Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

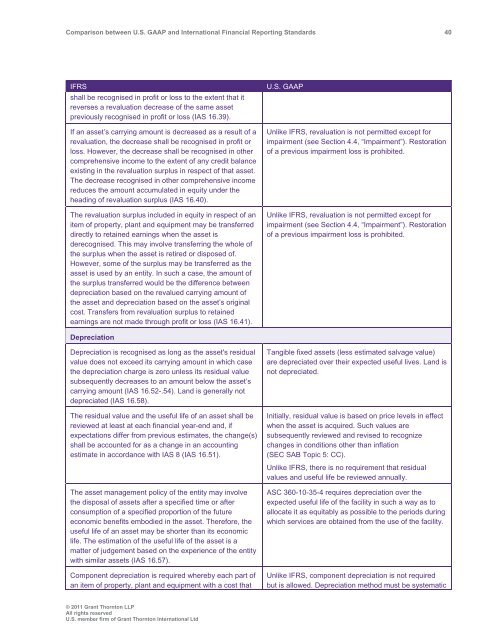

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 40<br />

IFRS<br />

shall be recognised in profit or loss to the extent that it<br />

reverses a revaluation decrease of the same asset<br />

previously recognised in profit or loss (IAS 16.39).<br />

If an asset’s carrying amount is decreased as a result of a<br />

revaluation, the decrease shall be recognised in profit or<br />

loss. However, the decrease shall be recognised in other<br />

comprehensive income to the extent of any credit balance<br />

existing in the revaluation surplus in respect of that asset.<br />

The decrease recognised in other comprehensive income<br />

reduces the amount accumulated in equity under the<br />

heading of revaluation surplus (IAS 16.40).<br />

The revaluation surplus included in equity in respect of an<br />

item of property, plant <strong>and</strong> equipment may be transferred<br />

directly to retained earnings when the asset is<br />

derecognised. This may involve transferring the whole of<br />

the surplus when the asset is retired or disposed of.<br />

However, some of the surplus may be transferred as the<br />

asset is used by an entity. In such a case, the amount of<br />

the surplus transferred would be the difference <strong>between</strong><br />

depreciation based on the revalued carrying amount of<br />

the asset <strong>and</strong> depreciation based on the asset’s original<br />

cost. Transfers from revaluation surplus to retained<br />

earnings are not made through profit or loss (IAS 16.41).<br />

U.S. <strong>GAAP</strong><br />

Unlike IFRS, revaluation is not permitted except for<br />

impairment (see Section 4.4, “Impairment”). Restoration<br />

of a previous impairment loss is prohibited.<br />

Unlike IFRS, revaluation is not permitted except for<br />

impairment (see Section 4.4, “Impairment”). Restoration<br />

of a previous impairment loss is prohibited.<br />

Depreciation<br />

Depreciation is recognised as long as the asset's residual<br />

value does not exceed its carrying amount in which case<br />

the depreciation charge is zero unless its residual value<br />

subsequently decreases to an amount below the asset’s<br />

carrying amount (IAS 16.52-.54). L<strong>and</strong> is generally not<br />

depreciated (IAS 16.58).<br />

The residual value <strong>and</strong> the useful life of an asset shall be<br />

reviewed at least at each financial year-end <strong>and</strong>, if<br />

expectations differ from previous estimates, the change(s)<br />

shall be accounted for as a change in an accounting<br />

estimate in accordance with IAS 8 (IAS 16.51).<br />

The asset management policy of the entity may involve<br />

the disposal of assets after a specified time or after<br />

consumption of a specified proportion of the future<br />

economic benefits embodied in the asset. Therefore, the<br />

useful life of an asset may be shorter than its economic<br />

life. The estimation of the useful life of the asset is a<br />

matter of judgement based on the experience of the entity<br />

with similar assets (IAS 16.57).<br />

Component depreciation is required whereby each part of<br />

an item of property, plant <strong>and</strong> equipment with a cost that<br />

Tangible fixed assets (less estimated salvage value)<br />

are depreciated over their expected useful lives. L<strong>and</strong> is<br />

not depreciated.<br />

Initially, residual value is based on price levels in effect<br />

when the asset is acquired. Such values are<br />

subsequently reviewed <strong>and</strong> revised to recognize<br />

changes in conditions other than inflation<br />

(SEC SAB Topic 5: CC).<br />

Unlike IFRS, there is no requirement that residual<br />

values <strong>and</strong> useful life be reviewed annually.<br />

ASC 360-10-35-4 requires depreciation over the<br />

expected useful life of the facility in such a way as to<br />

allocate it as equitably as possible to the periods during<br />

which services are obtained from the use of the facility.<br />

Unlike IFRS, component depreciation is not required<br />

but is allowed. Depreciation method must be systematic<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd