Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 57<br />

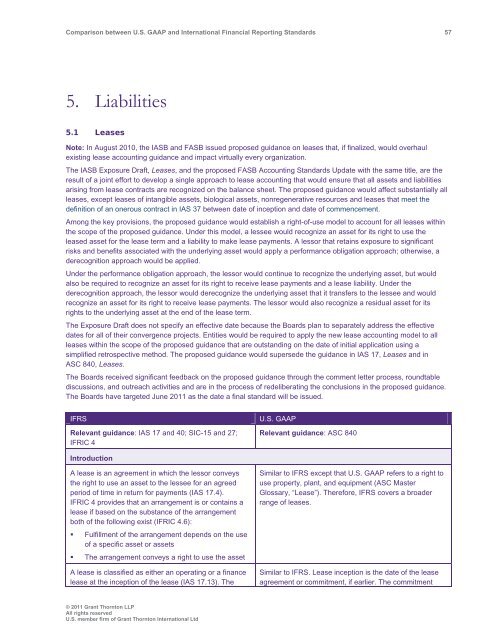

5. Liabilities<br />

5.1 Leases<br />

Note: In August 2010, the IASB <strong>and</strong> FASB issued proposed guidance on leases that, if finalized, would overhaul<br />

existing lease accounting guidance <strong>and</strong> impact virtually every organization.<br />

The IASB Exposure Draft, Leases, <strong>and</strong> the proposed FASB Accounting St<strong>and</strong>ards Update with the same title, are the<br />

result of a joint effort to develop a single approach to lease accounting that would ensure that all assets <strong>and</strong> liabilities<br />

arising from lease contracts are recognized on the balance sheet. The proposed guidance would affect substantially all<br />

leases, except leases of intangible assets, biological assets, nonregenerative resources <strong>and</strong> leases that meet the<br />

definition of an onerous contract in IAS 37 <strong>between</strong> date of inception <strong>and</strong> date of commencement.<br />

Among the key provisions, the proposed guidance would establish a right-of-use model to account for all leases within<br />

the scope of the proposed guidance. Under this model, a lessee would recognize an asset for its right to use the<br />

leased asset for the lease term <strong>and</strong> a liability to make lease payments. A lessor that retains exposure to significant<br />

risks <strong>and</strong> benefits associated with the underlying asset would apply a performance obligation approach; otherwise, a<br />

derecognition approach would be applied.<br />

Under the performance obligation approach, the lessor would continue to recognize the underlying asset, but would<br />

also be required to recognize an asset for its right to receive lease payments <strong>and</strong> a lease liability. Under the<br />

derecognition approach, the lessor would derecognize the underlying asset that it transfers to the lessee <strong>and</strong> would<br />

recognize an asset for its right to receive lease payments. The lessor would also recognize a residual asset for its<br />

rights to the underlying asset at the end of the lease term.<br />

The Exposure Draft does not specify an effective date because the Boards plan to separately address the effective<br />

dates for all of their convergence projects. Entities would be required to apply the new lease accounting model to all<br />

leases within the scope of the proposed guidance that are outst<strong>and</strong>ing on the date of initial application using a<br />

simplified retrospective method. The proposed guidance would supersede the guidance in IAS 17, Leases <strong>and</strong> in<br />

ASC 840, Leases.<br />

The Boards received significant feedback on the proposed guidance through the comment letter process, roundtable<br />

discussions, <strong>and</strong> outreach activities <strong>and</strong> are in the process of redeliberating the conclusions in the proposed guidance.<br />

The Boards have targeted June 2011 as the date a final st<strong>and</strong>ard will be issued.<br />

IFRS<br />

Relevant guidance: IAS 17 <strong>and</strong> 40; SIC-15 <strong>and</strong> 27;<br />

IFRIC 4<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: ASC 840<br />

Introduction<br />

A lease is an agreement in which the lessor conveys<br />

the right to use an asset to the lessee for an agreed<br />

period of time in return for payments (IAS 17.4).<br />

IFRIC 4 provides that an arrangement is or contains a<br />

lease if based on the substance of the arrangement<br />

both of the following exist (IFRIC 4.6):<br />

• Fulfillment of the arrangement depends on the use<br />

of a specific asset or assets<br />

• The arrangement conveys a right to use the asset<br />

A lease is classified as either an operating or a finance<br />

lease at the inception of the lease (IAS 17.13). The<br />

Similar to IFRS except that U.S. <strong>GAAP</strong> refers to a right to<br />

use property, plant, <strong>and</strong> equipment (ASC Master<br />

Glossary, “Lease”). Therefore, IFRS covers a broader<br />

range of leases.<br />

Similar to IFRS. Lease inception is the date of the lease<br />

agreement or commitment, if earlier. The commitment<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd