Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

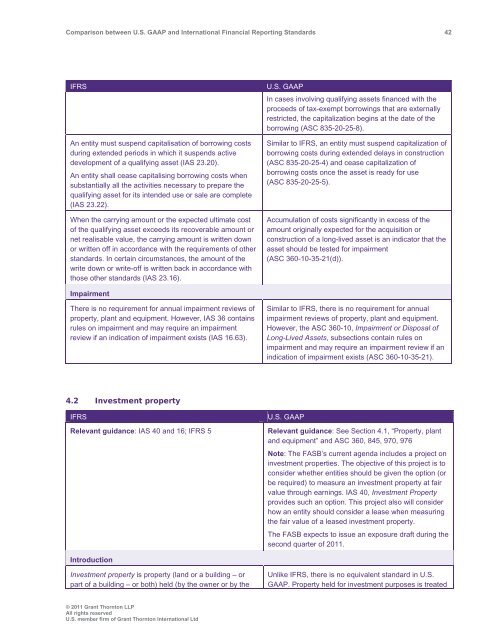

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 42<br />

IFRS<br />

An entity must suspend capitalisation of borrowing costs<br />

during extended periods in which it suspends active<br />

development of a qualifying asset (IAS 23.20).<br />

An entity shall cease capitalising borrowing costs when<br />

substantially all the activities necessary to prepare the<br />

qualifying asset for its intended use or sale are complete<br />

(IAS 23.22).<br />

When the carrying amount or the expected ultimate cost<br />

of the qualifying asset exceeds its recoverable amount or<br />

net realisable value, the carrying amount is written down<br />

or written off in accordance with the requirements of other<br />

st<strong>and</strong>ards. In certain circumstances, the amount of the<br />

write down or write-off is written back in accordance with<br />

those other st<strong>and</strong>ards (IAS 23.16).<br />

U.S. <strong>GAAP</strong><br />

In cases involving qualifying assets financed with the<br />

proceeds of tax-exempt borrowings that are externally<br />

restricted, the capitalization begins at the date of the<br />

borrowing (ASC 835-20-25-8).<br />

Similar to IFRS, an entity must suspend capitalization of<br />

borrowing costs during extended delays in construction<br />

(ASC 835-20-25-4) <strong>and</strong> cease capitalization of<br />

borrowing costs once the asset is ready for use<br />

(ASC 835-20-25-5).<br />

Accumulation of costs significantly in excess of the<br />

amount originally expected for the acquisition or<br />

construction of a long-lived asset is an indicator that the<br />

asset should be tested for impairment<br />

(ASC 360-10-35-21(d)).<br />

Impairment<br />

There is no requirement for annual impairment reviews of<br />

property, plant <strong>and</strong> equipment. However, IAS 36 contains<br />

rules on impairment <strong>and</strong> may require an impairment<br />

review if an indication of impairment exists (IAS 16.63).<br />

Similar to IFRS, there is no requirement for annual<br />

impairment reviews of property, plant <strong>and</strong> equipment.<br />

However, the ASC 360-10, Impairment or Disposal of<br />

Long-Lived Assets, subsections contain rules on<br />

impairment <strong>and</strong> may require an impairment review if an<br />

indication of impairment exists (ASC 360-10-35-21).<br />

4.2 Investment property<br />

IFRS<br />

Relevant guidance: IAS 40 <strong>and</strong> 16; IFRS 5<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: See Section 4.1, “Property, plant<br />

<strong>and</strong> equipment” <strong>and</strong> ASC 360, 845, 970, 976<br />

Note: The FASB’s current agenda includes a project on<br />

investment properties. The objective of this project is to<br />

consider whether entities should be given the option (or<br />

be required) to measure an investment property at fair<br />

value through earnings. IAS 40, Investment Property<br />

provides such an option. This project also will consider<br />

how an entity should consider a lease when measuring<br />

the fair value of a leased investment property.<br />

The FASB expects to issue an exposure draft during the<br />

second quarter of 2011.<br />

Introduction<br />

Investment property is property (l<strong>and</strong> or a building – or<br />

part of a building – or both) held (by the owner or by the<br />

Unlike IFRS, there is no equivalent st<strong>and</strong>ard in U.S.<br />

<strong>GAAP</strong>. Property held for investment purposes is treated<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd