Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

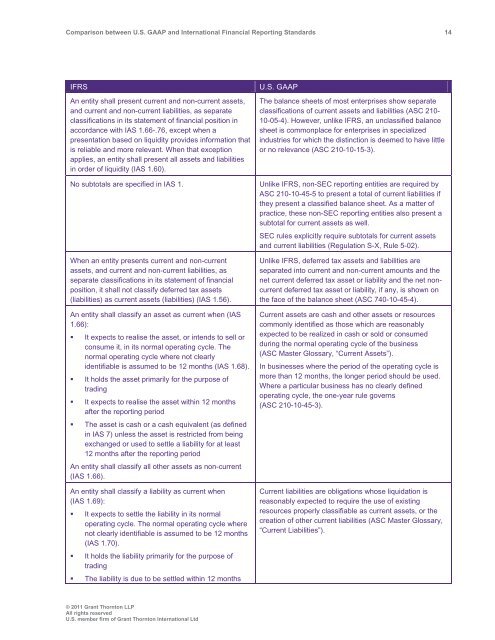

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 14<br />

IFRS<br />

An entity shall present current <strong>and</strong> non-current assets,<br />

<strong>and</strong> current <strong>and</strong> non-current liabilities, as separate<br />

classifications in its statement of financial position in<br />

accordance with IAS 1.66-.76, except when a<br />

presentation based on liquidity provides information that<br />

is reliable <strong>and</strong> more relevant. When that exception<br />

applies, an entity shall present all assets <strong>and</strong> liabilities<br />

in order of liquidity (IAS 1.60).<br />

No subtotals are specified in IAS 1.<br />

When an entity presents current <strong>and</strong> non-current<br />

assets, <strong>and</strong> current <strong>and</strong> non-current liabilities, as<br />

separate classifications in its statement of financial<br />

position, it shall not classify deferred tax assets<br />

(liabilities) as current assets (liabilities) (IAS 1.56).<br />

An entity shall classify an asset as current when (IAS<br />

1.66):<br />

• It expects to realise the asset, or intends to sell or<br />

consume it, in its normal operating cycle. The<br />

normal operating cycle where not clearly<br />

identifiable is assumed to be 12 months (IAS 1.68).<br />

• It holds the asset primarily for the purpose of<br />

trading<br />

• It expects to realise the asset within 12 months<br />

after the reporting period<br />

• The asset is cash or a cash equivalent (as defined<br />

in IAS 7) unless the asset is restricted from being<br />

exchanged or used to settle a liability for at least<br />

12 months after the reporting period<br />

An entity shall classify all other assets as non-current<br />

(IAS 1.66).<br />

An entity shall classify a liability as current when<br />

(IAS 1.69):<br />

• It expects to settle the liability in its normal<br />

operating cycle. The normal operating cycle where<br />

not clearly identifiable is assumed to be 12 months<br />

(IAS 1.70).<br />

• It holds the liability primarily for the purpose of<br />

trading<br />

• The liability is due to be settled within 12 months<br />

U.S. <strong>GAAP</strong><br />

The balance sheets of most enterprises show separate<br />

classifications of current assets <strong>and</strong> liabilities (ASC 210-<br />

10-05-4). However, unlike IFRS, an unclassified balance<br />

sheet is commonplace for enterprises in specialized<br />

industries for which the distinction is deemed to have little<br />

or no relevance (ASC 210-10-15-3).<br />

Unlike IFRS, non-SEC reporting entities are required by<br />

ASC 210-10-45-5 to present a total of current liabilities if<br />

they present a classified balance sheet. As a matter of<br />

practice, these non-SEC reporting entities also present a<br />

subtotal for current assets as well.<br />

SEC rules explicitly require subtotals for current assets<br />

<strong>and</strong> current liabilities (Regulation S-X, Rule 5-02).<br />

Unlike IFRS, deferred tax assets <strong>and</strong> liabilities are<br />

separated into current <strong>and</strong> non-current amounts <strong>and</strong> the<br />

net current deferred tax asset or liability <strong>and</strong> the net noncurrent<br />

deferred tax asset or liability, if any, is shown on<br />

the face of the balance sheet (ASC 740-10-45-4).<br />

Current assets are cash <strong>and</strong> other assets or resources<br />

commonly identified as those which are reasonably<br />

expected to be realized in cash or sold or consumed<br />

during the normal operating cycle of the business<br />

(ASC Master Glossary, “Current Assets”).<br />

In businesses where the period of the operating cycle is<br />

more than 12 months, the longer period should be used.<br />

Where a particular business has no clearly defined<br />

operating cycle, the one-year rule governs<br />

(ASC 210-10-45-3).<br />

Current liabilities are obligations whose liquidation is<br />

reasonably expected to require the use of existing<br />

resources properly classifiable as current assets, or the<br />

creation of other current liabilities (ASC Master Glossary,<br />

“Current Liabilities”).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd