Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

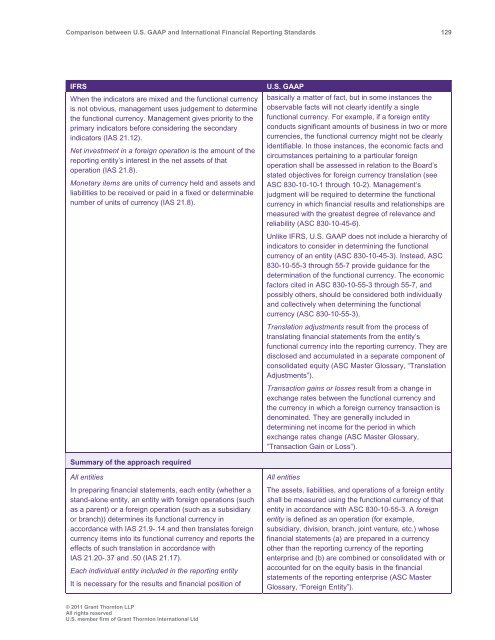

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 129<br />

IFRS<br />

When the indicators are mixed <strong>and</strong> the functional currency<br />

is not obvious, management uses judgement to determine<br />

the functional currency. Management gives priority to the<br />

primary indicators before considering the secondary<br />

indicators (IAS 21.12).<br />

Net investment in a foreign operation is the amount of the<br />

reporting entity’s interest in the net assets of that<br />

operation (IAS 21.8).<br />

Monetary items are units of currency held <strong>and</strong> assets <strong>and</strong><br />

liabilities to be received or paid in a fixed or determinable<br />

number of units of currency (IAS 21.8).<br />

U.S. <strong>GAAP</strong><br />

basically a matter of fact, but in some instances the<br />

observable facts will not clearly identify a single<br />

functional currency. For example, if a foreign entity<br />

conducts significant amounts of business in two or more<br />

currencies, the functional currency might not be clearly<br />

identifiable. In those instances, the economic facts <strong>and</strong><br />

circumstances pertaining to a particular foreign<br />

operation shall be assessed in relation to the Board’s<br />

stated objectives for foreign currency translation (see<br />

ASC 830-10-10-1 through 10-2). Management’s<br />

judgment will be required to determine the functional<br />

currency in which financial results <strong>and</strong> relationships are<br />

measured with the greatest degree of relevance <strong>and</strong><br />

reliability (ASC 830-10-45-6).<br />

Unlike IFRS, U.S. <strong>GAAP</strong> does not include a hierarchy of<br />

indicators to consider in determining the functional<br />

currency of an entity (ASC 830-10-45-3). Instead, ASC<br />

830-10-55-3 through 55-7 provide guidance for the<br />

determination of the functional currency. The economic<br />

factors cited in ASC 830-10-55-3 through 55-7, <strong>and</strong><br />

possibly others, should be considered both individually<br />

<strong>and</strong> collectively when determining the functional<br />

currency (ASC 830-10-55-3).<br />

Translation adjustments result from the process of<br />

translating financial statements from the entity’s<br />

functional currency into the reporting currency. They are<br />

disclosed <strong>and</strong> accumulated in a separate component of<br />

consolidated equity (ASC Master Glossary, “Translation<br />

Adjustments”).<br />

Transaction gains or losses result from a change in<br />

exchange rates <strong>between</strong> the functional currency <strong>and</strong><br />

the currency in which a foreign currency transaction is<br />

denominated. They are generally included in<br />

determining net income for the period in which<br />

exchange rates change (ASC Master Glossary,<br />

“Transaction Gain or Loss”).<br />

Summary of the approach required<br />

All entities<br />

In preparing financial statements, each entity (whether a<br />

st<strong>and</strong>-alone entity, an entity with foreign operations (such<br />

as a parent) or a foreign operation (such as a subsidiary<br />

or branch)) determines its functional currency in<br />

accordance with IAS 21.9-.14 <strong>and</strong> then translates foreign<br />

currency items into its functional currency <strong>and</strong> reports the<br />

effects of such translation in accordance with<br />

IAS 21.20-.37 <strong>and</strong> .50 (IAS 21.17).<br />

Each individual entity included in the reporting entity<br />

It is necessary for the results <strong>and</strong> financial position of<br />

All entities<br />

The assets, liabilities, <strong>and</strong> operations of a foreign entity<br />

shall be measured using the functional currency of that<br />

entity in accordance with ASC 830-10-55-3. A foreign<br />

entity is defined as an operation (for example,<br />

subsidiary, division, branch, joint venture, etc.) whose<br />

financial statements (a) are prepared in a currency<br />

other than the reporting currency of the reporting<br />

enterprise <strong>and</strong> (b) are combined or consolidated with or<br />

accounted for on the equity basis in the financial<br />

statements of the reporting enterprise (ASC Master<br />

Glossary, “Foreign Entity”).<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd