Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

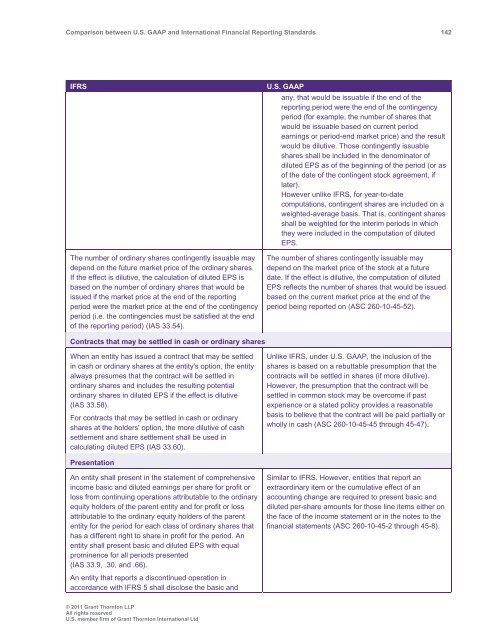

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 142<br />

IFRS<br />

The number of ordinary shares contingently issuable may<br />

depend on the future market price of the ordinary shares.<br />

If the effect is dilutive, the calculation of diluted EPS is<br />

based on the number of ordinary shares that would be<br />

issued if the market price at the end of the reporting<br />

period were the market price at the end of the contingency<br />

period (i.e. the contingencies must be satisfied at the end<br />

of the reporting period) (IAS 33.54).<br />

U.S. <strong>GAAP</strong><br />

any, that would be issuable if the end of the<br />

reporting period were the end of the contingency<br />

period (for example, the number of shares that<br />

would be issuable based on current period<br />

earnings or period-end market price) <strong>and</strong> the result<br />

would be dilutive. Those contingently issuable<br />

shares shall be included in the denominator of<br />

diluted EPS as of the beginning of the period (or as<br />

of the date of the contingent stock agreement, if<br />

later).<br />

However unlike IFRS, for year-to-date<br />

computations, contingent shares are included on a<br />

weighted-average basis. That is, contingent shares<br />

shall be weighted for the interim periods in which<br />

they were included in the computation of diluted<br />

EPS.<br />

The number of shares contingently issuable may<br />

depend on the market price of the stock at a future<br />

date. If the effect is dilutive, the computation of diluted<br />

EPS reflects the number of shares that would be issued<br />

based on the current market price at the end of the<br />

period being reported on (ASC 260-10-45-52).<br />

Contracts that may be settled in cash or ordinary shares<br />

When an entity has issued a contract that may be settled<br />

in cash or ordinary shares at the entity's option, the entity<br />

always presumes that the contract will be settled in<br />

ordinary shares <strong>and</strong> includes the resulting potential<br />

ordinary shares in diluted EPS if the effect is dilutive<br />

(IAS 33.58).<br />

For contracts that may be settled in cash or ordinary<br />

shares at the holders' option, the more dilutive of cash<br />

settlement <strong>and</strong> share settlement shall be used in<br />

calculating diluted EPS (IAS 33.60).<br />

Unlike IFRS, under U.S. <strong>GAAP</strong>, the inclusion of the<br />

shares is based on a rebuttable presumption that the<br />

contracts will be settled in shares (if more dilutive).<br />

However, the presumption that the contract will be<br />

settled in common stock may be overcome if past<br />

experience or a stated policy provides a reasonable<br />

basis to believe that the contract will be paid partially or<br />

wholly in cash (ASC 260-10-45-45 through 45-47).<br />

Presentation<br />

An entity shall present in the statement of comprehensive<br />

income basic <strong>and</strong> diluted earnings per share for profit or<br />

loss from continuing operations attributable to the ordinary<br />

equity holders of the parent entity <strong>and</strong> for profit or loss<br />

attributable to the ordinary equity holders of the parent<br />

entity for the period for each class of ordinary shares that<br />

has a different right to share in profit for the period. An<br />

entity shall present basic <strong>and</strong> diluted EPS with equal<br />

prominence for all periods presented<br />

(IAS 33.9, .30, <strong>and</strong> .66).<br />

Similar to IFRS. However, entities that report an<br />

extraordinary item or the cumulative effect of an<br />

accounting change are required to present basic <strong>and</strong><br />

diluted per-share amounts for those line items either on<br />

the face of the income statement or in the notes to the<br />

financial statements (ASC 260-10-45-2 through 45-8).<br />

An entity that reports a discontinued operation in<br />

accordance with IFRS 5 shall disclose the basic <strong>and</strong><br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd