Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

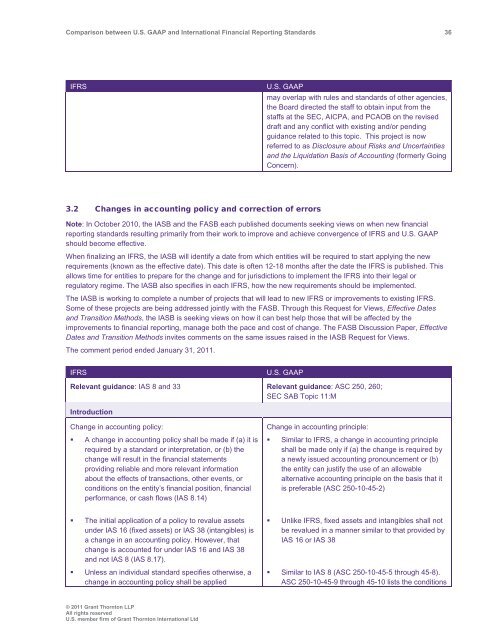

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 36<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

may overlap with rules <strong>and</strong> st<strong>and</strong>ards of other agencies,<br />

the Board directed the staff to obtain input from the<br />

staffs at the SEC, AICPA, <strong>and</strong> PCAOB on the revised<br />

draft <strong>and</strong> any conflict with existing <strong>and</strong>/or pending<br />

guidance related to this topic. This project is now<br />

referred to as Disclosure about Risks <strong>and</strong> Uncertainties<br />

<strong>and</strong> the Liquidation Basis of Accounting (formerly Going<br />

Concern).<br />

3.2 Changes in accounting policy <strong>and</strong> correction of errors<br />

Note: In October 2010, the IASB <strong>and</strong> the FASB each published documents seeking views on when new financial<br />

reporting st<strong>and</strong>ards resulting primarily from their work to improve <strong>and</strong> achieve convergence of IFRS <strong>and</strong> U.S. <strong>GAAP</strong><br />

should become effective.<br />

When finalizing an IFRS, the IASB will identify a date from which entities will be required to start applying the new<br />

requirements (known as the effective date). This date is often 12-18 months after the date the IFRS is published. This<br />

allows time for entities to prepare for the change <strong>and</strong> for jurisdictions to implement the IFRS into their legal or<br />

regulatory regime. The IASB also specifies in each IFRS, how the new requirements should be implemented.<br />

The IASB is working to complete a number of projects that will lead to new IFRS or improvements to existing IFRS.<br />

Some of these projects are being addressed jointly with the FASB. Through this Request for Views, Effective Dates<br />

<strong>and</strong> Transition Methods, the IASB is seeking views on how it can best help those that will be affected by the<br />

improvements to financial reporting, manage both the pace <strong>and</strong> cost of change. The FASB Discussion Paper, Effective<br />

Dates <strong>and</strong> Transition Methods invites comments on the same issues raised in the IASB Request for Views.<br />

The comment period ended January 31, 2011.<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 8 <strong>and</strong> 33 Relevant guidance: ASC 250, 260;<br />

SEC SAB Topic 11:M<br />

Introduction<br />

Change in accounting policy:<br />

• A change in accounting policy shall be made if (a) it is<br />

required by a st<strong>and</strong>ard or interpretation, or (b) the<br />

change will result in the financial statements<br />

providing reliable <strong>and</strong> more relevant information<br />

about the effects of transactions, other events, or<br />

conditions on the entity’s financial position, financial<br />

performance, or cash flows (IAS 8.14)<br />

Change in accounting principle:<br />

• Similar to IFRS, a change in accounting principle<br />

shall be made only if (a) the change is required by<br />

a newly issued accounting pronouncement or (b)<br />

the entity can justify the use of an allowable<br />

alternative accounting principle on the basis that it<br />

is preferable (ASC 250-10-45-2)<br />

• The initial application of a policy to revalue assets<br />

under IAS 16 (fixed assets) or IAS 38 (intangibles) is<br />

a change in an accounting policy. However, that<br />

change is accounted for under IAS 16 <strong>and</strong> IAS 38<br />

<strong>and</strong> not IAS 8 (IAS 8.17).<br />

• Unless an individual st<strong>and</strong>ard specifies otherwise, a<br />

change in accounting policy shall be applied<br />

• Unlike IFRS, fixed assets <strong>and</strong> intangibles shall not<br />

be revalued in a manner similar to that provided by<br />

IAS 16 or IAS 38<br />

• Similar to IAS 8 (ASC 250-10-45-5 through 45-8).<br />

ASC 250-10-45-9 through 45-10 lists the conditions<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd