Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

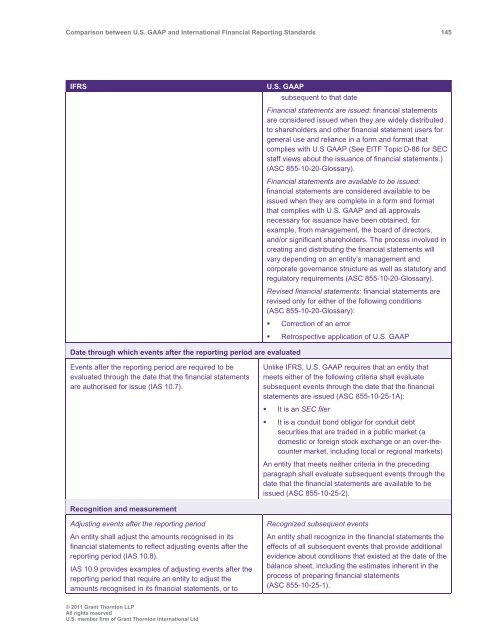

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 145<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

subsequent to that date<br />

Financial statements are issued: financial statements<br />

are considered issued when they are widely distributed<br />

to shareholders <strong>and</strong> other financial statement users for<br />

general use <strong>and</strong> reliance in a form <strong>and</strong> format that<br />

complies with U.S <strong>GAAP</strong> (See EITF Topic D-86 for SEC<br />

staff views about the issuance of financial statements.)<br />

(ASC 855-10-20-Glossary).<br />

Financial statements are available to be issued:<br />

financial statements are considered available to be<br />

issued when they are complete in a form <strong>and</strong> format<br />

that complies with U.S. <strong>GAAP</strong> <strong>and</strong> all approvals<br />

necessary for issuance have been obtained, for<br />

example, from management, the board of directors,<br />

<strong>and</strong>/or significant shareholders. The process involved in<br />

creating <strong>and</strong> distributing the financial statements will<br />

vary depending on an entity’s management <strong>and</strong><br />

corporate governance structure as well as statutory <strong>and</strong><br />

regulatory requirements (ASC 855-10-20-Glossary).<br />

Revised financial statements: financial statements are<br />

revised only for either of the following conditions<br />

(ASC 855-10-20-Glossary):<br />

• Correction of an error<br />

• Retrospective application of U.S. <strong>GAAP</strong><br />

Date through which events after the reporting period are evaluated<br />

Events after the reporting period are required to be<br />

evaluated through the date that the financial statements<br />

are authorised for issue (IAS 10.7).<br />

Unlike IFRS, U.S. <strong>GAAP</strong> requires that an entity that<br />

meets either of the following criteria shall evaluate<br />

subsequent events through the date that the financial<br />

statements are issued (ASC 855-10-25-1A):<br />

• It is an SEC filer<br />

• It is a conduit bond obligor for conduit debt<br />

securities that are traded in a public market (a<br />

domestic or foreign stock exchange or an over-thecounter<br />

market, including local or regional markets)<br />

An entity that meets neither criteria in the preceding<br />

paragraph shall evaluate subsequent events through the<br />

date that the financial statements are available to be<br />

issued (ASC 855-10-25-2).<br />

Recognition <strong>and</strong> measurement<br />

Adjusting events after the reporting period<br />

An entity shall adjust the amounts recognised in its<br />

financial statements to reflect adjusting events after the<br />

reporting period (IAS 10.8).<br />

IAS 10.9 provides examples of adjusting events after the<br />

reporting period that require an entity to adjust the<br />

amounts recognised in its financial statements, or to<br />

Recognized subsequent events<br />

An entity shall recognize in the financial statements the<br />

effects of all subsequent events that provide additional<br />

evidence about conditions that existed at the date of the<br />

balance sheet, including the estimates inherent in the<br />

process of preparing financial statements<br />

(ASC 855-10-25-1).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd