ASU, Disclosure of Certain Loss Contingencies, to address<br />

concerns that existing disclosures do not provide adequate <strong>and</strong> timely information to enable financial statement users<br />

to assess the likelihood, timing, <strong>and</strong> magnitude of future cash outflows associated with loss contingencies. The<br />

proposals would exp<strong>and</strong> the disclosure requirements in ASC 450, Contingencies, as well as the scope of events<br />

subject to those loss contingency disclosures. The FASB expects to begin redeliberating this project in the second<br />

quarter of 2011.<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 37; IFRIC 1 Relevant guidance: ASC 410, 420, <strong>and</strong> 450<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd