Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

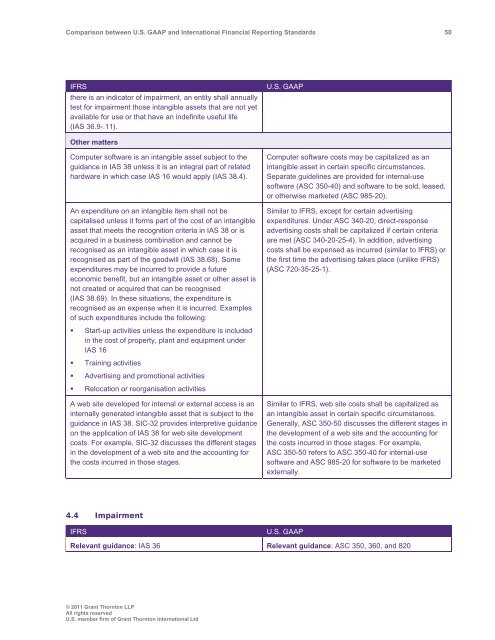

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 50<br />

IFRS<br />

there is an indicator of impairment, an entity shall annually<br />

test for impairment those intangible assets that are not yet<br />

available for use or that have an indefinite useful life<br />

(IAS 36.9-.11).<br />

U.S. <strong>GAAP</strong><br />

Other matters<br />

Computer software is an intangible asset subject to the<br />

guidance in IAS 38 unless it is an integral part of related<br />

hardware in which case IAS 16 would apply (IAS 38.4).<br />

An expenditure on an intangible item shall not be<br />

capitalised unless it forms part of the cost of an intangible<br />

asset that meets the recognition criteria in IAS 38 or is<br />

acquired in a business combination <strong>and</strong> cannot be<br />

recognised as an intangible asset in which case it is<br />

recognised as part of the goodwill (IAS 38.68). Some<br />

expenditures may be incurred to provide a future<br />

economic benefit, but an intangible asset or other asset is<br />

not created or acquired that can be recognised<br />

(IAS 38.69). In these situations, the expenditure is<br />

recognised as an expense when it is incurred. Examples<br />

of such expenditures include the following:<br />

Computer software costs may be capitalized as an<br />

intangible asset in certain specific circumstances.<br />

Separate guidelines are provided for internal-use<br />

software (ASC 350-40) <strong>and</strong> software to be sold, leased,<br />

or otherwise marketed (ASC 985-20).<br />

Similar to IFRS, except for certain advertising<br />

expenditures. Under ASC 340-20, direct-response<br />

advertising costs shall be capitalized if certain criteria<br />

are met (ASC 340-20-25-4). In addition, advertising<br />

costs shall be expensed as incurred (similar to IFRS) or<br />

the first time the advertising takes place (unlike IFRS)<br />

(ASC 720-35-25-1).<br />

• Start-up activities unless the expenditure is included<br />

in the cost of property, plant <strong>and</strong> equipment under<br />

IAS 16<br />

• Training activities<br />

• Advertising <strong>and</strong> promotional activities<br />

• Relocation or reorganisation activities<br />

A web site developed for internal or external access is an<br />

internally generated intangible asset that is subject to the<br />

guidance in IAS 38. SIC-32 provides interpretive guidance<br />

on the application of IAS 38 for web site development<br />

costs. For example, SIC-32 discusses the different stages<br />

in the development of a web site <strong>and</strong> the accounting for<br />

the costs incurred in those stages.<br />

Similar to IFRS, web site costs shall be capitalized as<br />

an intangible asset in certain specific circumstances.<br />

Generally, ASC 350-50 discusses the different stages in<br />

the development of a web site <strong>and</strong> the accounting for<br />

the costs incurred in those stages. For example,<br />

ASC 350-50 refers to ASC 350-40 for internal-use<br />

software <strong>and</strong> ASC 985-20 for software to be marketed<br />

externally.<br />

4.4 Impairment<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 36 Relevant guidance: ASC 350, 360, <strong>and</strong> 820<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd