Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

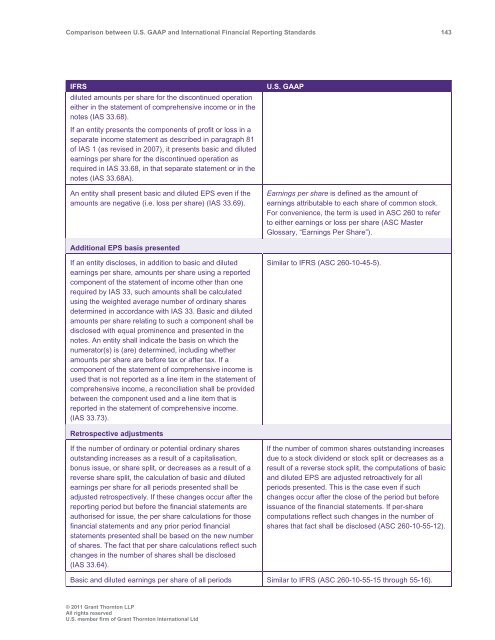

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 143<br />

IFRS<br />

diluted amounts per share for the discontinued operation<br />

either in the statement of comprehensive income or in the<br />

notes (IAS 33.68).<br />

If an entity presents the components of profit or loss in a<br />

separate income statement as described in paragraph 81<br />

of IAS 1 (as revised in 2007), it presents basic <strong>and</strong> diluted<br />

earnings per share for the discontinued operation as<br />

required in IAS 33.68, in that separate statement or in the<br />

notes (IAS 33.68A).<br />

An entity shall present basic <strong>and</strong> diluted EPS even if the<br />

amounts are negative (i.e. loss per share) (IAS 33.69).<br />

U.S. <strong>GAAP</strong><br />

Earnings per share is defined as the amount of<br />

earnings attributable to each share of common stock.<br />

For convenience, the term is used in ASC 260 to refer<br />

to either earnings or loss per share (ASC Master<br />

Glossary, “Earnings Per Share”).<br />

Additional EPS basis presented<br />

If an entity discloses, in addition to basic <strong>and</strong> diluted<br />

earnings per share, amounts per share using a reported<br />

component of the statement of income other than one<br />

required by IAS 33, such amounts shall be calculated<br />

using the weighted average number of ordinary shares<br />

determined in accordance with IAS 33. Basic <strong>and</strong> diluted<br />

amounts per share relating to such a component shall be<br />

disclosed with equal prominence <strong>and</strong> presented in the<br />

notes. An entity shall indicate the basis on which the<br />

numerator(s) is (are) determined, including whether<br />

amounts per share are before tax or after tax. If a<br />

component of the statement of comprehensive income is<br />

used that is not reported as a line item in the statement of<br />

comprehensive income, a reconciliation shall be provided<br />

<strong>between</strong> the component used <strong>and</strong> a line item that is<br />

reported in the statement of comprehensive income.<br />

(IAS 33.73).<br />

Similar to IFRS (ASC 260-10-45-5).<br />

Retrospective adjustments<br />

If the number of ordinary or potential ordinary shares<br />

outst<strong>and</strong>ing increases as a result of a capitalisation,<br />

bonus issue, or share split, or decreases as a result of a<br />

reverse share split, the calculation of basic <strong>and</strong> diluted<br />

earnings per share for all periods presented shall be<br />

adjusted retrospectively. If these changes occur after the<br />

reporting period but before the financial statements are<br />

authorised for issue, the per share calculations for those<br />

financial statements <strong>and</strong> any prior period financial<br />

statements presented shall be based on the new number<br />

of shares. The fact that per share calculations reflect such<br />

changes in the number of shares shall be disclosed<br />

(IAS 33.64).<br />

If the number of common shares outst<strong>and</strong>ing increases<br />

due to a stock dividend or stock split or decreases as a<br />

result of a reverse stock split, the computations of basic<br />

<strong>and</strong> diluted EPS are adjusted retroactively for all<br />

periods presented. This is the case even if such<br />

changes occur after the close of the period but before<br />

issuance of the financial statements. If per-share<br />

computations reflect such changes in the number of<br />

shares that fact shall be disclosed (ASC 260-10-55-12).<br />

Basic <strong>and</strong> diluted earnings per share of all periods Similar to IFRS (ASC 260-10-55-15 through 55-16).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd