Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

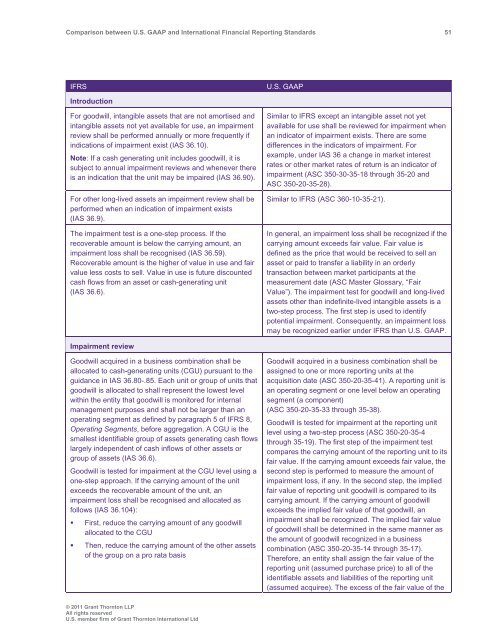

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 51<br />

IFRS<br />

U.S. <strong>GAAP</strong><br />

Introduction<br />

For goodwill, intangible assets that are not amortised <strong>and</strong><br />

intangible assets not yet available for use, an impairment<br />

review shall be performed annually or more frequently if<br />

indications of impairment exist (IAS 36.10).<br />

Note: If a cash generating unit includes goodwill, it is<br />

subject to annual impairment reviews <strong>and</strong> whenever there<br />

is an indication that the unit may be impaired (IAS 36.90).<br />

For other long-lived assets an impairment review shall be<br />

performed when an indication of impairment exists<br />

(IAS 36.9).<br />

The impairment test is a one-step process. If the<br />

recoverable amount is below the carrying amount, an<br />

impairment loss shall be recognised (IAS 36.59).<br />

Recoverable amount is the higher of value in use <strong>and</strong> fair<br />

value less costs to sell. Value in use is future discounted<br />

cash flows from an asset or cash-generating unit<br />

(IAS 36.6).<br />

Similar to IFRS except an intangible asset not yet<br />

available for use shall be reviewed for impairment when<br />

an indicator of impairment exists. There are some<br />

differences in the indicators of impairment. For<br />

example, under IAS 36 a change in market interest<br />

rates or other market rates of return is an indicator of<br />

impairment (ASC 350-30-35-18 through 35-20 <strong>and</strong><br />

ASC 350-20-35-28).<br />

Similar to IFRS (ASC 360-10-35-21).<br />

In general, an impairment loss shall be recognized if the<br />

carrying amount exceeds fair value. Fair value is<br />

defined as the price that would be received to sell an<br />

asset or paid to transfer a liability in an orderly<br />

transaction <strong>between</strong> market participants at the<br />

measurement date (ASC Master Glossary, “Fair<br />

Value”). The impairment test for goodwill <strong>and</strong> long-lived<br />

assets other than indefinite-lived intangible assets is a<br />

two-step process. The first step is used to identify<br />

potential impairment. Consequently, an impairment loss<br />

may be recognized earlier under IFRS than U.S. <strong>GAAP</strong>.<br />

Impairment review<br />

Goodwill acquired in a business combination shall be<br />

allocated to cash-generating units (CGU) pursuant to the<br />

guidance in IAS 36.80-.85. Each unit or group of units that<br />

goodwill is allocated to shall represent the lowest level<br />

within the entity that goodwill is monitored for internal<br />

management purposes <strong>and</strong> shall not be larger than an<br />

operating segment as defined by paragraph 5 of IFRS 8,<br />

Operating Segments, before aggregation. A CGU is the<br />

smallest identifiable group of assets generating cash flows<br />

largely independent of cash inflows of other assets or<br />

group of assets (IAS 36.6).<br />

Goodwill is tested for impairment at the CGU level using a<br />

one-step approach. If the carrying amount of the unit<br />

exceeds the recoverable amount of the unit, an<br />

impairment loss shall be recognised <strong>and</strong> allocated as<br />

follows (IAS 36.104):<br />

• First, reduce the carrying amount of any goodwill<br />

allocated to the CGU<br />

• Then, reduce the carrying amount of the other assets<br />

of the group on a pro rata basis<br />

Goodwill acquired in a business combination shall be<br />

assigned to one or more reporting units at the<br />

acquisition date (ASC 350-20-35-41). A reporting unit is<br />

an operating segment or one level below an operating<br />

segment (a component)<br />

(ASC 350-20-35-33 through 35-38).<br />

Goodwill is tested for impairment at the reporting unit<br />

level using a two-step process (ASC 350-20-35-4<br />

through 35-19). The first step of the impairment test<br />

compares the carrying amount of the reporting unit to its<br />

fair value. If the carrying amount exceeds fair value, the<br />

second step is performed to measure the amount of<br />

impairment loss, if any. In the second step, the implied<br />

fair value of reporting unit goodwill is compared to its<br />

carrying amount. If the carrying amount of goodwill<br />

exceeds the implied fair value of that goodwill, an<br />

impairment shall be recognized. The implied fair value<br />

of goodwill shall be determined in the same manner as<br />

the amount of goodwill recognized in a business<br />

combination (ASC 350-20-35-14 through 35-17).<br />

Therefore, an entity shall assign the fair value of the<br />

reporting unit (assumed purchase price) to all of the<br />

identifiable assets <strong>and</strong> liabilities of the reporting unit<br />

(assumed acquiree). The excess of the fair value of the<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd