Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

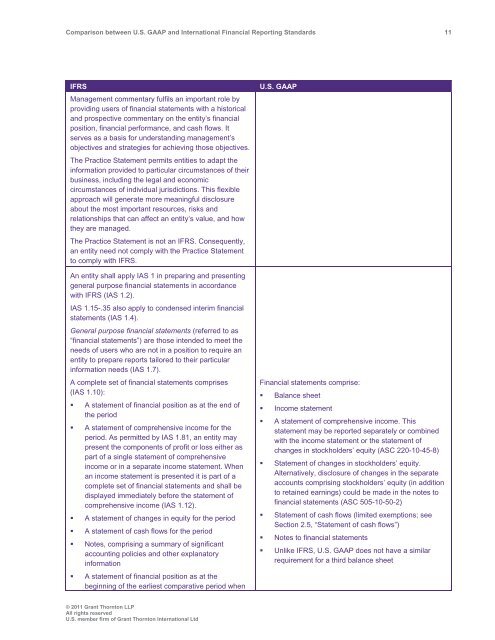

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 11<br />

IFRS<br />

Management commentary fulfils an important role by<br />

providing users of financial statements with a historical<br />

<strong>and</strong> prospective commentary on the entity’s financial<br />

position, financial performance, <strong>and</strong> cash flows. It<br />

serves as a basis for underst<strong>and</strong>ing management’s<br />

objectives <strong>and</strong> strategies for achieving those objectives.<br />

The Practice Statement permits entities to adapt the<br />

information provided to particular circumstances of their<br />

business, including the legal <strong>and</strong> economic<br />

circumstances of individual jurisdictions. This flexible<br />

approach will generate more meaningful disclosure<br />

about the most important resources, risks <strong>and</strong><br />

relationships that can affect an entity’s value, <strong>and</strong> how<br />

they are managed.<br />

The Practice Statement is not an IFRS. Consequently,<br />

an entity need not comply with the Practice Statement<br />

to comply with IFRS.<br />

An entity shall apply IAS 1 in preparing <strong>and</strong> presenting<br />

general purpose financial statements in accordance<br />

with IFRS (IAS 1.2).<br />

IAS 1.15-.35 also apply to condensed interim financial<br />

statements (IAS 1.4).<br />

General purpose financial statements (referred to as<br />

“financial statements”) are those intended to meet the<br />

needs of users who are not in a position to require an<br />

entity to prepare reports tailored to their particular<br />

information needs (IAS 1.7).<br />

A complete set of financial statements comprises<br />

(IAS 1.10):<br />

• A statement of financial position as at the end of<br />

the period<br />

• A statement of comprehensive income for the<br />

period. As permitted by IAS 1.81, an entity may<br />

present the components of profit or loss either as<br />

part of a single statement of comprehensive<br />

income or in a separate income statement. When<br />

an income statement is presented it is part of a<br />

complete set of financial statements <strong>and</strong> shall be<br />

displayed immediately before the statement of<br />

comprehensive income (IAS 1.12).<br />

• A statement of changes in equity for the period<br />

• A statement of cash flows for the period<br />

• Notes, comprising a summary of significant<br />

accounting policies <strong>and</strong> other explanatory<br />

information<br />

• A statement of financial position as at the<br />

beginning of the earliest comparative period when<br />

U.S. <strong>GAAP</strong><br />

Financial statements comprise:<br />

• Balance sheet<br />

• Income statement<br />

• A statement of comprehensive income. This<br />

statement may be reported separately or combined<br />

with the income statement or the statement of<br />

changes in stockholders’ equity (ASC 220-10-45-8)<br />

• Statement of changes in stockholders’ equity.<br />

Alternatively, disclosure of changes in the separate<br />

accounts comprising stockholders’ equity (in addition<br />

to retained earnings) could be made in the notes to<br />

financial statements (ASC 505-10-50-2)<br />

• Statement of cash flows (limited exemptions; see<br />

Section 2.5, “Statement of cash flows”)<br />

• Notes to financial statements<br />

• Unlike IFRS, U.S. <strong>GAAP</strong> does not have a similar<br />

requirement for a third balance sheet<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd