Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

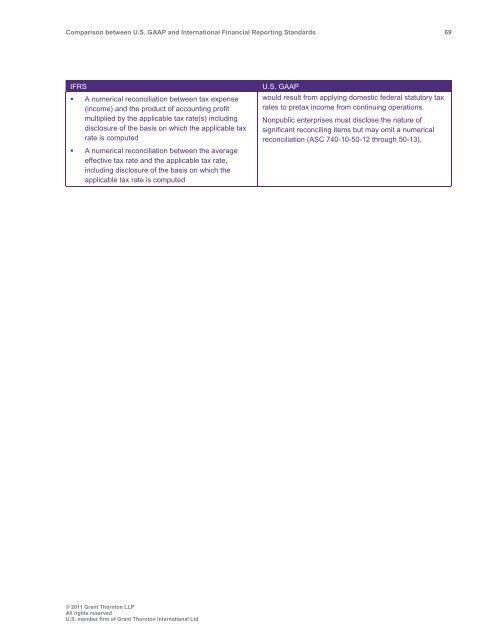

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 69<br />

IFRS<br />

• A numerical reconciliation <strong>between</strong> tax expense<br />

(income) <strong>and</strong> the product of accounting profit<br />

multiplied by the applicable tax rate(s) including<br />

disclosure of the basis on which the applicable tax<br />

rate is computed<br />

• A numerical reconciliation <strong>between</strong> the average<br />

effective tax rate <strong>and</strong> the applicable tax rate,<br />

including disclosure of the basis on which the<br />

applicable tax rate is computed<br />

U.S. <strong>GAAP</strong><br />

would result from applying domestic federal statutory tax<br />

rates to pretax income from continuing operations.<br />

Nonpublic enterprises must disclose the nature of<br />

significant reconciling items but may omit a numerical<br />

reconciliation (ASC 740-10-50-12 through 50-13).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd