Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

Comparison between U.S. GAAP and International ... - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

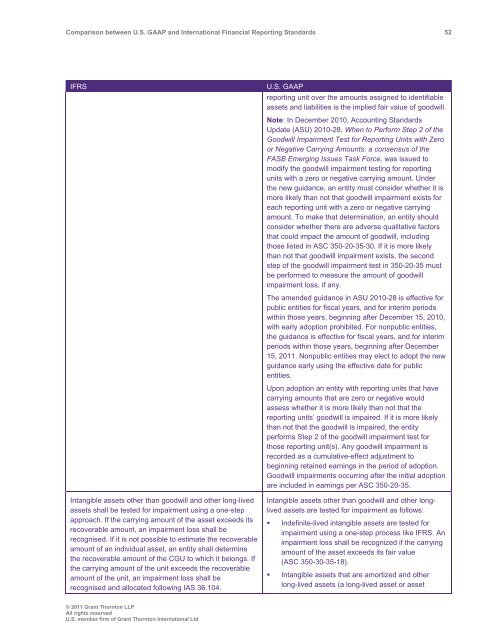

<strong>Comparison</strong> <strong>between</strong> U.S. <strong>GAAP</strong> <strong>and</strong> <strong>International</strong> Financial Reporting St<strong>and</strong>ards 52<br />

IFRS<br />

Intangible assets other than goodwill <strong>and</strong> other long-lived<br />

assets shall be tested for impairment using a one-step<br />

approach. If the carrying amount of the asset exceeds its<br />

recoverable amount, an impairment loss shall be<br />

recognised. If it is not possible to estimate the recoverable<br />

amount of an individual asset, an entity shall determine<br />

the recoverable amount of the CGU to which it belongs. If<br />

the carrying amount of the unit exceeds the recoverable<br />

amount of the unit, an impairment loss shall be<br />

recognised <strong>and</strong> allocated following IAS 36.104.<br />

U.S. <strong>GAAP</strong><br />

reporting unit over the amounts assigned to identifiable<br />

assets <strong>and</strong> liabilities is the implied fair value of goodwill.<br />

Note: In December 2010, Accounting St<strong>and</strong>ards<br />

Update (ASU) 2010-28, When to Perform Step 2 of the<br />

Goodwill Impairment Test for Reporting Units with Zero<br />

or Negative Carrying Amounts: a consensus of the<br />

FASB Emerging Issues Task Force, was issued to<br />

modify the goodwill impairment testing for reporting<br />

units with a zero or negative carrying amount. Under<br />

the new guidance, an entity must consider whether it is<br />

more likely than not that goodwill impairment exists for<br />

each reporting unit with a zero or negative carrying<br />

amount. To make that determination, an entity should<br />

consider whether there are adverse qualitative factors<br />

that could impact the amount of goodwill, including<br />

those listed in ASC 350-20-35-30. If it is more likely<br />

than not that goodwill impairment exists, the second<br />

step of the goodwill impairment test in 350-20-35 must<br />

be performed to measure the amount of goodwill<br />

impairment loss, if any.<br />

The amended guidance in ASU 2010-28 is effective for<br />

public entities for fiscal years, <strong>and</strong> for interim periods<br />

within those years, beginning after December 15, 2010,<br />

with early adoption prohibited. For nonpublic entities,<br />

the guidance is effective for fiscal years, <strong>and</strong> for interim<br />

periods within those years, beginning after December<br />

15, 2011. Nonpublic entities may elect to adopt the new<br />

guidance early using the effective date for public<br />

entities.<br />

Upon adoption an entity with reporting units that have<br />

carrying amounts that are zero or negative would<br />

assess whether it is more likely than not that the<br />

reporting units’ goodwill is impaired. If it is more likely<br />

than not that the goodwill is impaired, the entity<br />

performs Step 2 of the goodwill impairment test for<br />

those reporting unit(s). Any goodwill impairment is<br />

recorded as a cumulative-effect adjustment to<br />

beginning retained earnings in the period of adoption.<br />

Goodwill impairments occurring after the initial adoption<br />

are included in earnings per ASC 350-20-35.<br />

Intangible assets other than goodwill <strong>and</strong> other longlived<br />

assets are tested for impairment as follows:<br />

• Indefinite-lived intangible assets are tested for<br />

impairment using a one-step process like IFRS. An<br />

impairment loss shall be recognized if the carrying<br />

amount of the asset exceeds its fair value<br />

(ASC 350-30-35-18).<br />

• Intangible assets that are amortized <strong>and</strong> other<br />

long-lived assets (a long-lived asset or asset<br />

© 2011 <strong>Grant</strong> <strong>Thornton</strong> LLP<br />

All rights reserved<br />

U.S. member firm of <strong>Grant</strong> <strong>Thornton</strong> <strong>International</strong> Ltd