Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

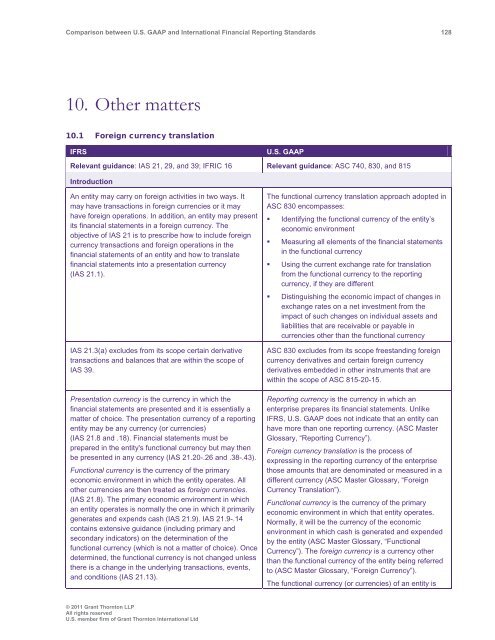

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 128<br />

10. Other matters<br />

10.1 Foreign currency translation<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: IAS 21, 29, <strong>and</strong> 39; IFRIC 16 Relevant guidance: ASC 740, 830, <strong>and</strong> 815<br />

Introduction<br />

An entity may carry on foreign activities in two ways. It<br />

may have transactions in foreign currencies or it may<br />

have foreign operations. In addition, an entity may present<br />

its financial statements in a foreign currency. The<br />

objective of IAS 21 is to prescribe how to include foreign<br />

currency transactions <strong>and</strong> foreign operations in the<br />

financial statements of an entity <strong>and</strong> how to translate<br />

financial statements into a presentation currency<br />

(IAS 21.1).<br />

IAS 21.3(a) excludes from its scope certain derivative<br />

transactions <strong>and</strong> balances that are within the scope of<br />

IAS 39.<br />

Presentation currency is the currency in which the<br />

financial statements are presented <strong>and</strong> it is essentially a<br />

matter of choice. The presentation currency of a reporting<br />

entity may be any currency (or currencies)<br />

(IAS 21.8 <strong>and</strong> .18). Financial statements must be<br />

prepared in the entity's functional currency but may then<br />

be presented in any currency (IAS 21.20-.26 <strong>and</strong> .38-.43).<br />

Functional currency is the currency of the primary<br />

economic environment in which the entity operates. All<br />

other currencies are then treated as foreign currencies.<br />

(IAS 21.8). The primary economic environment in which<br />

an entity operates is normally the one in which it primarily<br />

generates <strong>and</strong> expends cash (IAS 21.9). IAS 21.9-.14<br />

contains extensive guidance (including primary <strong>and</strong><br />

secondary indicators) on the determination of the<br />

functional currency (which is not a matter of choice). Once<br />

determined, the functional currency is not changed unless<br />

there is a change in the underlying transactions, events,<br />

<strong>and</strong> conditions (IAS 21.13).<br />

The functional currency translation approach adopted in<br />

ASC 830 encompasses:<br />

• Identifying the functional currency of the entity’s<br />

economic environment<br />

• Measuring all elements of the financial statements<br />

in the functional currency<br />

• Using the current exchange rate for translation<br />

from the functional currency to the reporting<br />

currency, if they are different<br />

• Distinguishing the economic impact of changes in<br />

exchange rates on a net investment from the<br />

impact of such changes on individual assets <strong>and</strong><br />

liabilities that are receivable or payable in<br />

currencies other than the functional currency<br />

ASC 830 excludes from its scope freest<strong>and</strong>ing foreign<br />

currency derivatives <strong>and</strong> certain foreign currency<br />

derivatives embedded in other instruments that are<br />

within the scope of ASC 815-20-15.<br />

Reporting currency is the currency in which an<br />

enterprise prepares its financial statements. Unlike<br />

IFRS, U.S. <strong>GAAP</strong> does not indicate that an entity can<br />

have more than one reporting currency. (ASC Master<br />

Glossary, “Reporting Currency”).<br />

Foreign currency translation is the process of<br />

expressing in the reporting currency of the enterprise<br />

those amounts that are denominated or measured in a<br />

different currency (ASC Master Glossary, “Foreign<br />

Currency Translation”).<br />

Functional currency is the currency of the primary<br />

economic environment in which that entity operates.<br />

Normally, it will be the currency of the economic<br />

environment in which cash is generated <strong>and</strong> expended<br />

by the entity (ASC Master Glossary, “Functional<br />

Currency”). The foreign currency is a currency other<br />

than the functional currency of the entity being referred<br />

to (ASC Master Glossary, “Foreign Currency”).<br />

The functional currency (or currencies) of an entity is<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd