Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

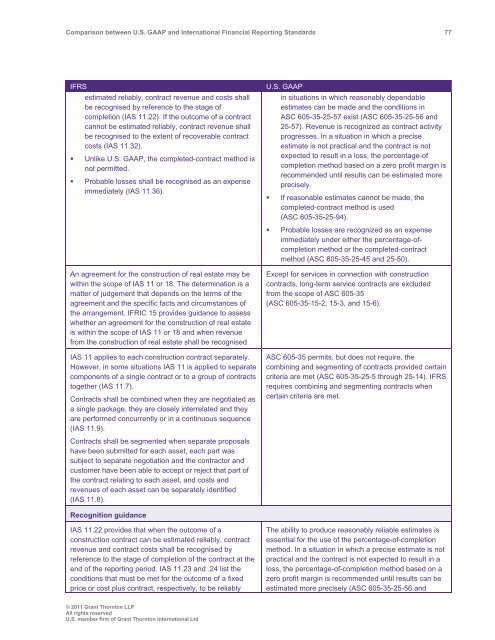

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 77<br />

IFRS<br />

estimated reliably, contract revenue <strong>and</strong> costs shall<br />

be recognised by reference to the stage of<br />

completion (IAS 11.22). If the outcome of a contract<br />

cannot be estimated reliably, contract revenue shall<br />

be recognised to the extent of recoverable contract<br />

costs (IAS 11.32).<br />

• Unlike U.S. <strong>GAAP</strong>, the completed-contract method is<br />

not permitted.<br />

• Probable losses shall be recognised as an expense<br />

immediately (IAS 11.36).<br />

An agreement for the construction of real estate may be<br />

within the scope of IAS 11 or 18. The determination is a<br />

matter of judgement that depends on the terms of the<br />

agreement <strong>and</strong> the specific facts <strong>and</strong> circumstances of<br />

the arrangement. IFRIC 15 provides guidance to assess<br />

whether an agreement for the construction of real estate<br />

is within the scope of IAS 11 or 18 <strong>and</strong> when revenue<br />

from the construction of real estate shall be recognised.<br />

IAS 11 applies to each construction contract separately.<br />

However, in some situations IAS 11 is applied to separate<br />

components of a single contract or to a group of contracts<br />

together (IAS 11.7).<br />

Contracts shall be combined when they are negotiated as<br />

a single package, they are closely interrelated <strong>and</strong> they<br />

are performed concurrently or in a continuous sequence<br />

(IAS 11.9).<br />

Contracts shall be segmented when separate proposals<br />

have been submitted for each asset, each part was<br />

subject to separate negotiation <strong>and</strong> the contractor <strong>and</strong><br />

customer have been able to accept or reject that part of<br />

the contract relating to each asset, <strong>and</strong> costs <strong>and</strong><br />

revenues of each asset can be separately identified<br />

(IAS 11.8).<br />

U.S. <strong>GAAP</strong><br />

in situations in which reasonably dependable<br />

estimates can be made <strong>and</strong> the conditions in<br />

ASC 605-35-25-57 exist (ASC 605-35-25-56 <strong>and</strong><br />

25-57). Revenue is recognized as contract activity<br />

progresses. In a situation in which a precise<br />

estimate is not practical <strong>and</strong> the contract is not<br />

expected to result in a loss, the percentage-of<br />

completion method based on a zero profit margin is<br />

recommended until results can be estimated more<br />

precisely.<br />

• If reasonable estimates cannot be made, the<br />

completed-contract method is used<br />

(ASC 605-35-25-94).<br />

• Probable losses are recognized as an expense<br />

immediately under either the percentage-ofcompletion<br />

method or the completed-contract<br />

method (ASC 605-35-25-45 <strong>and</strong> 25-50).<br />

Except for services in connection with construction<br />

contracts, long-term service contracts are excluded<br />

from the scope of ASC 605-35<br />

(ASC 605-35-15-2, 15-3, <strong>and</strong> 15-6).<br />

ASC 605-35 permits, but does not require, the<br />

combining <strong>and</strong> segmenting of contracts provided certain<br />

criteria are met (ASC 605-35-25-5 through 25-14). IFRS<br />

requires combining <strong>and</strong> segmenting contracts when<br />

certain criteria are met.<br />

Recognition guidance<br />

IAS 11.22 provides that when the outcome of a<br />

construction contract can be estimated reliably, contract<br />

revenue <strong>and</strong> contract costs shall be recognised by<br />

reference to the stage of completion of the contract at the<br />

end of the reporting period. IAS 11.23 <strong>and</strong> .24 list the<br />

conditions that must be met for the outcome of a fixed<br />

price or cost plus contract, respectively, to be reliably<br />

The ability to produce reasonably reliable estimates is<br />

essential for the use of the percentage-of-completion<br />

method. In a situation in which a precise estimate is not<br />

practical <strong>and</strong> the contract is not expected to result in a<br />

loss, the percentage-of-completion method based on a<br />

zero profit margin is recommended until results can be<br />

estimated more precisely (ASC 605-35-25-56 <strong>and</strong><br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd