Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

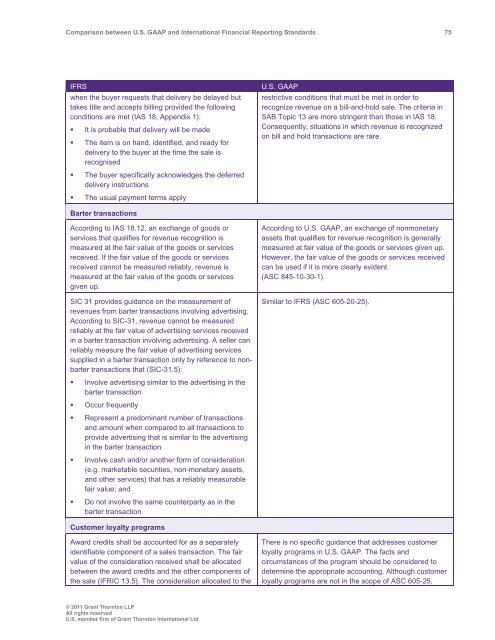

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 75<br />

IFRS<br />

when the buyer requests that delivery be delayed but<br />

takes title <strong>and</strong> accepts billing provided the following<br />

conditions are met (IAS 18, Appendix 1):<br />

• It is probable that delivery will be made<br />

• The item is on h<strong>and</strong>, identified, <strong>and</strong> ready for<br />

delivery to the buyer at the time the sale is<br />

recognised<br />

• The buyer specifically acknowledges the deferred<br />

delivery instructions<br />

• The usual payment terms apply<br />

U.S. <strong>GAAP</strong><br />

restrictive conditions that must be met in order to<br />

recognize revenue on a bill-<strong>and</strong>-hold sale. The criteria in<br />

SAB Topic 13 are more stringent than those in IAS 18.<br />

Consequently, situations in which revenue is recognized<br />

on bill <strong>and</strong> hold transactions are rare.<br />

Barter transactions<br />

According to IAS 18.12, an exchange of goods or<br />

services that qualifies for revenue recognition is<br />

measured at the fair value of the goods or services<br />

received. If the fair value of the goods or services<br />

received cannot be measured reliably, revenue is<br />

measured at the fair value of the goods or services<br />

given up.<br />

SIC 31 provides guidance on the measurement of<br />

revenues from barter transactions involving advertising.<br />

According to SIC-31, revenue cannot be measured<br />

reliably at the fair value of advertising services received<br />

in a barter transaction involving advertising. A seller can<br />

reliably measure the fair value of advertising services<br />

supplied in a barter transaction only by reference to nonbarter<br />

transactions that (SIC-31.5):<br />

According to U.S. <strong>GAAP</strong>, an exchange of nonmonetary<br />

assets that qualifies for revenue recognition is generally<br />

measured at fair value of the goods or services given up.<br />

However, the fair value of the goods or services received<br />

can be used if it is more clearly evident<br />

(ASC 845-10-30-1).<br />

Similar to IFRS (ASC 605-20-25).<br />

• Involve advertising similar to the advertising in the<br />

barter transaction<br />

• Occur frequently<br />

• Represent a predominant number of transactions<br />

<strong>and</strong> amount when compared to all transactions to<br />

provide advertising that is similar to the advertising<br />

in the barter transaction<br />

• Involve cash <strong>and</strong>/or another form of consideration<br />

(e.g. marketable securities, non-monetary assets,<br />

<strong>and</strong> other services) that has a reliably measurable<br />

fair value; <strong>and</strong><br />

• Do not involve the same counterparty as in the<br />

barter transaction<br />

Customer loyalty programs<br />

Award credits shall be accounted for as a separately<br />

identifiable component of a sales transaction. The fair<br />

value of the consideration received shall be allocated<br />

<strong>between</strong> the award credits <strong>and</strong> the other components of<br />

the sale (IFRIC 13.5). The consideration allocated to the<br />

There is no specific guidance that addresses customer<br />

loyalty programs in U.S. <strong>GAAP</strong>. The facts <strong>and</strong><br />

circumstances of the program should be considered to<br />

determine the appropriate accounting. Although customer<br />

loyalty programs are not in the scope of ASC 605-25,<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd