Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

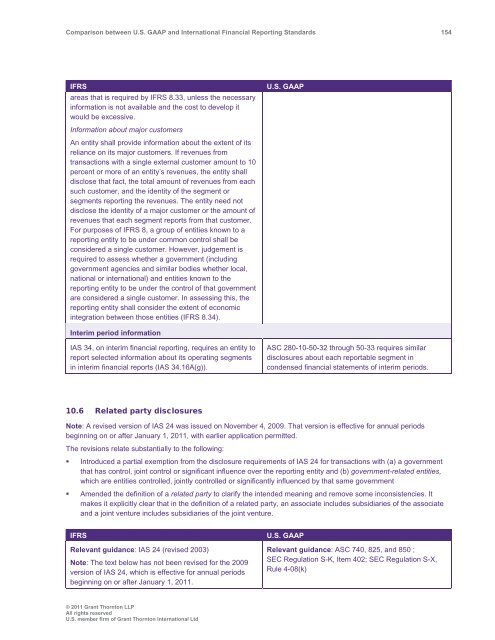

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 154<br />

IFRS<br />

areas that is required by IFRS 8.33, unless the necessary<br />

information is not available <strong>and</strong> the cost to develop it<br />

would be excessive.<br />

Information about major customers<br />

An entity shall provide information about the extent of its<br />

reliance on its major customers. If revenues from<br />

transactions with a single external customer amount to 10<br />

percent or more of an entity’s revenues, the entity shall<br />

disclose that fact, the total amount of revenues from each<br />

such customer, <strong>and</strong> the identity of the segment or<br />

segments reporting the revenues. The entity need not<br />

disclose the identity of a major customer or the amount of<br />

revenues that each segment reports from that customer.<br />

For purposes of IFRS 8, a group of entities known to a<br />

reporting entity to be under common control shall be<br />

considered a single customer. However, judgement is<br />

required to assess whether a government (including<br />

government agencies <strong>and</strong> similar bodies whether local,<br />

national or international) <strong>and</strong> entities known to the<br />

reporting entity to be under the control of that government<br />

are considered a single customer. In assessing this, the<br />

reporting entity shall consider the extent of economic<br />

integration <strong>between</strong> those entities (IFRS 8.34).<br />

U.S. <strong>GAAP</strong><br />

Interim period information<br />

IAS 34, on interim financial reporting, requires an entity to<br />

report selected information about its operating segments<br />

in interim financial reports (IAS 34.16A(g)).<br />

ASC 280-10-50-32 through 50-33 requires similar<br />

disclosures about each reportable segment in<br />

condensed financial statements of interim periods.<br />

10.6 Related party disclosures<br />

Note: A revised version of IAS 24 was issued on November 4, 2009. That version is effective for annual periods<br />

beginning on or after January 1, 2011, with earlier application permitted.<br />

The revisions relate substantially to the following:<br />

• Introduced a partial exemption from the disclosure requirements of IAS 24 for transactions with (a) a government<br />

that has control, joint control or significant influence over the reporting entity <strong>and</strong> (b) government-related entities,<br />

which are entities controlled, jointly controlled or significantly influenced by that same government<br />

• Amended the definition of a related party to clarify the intended meaning <strong>and</strong> remove some inconsistencies. It<br />

makes it explicitly clear that in the definition of a related party, an associate includes subsidiaries of the associate<br />

<strong>and</strong> a joint venture includes subsidiaries of the joint venture.<br />

IFRS<br />

Relevant guidance: IAS 24 (revised 2003)<br />

Note: The text below has not been revised for the 2009<br />

version of IAS 24, which is effective for annual periods<br />

beginning on or after January 1, 2011.<br />

U.S. <strong>GAAP</strong><br />

Relevant guidance: ASC 740, 825, <strong>and</strong> 850 ;<br />

SEC Regulation S-K, Item 402; SEC Regulation S-X,<br />

Rule 4-08(k)<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd